Fiscal 2023

Annual Report

Best Buy Co., Inc.

7601 Penn Avenue S.

Richfield, MN 55423

bestbuy.com

(866) 758-1457

©2023 Best Buy. All rights reserved.

Corie Barry, CEO

A message from

Fiscal year 2023 brought continued uncertainty to

our business and customers, following two years

of record demand and a global pandemic.

I am proud to report that Best Buy navigated these

obstacles by doing what we do best: focusing

on our customers, investing in our strengths, and

planning a deinitive course for the future.

We quickly pivoted operations during another

complex year overshadowed by macroeconomic

headwinds. We faced the challenges head on

using the same approach that has served us well

in recent years: Balancing our near-term response

to current conditions and managing what is in our

control, while advancing our strategic initiatives

and investing in areas critical to our long-term

growth.

Before I proceed further, let me take this

opportunity to thank our amazing employees for

the dedication and resilience they continue to

show in this ever-changing environment. Every

day, our management team and employees

across the company make diicult trade-o

decisions while providing amazing customer

experiences. Through all this uncertainty, I am

so proud of the way our team has always kept

our customers as our top priority. It’s because of

the tireless work of this team that Best Buy can

continue to evolve and grow into an even more

vibrant company.

I believe this commitment is driven by our

shared connection to our company purpose — a

purpose that is more relevant today than ever: to

enrich lives through technology.

From a inancial results standpoint, we inished

FY23 slightly better than the updated expectations

we provided midway through the year as the

environment evolved. We returned $1.8 billion

to shareholders through share repurchases and

dividends. We increased our quarterly dividend

to $0.92 per share, which represents the tenth

consecutive year of regular quarterly dividend

increases.

I am also excited to share that we reached our

target of achieving $1 billion in annualized cost

reductions during FY23, two years ahead of the

goal we set in 2019. We continue to use these

cost savings to make strategic investments and

navigate other pressures that aect our business.

We began FY23 with an investor update outlining

Best Buy’s path forward. In that update, we shared

three reasons why we believe our strategy is the

right one to deliver growth and long-term value for

all our stakeholders.

1. Technology is a necessity, and we are the only

national tech solutions provider for the home.

2. We have built a unique ecosystem of

customer-centric assets, delivering

experiences that no one else can.

3. Our dierentiated abilities and ongoing

investments in our business are designed to

lead to compelling inancial returns over time.

Dear fellow

shareholders,

These three points remain truer today than

ever before. While we are preparing for another

challenging year for the industry as a whole, we

also believe that this calendar year will be the

bottom of the decline in tech demand.

With this in mind, on behalf of my leadership team,

let me state clearly that we are optimistic about the

future, in part because of the following reasons:

1. Households have twice as many connected

devices as they did before the pandemic.

(Deloitte. “Mastering the New Digital Life: 2022

Connectivity and Mobile Trends, 3rd Edition”)

2. Tech is increasingly viewed more as a

functional need versus an emotional want.

3. Upgrade and replacement cycles in the

Consumer Electronics category are historically

three to seven years, so many of those recently

purchased devices will likely be eligible for an

upgrade soon.

4. Innovation is normalizing after having been

largely paused since the beginning of the

pandemic. This will likely take shape in two

ways: Stimulating upgrades/replacements and

creating new categories.

5. Structural innovations (like cloud, augmented

reality, broadband infrastructure funding, and

the electriication of our homes and vehicles)

will continue to drive demand.

These factors align well with our vision to

humanize and personalize technology for every

stage of life. We continue our own expansion

into newer categories, like wellness and electric

transportation, and our employees provide the

advice our customers need to make the best

decision for their needs. We are the technology

experts and remain the best place for people

to see and try the latest products and get tech

support, even in their own homes.

We intend not only to maintain that reputation but

also to build on it. In keeping with our approach

to manage today while investing for tomorrow,

we are focused on ive strategic areas in FY24.

• Building customer relationships through

membership. We will continue to evolve our

offerings to create long-lasting connections

with customers that align with their wants

and needs. Millions of customers belong to

our My Best Buy and Totaltech programs,

and we are seeing increased engagement,

higher spending with us and more cross-

category buying than from nonmembers.

• Evolving our omnichannel retail model.

Over the past three years, we have seen our

digital sales increase signiicantly, and they

now make up one-third of our total domestic

sales. At the same time, our stores remain

a cornerstone asset. Based on successful

pilots in several markets, we are rolling out

a new approach to our stores and stafing.

We are moving away from a “one-size-its-

all” model to serving deined geographic

areas with the right mix of store formats

and fulillment solutions that best serve the

customers who live there.

• Incubating and growing Best Buy Health.

We’re building on our early successes in

this space by leveraging our unique assets,

including the Geek Squad, to enable care

at home for everyone throughout their

health journey. Partnerships with some

of the nation’s largest health systems are

accelerating our footprint in the market.

• Unlocking reverse secondary market

opportunities. By refurbishing and reselling

non-new inventory, we believe Best Buy will

be able to create new revenue streams and

appeal to a larger customer base. This also

aligns with our priority of contributing to a

circular economy, a system that promotes

using fewer new natural resources, keeping

products and materials in use as long

as possible, and inding alternatives to

throwing them away.

• Removing cost and improving eficiency

and effectiveness. As mentioned earlier,

driving proitability across our business and

eliminating unnecessary spending allows us

to make investments to fuel our future.

As you can see, we are investing despite these

turbulent times. Our investments build on our

one-of-a-kind suite of capabilities that allows

us to create customer experiences no one else

can. In fact, our customer satisfaction scores tell

us that we delivered better experiences across

many areas this past holiday season than last

year and the pre-pandemic fourth quarter of

FY20, especially within our services and delivery

experiences. All of this work continues our proven

track record of managing through challenges to

become a stronger company on the other side.

To be clear, it’s Best Buy’s culture and incredible

teams of employees that make this possible and

make us conident in our future.

We know our employees and the expert

service they provide are our core competitive

dierentiator, and we remain focused on being a

best place to work. I am proud that our employee

retention rates continue to outperform the retail

industry and remain low, especially in crucial areas

like store general managers.

Competitive compensation continues to be

critical to attracting and retaining top talent, and

we have increased our store associate hourly pay

by approximately 25% in the last three years. We

also provide training and opportunities for our

employees to upskill and reskill so they can work

more lexibly and pick the career path best for

them at Best Buy. I am also incredibly proud that

60% of our general managers started their Best

Buy careers in non-leadership roles, and 94% of

our general managers and assistant managers

here today were hired internally.

From a community standpoint, we celebrated

a milestone this year: the Best Buy Foundation

saw the opening of its 52nd Best Buy Teen Tech

Center®. That puts the foundation more than

halfway to its goal of building 100 locations

across the United States by 2025. These centers

continue to provide young people with the access,

inspiration and opportunity they deserve to help

them deine their futures. And we know they work:

On average, 95% of Teen Tech Center members

plan to continue their education after high school,

and 71% have an increased interest in studying

STEM ields (Science, T

echnology, Engineering

and Math).

I am proud to say that Best Buy continues to be

recognized for the many ways we are supporting

our employees and communities. We ranked

34th, and were the No. 1 retailer, on the JUST

Capital list that evaluates and ranks the largest

publicly traded companies in the U.S., in part, on

how a company invests in its workers, supports

its communities and minimizes environmental

impact. And for the eighth time, we were named

to the Ethisphere World’s Most Ethical Companies

list, which recognizes companies based on

culture, environmental and social practices, ethics

and compliance activities, and diversity initiatives.

We were one of only three retailers on the list of

136 companies from 22 countries. (Click here

to view our FY22 ESG Report. We publish a new

report every summer and have been doing so

since 2006.)

I would like to conclude by expressing my deepest

gratitude to my colleagues across Best Buy. Your

enthusiasm for the work we do, the celebration of

our culture and the commitment to our customers

is truly amazing. To our shareholders, please

accept my heartfelt thank you for the conidence

and support you continue to show.

Respectfully,

Corie Barry, CEO,

Best Buy Co., Inc.

This report contains forward-looking statements. Please refer to

“CAUTIONARY STATEMENT PURSUANT TO THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995” in the accompanying Annual

Report on Form 10-K for further information.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2023

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-9595

______________________________________________________________

BEST BUY CO., INC.

(Exact name of registrant as specified in its charter)

Minnesota

41-0907483

State or other jurisdiction of

incorporation or organization

(I.R.S. Employer

Identification No.)

7601 Penn Avenue South

Richfield, Minnesota

55423

(Zip Code)

(Address of principal executive offices)

(612) 291-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Trading Symbol

Name of exchange on which registered

Common Stock, $0.10 par value per share

BBY

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer

Accelerated Filer

Non-accelerated Filer

Smaller Reporting Company

Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the

correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of July 29, 2022, was approximately $13.4 billion, computed

by reference to the price of $76.99 per share, the price at which the common equity was last sold on July 29, 2022, as reported on the New York Stock Exchange-Composite

Index. (For purposes of this calculation, all of the registrant’s directors and executive officers are deemed affiliates of the registrant.)

As of March 15, 2023, the registrant had 218,045,737 shares of its common stock, $0.10 par value per share, issued and outstanding.

2

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement relating to its 2023 Regular Meeting of Shareholders ("Proxy Statement") are

incorporated by reference into Part III. The Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120

days after the end of the fiscal year to which this report relates.

CAUTIONARY STATEMENT PURSUANT TO THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended (“Exchange Act”), provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective

information about their companies. With the exception of historical information, the matters discussed in this Annual Report on Form 10-

K are forward-looking statements and may be identified by the use of words such as “anticipate,” “appear,” “approximate,” “assume,”

“believe,” “continue,” “could,” “estimate,” “expect,” “foresee,” “guidance,” “intend,” “may,” “might,” “outlook,” “plan,” “possible,” “project”

“seek,” “should,” “would,” and other words and terms of similar meaning or the negatives thereof. Such statements reflect our current

view with respect to future events and are subject to certain risks, uncertainties and assumptions. A variety of factors could cause our

future results to differ materially from the anticipated results expressed in such forward-looking statements. Readers should review

Item 1A, Risk Factors, of this Annual Report on Form 10-K for a description of important factors that could cause our future results to

differ materially from those contemplated by the forward-looking statements made in this Annual Report on Form 10-K. Our forward-

looking statements speak only as of the date of this report or as of the date they are made, and we undertake no obligation to update

our forward-looking statements.

3

BEST BUY FISCAL 2023 FORM 10-K

TABLE OF CONTENTS

PART I

4

Item 1.

Business.

4

Item 1A.

Risk Factors.

8

Item 1B.

Unresolved Staff Comments.

18

Item 2.

Properties.

19

Item 3.

Legal Proceedings.

20

Item 4.

Mine Safety Disclosures.

20

Information about our Executive Officers.

20

PART II

21

Item 5.

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

21

Item 6.

[Reserved].

22

Item 7.

Management's Discussion and Analysis of Financial Condition and Results of Operations.

23

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk.

33

Item 8.

Financial Statements and Supplementary Data.

35

Item 9.

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

64

Item 9A.

Controls and Procedures.

64

Item 9B.

Other Information.

64

Item 9C.

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections.

64

PART III

64

Item 10.

Directors, Executive Officers and Corporate Governance.

64

Item 11.

Executive Compensation.

64

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

65

Item 13.

Certain Relationships and Related Transactions, and Director Independence.

65

Item 14.

Principal Accountant Fees and Services.

65

PART IV

65

Item 15.

Exhibit and Financial Statement Schedules.

65

Item 16.

Form 10-K Summary.

67

Signatures.

68

4

PART I

Item 1. Business.

Unless the context otherwise requires, the terms “we,” “us” and “our” in this Annual Report on Form 10-K refer to Best Buy Co., Inc.

and, as applicable, its consolidated subsidiaries. Any references to our website addresses do not constitute incorporation by reference

of the information contained on the websites.

Description of Business

We were incorporated in the state of Minnesota in 1966. We are driven by our purpose to enrich lives through technology and our vision

to personalize and humanize technology solutions for every stage of life. We accomplish this by leveraging our combination of

technology and a human touch to meet our customers’ everyday needs, whether they come to us online, visit our stores or invite us into

their homes. We have operations in the U.S. and Canada.

Segments and Geographic Areas

We have two reportable segments: Domestic and International. The Domestic segment is comprised of our operations in all states,

districts and territories of the U.S. and our Best Buy Health business, and includes the brand names Best Buy, Best Buy Ads, Best Buy

Business, Best Buy Health, CST, Current Health, Geek Squad, Lively, Magnolia, Pacific Kitchen and Home, TechLiquidators and

Yardbird and the domain names bestbuy.com, currenthealth.com, lively.com, techliquidators.com and yardbird.com. All of our former

stores in Mexico were closed as of the end of the first quarter of fiscal 2022, and our International segment is comprised of all

operations in Canada under the brand names Best Buy, Best Buy Mobile and Geek Squad and the domain name bestbuy.ca.

In fiscal 2022, we acquired all of the outstanding shares of Current Health Ltd. (“Current Health”) and Two Peaks, LLC d/b/a Yardbird

Furniture (“Yardbird”).

Operations

Our Domestic and International segments are managed by leadership teams responsible for all areas of the business. Both segments

operate an omnichannel platform that allows customers to come to us online, visit our stores or invite us into their homes.

Development of merchandise and service offerings, pricing and promotions, procurement and supply chain, online and mobile

application operations, marketing and advertising and labor deployment across all channels are centrally managed. In addition, support

capabilities (for example, human resources, finance, information technology and real estate management) operate from our corporate

headquarters. We also have field operations that support retail, services and in-home teams from our corporate headquarters and

regional locations. Our retail stores have procedures for inventory management, asset protection, transaction processing, customer

relations, store administration, product sales and services, staff training and merchandise display that are largely standardized. All

stores generally operate under standard procedures with a degree of flexibility for store management to address certain local market

characteristics. While day-to-day operations of our stores are led by store management, more strategic decisions regarding, for

example, store locations, format, category assortment and fulfillment strategy are addressed at a market or regional level.

Our Best Buy Health business has a dedicated leadership team and operations team. The Best Buy Health leadership team manages

the day-to-day affairs of all aspects of its business, while receiving support from certain Best Buy enterprise capabilities.

Merchandise and Services

Our Domestic and International segments have offerings in six revenue categories. The key components of each revenue category are

as follows:

• Computing and Mobile Phones - computing (including desktops, notebooks and peripherals), mobile phones (including

related mobile network carrier commissions), networking, tablets (including e-readers) and wearables (including

smartwatches);

• Consumer Electronics - digital imaging, health and fitness products, home theater, portable audio (including headphones

and portable speakers) and smart home;

• Appliances - large appliances (including dishwashers, laundry, ovens and refrigerators) and small appliances (including

blenders, coffee makers and vacuums);

• Entertainment - drones, gaming (including hardware, peripherals and software), movies, music, toys, virtual reality and other

software;

• Services - consultation, delivery, design, health-related services, installation, memberships, repair, set-up, technical support

and warranty-related services; and

• Other - other product offerings, including baby, food and beverage, luggage, outdoor living and sporting goods.

5

Distribution

Customers within our Domestic and International segments who purchase product online have the choice to pick up product at a Best

Buy store (including curbside pick-up for select products at most Domestic stores), at an alternative pick-up location or take delivery

direct to their homes. Our ship-from-store capability allows us to improve product availability and delivery times for customers. Most

merchandise is shipped directly from manufacturers to our distribution centers.

Suppliers and Inventory

Our Domestic and International segments purchase merchandise from a variety of suppliers. In fiscal 2023, our 20 largest suppliers

accounted for approximately 79% of the merchandise we purchased, with five suppliers – Apple, Samsung, HP, LG and Sony –

representing approximately 57% of total merchandise purchased. We generally do not have long-term written contracts with our

vendors that would require them to continue supplying us with merchandise or that secure any of the key terms of our arrangements.

We carefully monitor and manage our inventory levels in an effort to match quantities on hand with consumer demand as closely as

possible. Key elements to our inventory management process include the following: continuous monitoring of consumer demand,

continuous monitoring and adjustment of inventory receipt levels and pricing, agreements with vendors relating to reimbursement for

the cost of markdowns or sales incentives, and agreements with vendors relating to return privileges for certain products.

We also have a global sourcing operation to design, develop, test and contract-manufacture our exclusive brands products.

Store Development

We had 1,138 stores at the end of fiscal 2023 throughout our Domestic and International segments. Our stores are a vital component of

our omnichannel strategy, and we believe they are an important competitive advantage. We also have vendor store-within-a-store

concepts to allow closer vendor partnerships and a higher quality customer experience. We continuously look for opportunities to

optimize our store space, renegotiate leases and selectively open or close locations to support our operations.

Refer to Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, for tables reconciling our

Domestic and International segment stores open at the end of each of the last three fiscal years.

Intellectual Property

We own or have the right to use valuable intellectual property such as trademarks, service marks and trade names, including, but not

limited to, Best Buy, Best Buy Ads, Best Buy Essentials, Best Buy Health, Best Buy Mobile, Best Buy Totaltech, CST, Current Health,

Dynex, Geek Squad, Insignia, Jitterbug, Lively, Magnolia, Modal, My Best Buy, Pacific Kitchen and Home, Pacific Sales, Platinum,

Rocketfish, TechLiquidators, Yardbird and our Yellow Tag logo.

We have secured domestic and international trademark and service mark registrations for many of our brands. We have also secured

patents for many of our inventions. We believe our intellectual property has significant value and is an important factor in the marketing

of our company, our stores, our products and our websites.

Seasonality

Our business, like that of many retailers, is seasonal. A large proportion of our revenue and earnings is generated in the fiscal fourth

quarter, which includes the majority of the holiday shopping season.

Working Capital

We fund our business operations through a combination of available cash and cash equivalents and cash flows generated from

operations. In addition, our revolving credit facilities are available for additional working capital needs, for general corporate purposes,

investments and growth opportunities. Our working capital needs typically increase in the months leading up to the holiday shopping

season as we purchase inventory in advance of expected sales.

Competition

Our competitors are primarily multi-channel retailers, e-commerce businesses, technology service providers, traditional store-based

retailers, vendors and mobile network carriers who offer their products and services directly to customers. We believe our ability to help

customers online, in our stores and in their homes, and to connect technology product and solutions with customer needs, provides us

key competitive advantages. Some of our competitors have lower cost operating structures and seek to compete for sales primarily on

price. We carefully monitor pricing offered by other retailers and service providers, as maintaining price competitiveness is one of our

ongoing priorities. In addition, we have price-matching policies that allow customers to request that we match a price offered by certain

retail stores and online operators. In order to allow this, we are focused on maintaining efficient operations and leveraging the

economies of scale available to us through our global vendor partnerships. We believe our dedicated and knowledgeable people; our

integrated online, retail and in-home assets; our broad and curated product assortment; our strong vendor partnerships; our service and

support offerings designed to solve real customer needs; our unique ability to showcase technology in distinct store formats and our

supply chain are important ways in which we maintain our competitive advantage.

6

Environmental and Social

As we pursue our purpose to enrich lives through technology, we are committed to having a positive impact on the world, the

environment and the communities in which we operate through interactions with all of our stakeholders, including our customers,

employees, vendor partners and shareholders.

The Nominating, Corporate Governance and Public Policy Committee of our Board of Directors (“Board”) advises and oversees

management regarding the effectiveness and risks of our environmental, social and governance strategy, programs and initiatives,

including environmental goals and progress, social responsibility programs, and initiatives and public policy positions and advocacy.

Environmental

We aspire to drive forward the circular economy and we are committed to conserving natural resources, reducing waste in our

operations, offering products that help our customers live more sustainably and transitioning to renewable energy sources. As of the

end of fiscal 2023, we have invested in five solar fields, helping to accelerate the progress towards our carbon reduction goals.

We intend to reduce the use of natural resources in our operations as demonstrated by the following goals, which we believe can be

managed within our normal operating budget without significant incremental spending:

• Reduce carbon emissions 75% by 2030 (over a 2009 baseline) and become carbon neutral by 2040. We continue to reduce

our carbon emissions and plan to achieve this goal by investing in energy efficiency improvements, deploying small-scale

onsite and utility-scale renewable energy systems, electrifying our fleet and neutralizing residual emissions.

• Reduce water consumption 15% by 2025 (over a 2019 baseline). By monitoring our water consumption across our business,

and identifying actions that lessen our dependence on water, we continue to reduce our water usage.

• Achieve zero-waste certification at additional distribution center locations. To continue reducing our impact on the

environment, we are working toward building a more sustainable supply chain and expanding our Total Resource Use and

Efficiency zero-waste certification efforts across our warehousing operations.

We aim to help our customers reduce their impact on the environment as well. Through the sale of ENERGY STAR® products, we

expect to help our customers reduce carbon emissions 20% by 2030 (over a 2017 baseline), which we estimate will save our customers

collectively at least $5 billion on utility bills.

We support the circular economy by keeping consumer products in use for as long as possible through our repair and trade-in services.

Finally, we put materials back into the manufacturing process when products reach the end of their lives through our electronics and

appliance recycling program. We have collected more than 2.7 billion pounds of electronics and appliances for recycling since 2009,

including more than 183 million pounds in fiscal 2023. We remain committed to maintaining this program to collect even more in the

years ahead.

Social

Human Rights and Responsible Sourcing

We are committed to respecting and advancing human rights through our alignment with the United Nations Guiding Principles on

Business and Human Rights. Further, across all the products and services we procure, we seek to enhance our partnership with

suppliers and create value for all stakeholders through our Responsible Sourcing Program. We are active members of the Responsible

Business Alliance, which allows us to partner with many of the brands we sell, including Apple, Intel, Microsoft and Samsung.

Collectively, we embrace a common Supplier Code of Conduct and audit methodology that seeks to improve working and

environmental conditions in the supply chain.

Community Impact

The Best Buy Foundation is working to build brighter futures for teens from disinvested communities. The Best Buy Foundation

currently supports a network of 52 Best Buy Teen Tech Center

®

locations and has a goal of supporting 100 locations by 2025. Through

the Best Buy Teen Tech Centers and a suite of supporting programs, teens are able to prepare for careers of the future through access

to:

• cutting-edge technology and related training;

• post-secondary guidance for college prep and technical programs;

• mentors who inspire new passions and possibilities;

• social and emotional support, including mental health resources; and

• paid internship and career exploration opportunities that put learning into practice.

7

Human Capital Management

We believe in the power of our people. Our culture is built on the belief that engaged and committed employees – supported by

opportunities to learn, grow, innovate and explore – can lead to extraordinary outcomes. At the end of fiscal 2023, we employed more

than 90,000 employees in the U.S. and Canada, comprised of approximately 58% full-time employees, 32% part-time employees and

10% seasonal/occasional employees.

Diversity, Equity and Inclusion

We are creating a more inclusive future, both inside our company and in our communities. In fiscal 2021, we set employee diversity

goals to be attained by 2025, and we are pleased to report the following achievements in fiscal 2023:

• filled 37% of new, salaried corporate positions with Black, Indigenous and People of Color (“BIPOC”) employees, compared to

our goal to fill one of three positions; and

• filled 25% of new, salaried field positions with female employees, compared to our goal to fill one of three positions.

We are committed to creating a stronger community of diverse suppliers to help increase BIPOC representation in the tech industry. We

continue making progress on our commitment to spend at least $1.2 billion with BIPOC and diverse businesses by 2025. In addition, we

are investing up to $10 million with Brown Venture Group, a venture capital firm that focuses exclusively on Black, Latino and

Indigenous technology startups in emerging technologies.

For our communities, we continue making progress on our commitment to spend $44 million by 2025 to expand college preparation and

career opportunities for BIPOC students, including adding scholarships for Historically Black Colleges and University students and

increasing scholarship funding for Best Buy Teen Tech Center youth.

The Compensation and Human Resources Committee of our Board supports the development of an inclusive and diverse culture

through oversight of our human resources policies and program. The Nominating, Corporate Governance and Public Policy Committee

of our Board recommends criteria for the selection of individuals to be considered as candidates for election to the Board, which

includes diversity considerations.

Training and Development

Personal growth is at the heart of our people strategy, and we believe investing in training, upskilling and reskilling programs will

produce long-lasting benefits to the organization by creating a more productive, engaged and adaptable workforce. In fiscal 2023, each

of our U.S. employees spent an average of at least 44 hours on training and development.

We made the following enhancements to our training and development program in fiscal 2023:

• expanded our leadership development program to all field and corporate leaders and directors across the enterprise with a

focus on adaptability, the ability to work effectively with others and create a culture of belonging, the ability to apply reason and

learning experiences into one’s role, and the ability to understand and thrive in a digital economy;

• launched a program with an artificial intelligence platform to proactively plan for future workforce roles, creating new learning

and career paths;

• provided LinkedIn Learning to full-time employees for continuous learning in leadership and functional skills; and

• created a new onboarding training program for all new employees to create a consistent experience that starts their unique

learning path specific for their job.

Employee Benefits

We strive to help our employees live happy, healthy and productive lives that balances work and home.

Our benefits aim to support employees’ overall well-being. In fiscal 2023, we elevated caregiver support for employees with a focus on

disabilities and neurodivergence through a partnership with Joshin.

Additionally, we continued our focus on:

• caregiver support benefits that enable employees to receive personalized help in a time of great need through Wellthy, a

program that helps employees with emergency housing, healthcare, substance abuse, complex eldercare issues and other

moments of crisis;

• pay continuation (paid leave) and caregiver pay so employees can care for themselves and their loved ones;

• maternity leave that provides qualifying employees up to 10 weeks at 100% pay;

• Included Health – a new benefit providing support for employees with a focus on LGBTQ+ needs that connect members to

affirming and clinically competent providers, and one-on-one support with a care coordinator;

• access to physical and mental health virtual visits;

• emergency assistance through the HOPE Fund – Helping Our People in Emergencies – in equal partnership with the Richard

M. Schultze Family Foundation, provides employees in hardship situations an opportunity to receive up to $2,500 in financial

assistance;

8

• mental health, including our commitment to raise awareness about mental health, equipping employees with training to notice

issues in themselves or others, and then find help; and

• tuition assistance, including the expansion of our partnership schools giving eligible employees the opportunity to earn a

degree with no out-of-pocket costs.

The Compensation and Human Resources Committee of our Board oversees risks related to our human capital management through

its regular review of our practices, policies and programs, which includes overall employee wellness and engagement in these areas,

employee benefit plan compliance, leadership succession planning and wage, retention and hiring programs.

For more information on environmental and social matters, as well as human capital management, please see Best Buy’s Fiscal 2023

Environmental, Social and Governance Report, including a Task Force for Climate Related Financial Disclosures index, expected to be

published in June 2023, at https://corporate.bestbuy.com/sustainability. This website and the report are not part of this annual report

and are not incorporated by reference herein.

Available Information

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file

reports, proxy statements and other information with the U.S. Securities and Exchange Commission (“SEC”). We make available, free

of charge on our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy

statements and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as

reasonably practicable after we electronically file these documents with, or furnish them to, the SEC. These documents are posted on

our website at https://investors.bestbuy.com. The SEC also maintains a website that contains reports, proxy and information

statements, and other information regarding issuers, including us, that file electronically with the SEC at https://sec.gov.

We also make available, free of charge on our website, our Amended and Restated Articles of Incorporation, Amended and Restated

By-laws, the Corporate Governance Principles of our Board and our Code of Business Ethics adopted by our Board, as well as the

charters of all of our Board's committees: Audit Committee; Compensation and Human Resources Committee; Finance and Investment

Policy Committee; and Nominating, Corporate Governance and Public Policy Committee. These documents are posted on our website

at https://investors.bestbuy.com.

Copies of any of the above-referenced documents will also be made available, free of charge, upon written request to

Best Buy Co., Inc. Investor Relations Department at 7601 Penn Avenue South, Richfield, MN 55423-3645.

Website and Social Media Disclosure

We disclose information to the public concerning Best Buy, Best Buy’s products, content and services and other items through our

websites in order to achieve broad, non-exclusionary distribution of information to the public. Some of the information distributed

through this channel may be considered material information. Investors and others are encouraged to review the information we make

public in the locations below.* This list may be updated from time to time.

• For information concerning Best Buy and its products, content and services, please visit: https://bestbuy.com.

• For information provided to the investment community, including news releases, events and presentations, and filings with the

SEC, please visit: https://investors.bestbuy.com.

• For the latest information from Best Buy, including press releases, please visit: https://corporate.bestbuy.com/archive/.

* These corporate websites, and the contents thereof, are not incorporated by reference into this Periodic Report on Form 10-K nor

deemed filed with the SEC.

Item 1A. Risk Factors.

Described below are certain risks we believe apply to our business and the industry in which we operate. The risks are categorized

using the following headings: external, strategic, operational, regulatory and legal, and financial and market. Each of the following risk

factors should be carefully considered in conjunction with other information provided in this Annual Report on Form 10-K and in our

other public disclosures. The risks described below highlight potential events, trends or other circumstances that could adversely affect

our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing and, consequently, the

market value of our common stock and debt instruments. These risks could cause our future results to differ materially from historical

results and from guidance we may provide regarding our expectations of future financial performance. The risks described below are

not an exhaustive list of all the risks we face. There may be others that we have not identified or that we have deemed to be immaterial.

All forward-looking statements made by us or on our behalf are qualified by the risks described below.

9

External Risks

Macroeconomic pressures, including, but not limited to, the current geopolitical climate, may adversely affect consumer

spending and our financial results.

To varying degrees, our products and services are sensitive to changes in macroeconomic conditions that impact consumer spending.

As a result, consumers may be affected in many different ways, including, for example:

• whether or not they make a purchase;

• their choice of brand, model or price-point;

• how frequently they upgrade or replace their devices; and

• their appetite for complementary services (for example, Best Buy Totaltech).

Real GDP growth, inflation (including wage inflation), consumer confidence, the COVID-19 pandemic, employment levels, oil prices,

interest, tax and foreign currency exchange rates, availability of consumer financing, housing market conditions, limitations on a

government’s ability to borrow and/or spend capital, costs for items such as fuel and food, any recession (and resulting corresponding

declines in consumer sentiment) in response at least in part to central banks’ actions to reduce inflation, bank failures or limited liquidity

in accessing bank deposits, and other macroeconomic trends can adversely affect consumer demand for the products and services that

we offer. In addition to general levels of inflation, we are also subject to risks of specific inflationary pressures on product prices due to,

for example, high consumer demand, component shortages and supply chain disruption. We may be unable to increase our prices

sufficiently to offset these pressures.

Geopolitical issues around the world and how our markets are positioned can also impact macroeconomic conditions and could have a

material adverse impact on our financial results. For example, the conflict in Ukraine may continue to significantly impact fuel prices,

inflation, the global supply chain and other macroeconomic conditions, which may further adversely affect global economic growth,

consumer confidence and demand for our products and services. Russia is a significant global producer of both fuel and raw materials

used in certain of the products we sell, including nickel, aluminum and copper. Disruptions in the markets for those inputs or other

inputs produced by Russia, whether due to sanctions, market pressure not to purchase inputs from Russia or otherwise, could increase

overall material costs for many of the products we sell. We cannot predict the extent or duration of sanctions in response to the conflict

in Ukraine, nor can we predict the effects of legislative or other governmental actions or regulatory scrutiny of Russia, its allies or other

countries with which Russia has significant trade or financial ties, including China. The conflict in Ukraine has exacerbated geopolitical

tensions globally. Further deterioration of relations between Taiwan and China, the resulting actions taken, the response of the

international community and other factors affecting trade with China or political or economic conditions in Taiwan could disrupt the

manufacturing of products or hardware components in the region, such as semiconductors and television panels sourced from Taiwan

or the broader array of products sourced from China. One or more of these factors could have a material adverse effect on our supply

chain, the cost of our products or our revenues and financial results.

Catastrophic events, including global pandemics such as the COVID-19 pandemic, could adversely affect our operating

results.

The risk or actual occurrence of various catastrophic events could have a material adverse effect on our financial performance. Such

events may consist of, or be caused by, for example:

• natural disasters or extreme weather events, including those related to climate change;

• diseases or pandemics (including COVID-19) that have affected and may continue to affect our employees, customers or

partners;

• earthquakes, floods, fires or other catastrophes affecting our properties, employees or customers;

• power loss, telecommunications failures, or software or hardware malfunctions; or

• terrorism, civil unrest, mass violence or violent acts, or other conflicts.

In recent years, we have observed an increase in the number and severity of certain catastrophic events in many of our markets. Such

events can adversely affect our workforce and prevent employees and customers from reaching our stores and properties. They can

also disrupt or disable portions of our supply chain, distribution network and third-party business operations that may impact our ability

to procure goods or services required for business operations at the quantities and levels we require. Finally, such events can also

affect our information technology systems, resulting in disruption to various aspects of our operations, including our ability to transact

with customers and fulfill orders. The adverse effects of any such catastrophic event would be exacerbated if experienced at the same

time as another unexpected and adverse event, such as the COVID-19 pandemic.

The COVID-19 pandemic in particular has had and may continue to subject our business, operations and financial condition to a

number of risks. These risks have included or may in the future continue to include: (i) significant reductions in customer visits to, and

spending at, our stores; (ii) significant disruptions to our supply chain; (iii) fluctuating consumer spending, particularly in light of the

provision of government stimulus funds; (iv) novel changes to our operations, such as the roll-out of contactless, curbside pick-up for

our goods, (v) the implementation of safety standards by various state and federal agencies; (vi) risks related to the shift in channels in

which customers choose to engage us, such as by switching to online shopping, which may affect our profitability; and (vii) our ability to

finance our operations. The emergence of new and more transmissible, more virulent, and/or immune-evading SARS-COV-2 variants

could exacerbate these risks.

10

Three of our largest states by total sales are California, Texas and Florida, areas where natural disasters and extreme weather

conditions have been, and could continue to be, more prevalent. Natural disasters and climate-related events in those states and other

areas where our sales and operations are concentrated could result in significant physical damage to or closure of our stores,

distribution centers or other facilities.

Further, external social activism, tension and violence resulting from external events impacting social justice and inequality, and our

response to them, may adversely affect our employees, customers, properties and the communities in which we operate. Also, if our

customers and employees do not perceive our response to be appropriate or adequate for a particular region or our company as a

whole, we could suffer damage to our reputation and our brand, which could adversely affect our business in the future. As a

consequence of these or other catastrophic events, we may endure interruption to our operations or losses of property, equipment or

inventory, which could adversely affect our revenue and profitability.

Many of the products we sell are highly susceptible to technological advancement, product life cycle fluctuations and

changes in consumer preferences.

We operate in a highly and increasingly dynamic industry sector fueled by constant technological innovation and disruption. This

manifests itself in a variety of ways: the emergence of new products and categories, the often rapid maturation of categories,

cannibalization of categories, changing price points, and product replacement and upgrade cycles.

This rapid pace of change can be hard to predict and manage, and there is no guarantee we can effectively do this all the time. If we fail

to interpret, predict and react to these changes in a timely and effective manner, the consequences can include: failure to offer the

products and services that our customers want; excess inventory, which may require heavy discounting or liquidation; inability to secure

adequate access to brands or products for which consumer demand exceeds supply; delays in adapting our merchandising, marketing

or supply chain capabilities to accommodate changes in product trends; and damage to our brand and reputation. These and other

similar factors could have a material adverse impact on our revenue and profitability.

Strategic Risks

We face strong competition from multi-channel retailers, e-commerce businesses, technology service providers, traditional

store-based retailers, vendors and mobile network carriers, which directly affects our revenue and profitability.

While we constantly strive to offer consumers the best value, the retail sector is highly competitive. Price is of great importance to most

customers and price transparency and comparability continues to increase, particularly as a result of digital technology. The ability of

consumers to compare prices on a real-time basis puts additional pressure on us to maintain competitive prices. We compete with

many other local, regional, national and international retailers and technology service providers, as well as some of our vendors and

mobile network carriers that market their products directly to consumers. Competition may also result from new entrants into the

markets we serve, offering products and/or services that compete with us.

The retail sector continues to experience increased sales initiated online and using mobile applications, as well as online sales for both

in-store or curbside pick-up. Online and multi-channel retailers continue to focus on delivery services, with customers increasingly

seeking faster, guaranteed delivery times and low-cost or free shipping. Our ability to be competitive on delivery times and delivery

costs depends on many factors, and our failure to successfully manage these factors and offer competitive delivery options could

negatively impact the demand for our products and our profit margins. Because our business strategy is based on offering superior

levels of customer service and a full range of services to complement the products we offer, our cost structure might be higher than

some of our competitors, and this, in conjunction with price transparency, could put pressure on our margins. As these and related

competitive factors evolve, we may experience material adverse pressure on our revenue and profitability.

If we fail to attract, retain and engage appropriately qualified employees, including employees in key positions, our operations

and profitability may be harmed. In addition, changes in market compensation rates may adversely affect our profitability.

Our performance is highly dependent on attracting, retaining and engaging appropriately qualified employees in our stores, service

centers, distribution centers, field and corporate offices. Our strategy of offering high-quality services and assistance for our customers

requires a highly trained and engaged workforce. The turnover rate in the retail sector is relatively high and increased during the

COVID-19 pandemic, and there is an ongoing need to recruit and train new employees. Factors that affect our ability to maintain

sufficient numbers of qualified employees include, for example, employee engagement, our reputation, unemployment rates,

competition from other employers, availability of qualified personnel and our ability to offer appropriate compensation and benefit

packages. Failure to recruit or retain qualified employees in the future may impair our efficiency and effectiveness and our ability to

pursue growth opportunities. In addition, a significant amount of turnover of our executive team or other employees in key positions with

specific knowledge relating to us, our operations and our industry may negatively impact our operations.

We operate in a competitive labor market and there is a risk that market increases in compensation and employer-provided benefits

could have a material adverse effect on our profitability. We may also be subject to continued market pressure to increase employee

hourly wage rates and increased cost pressure on employer-provided benefits. Our need to implement corresponding adjustments

within our labor model and compensation and benefit packages could have a material adverse impact to the profitability of our

business.

11

Our strategy to expand into health and new products, services and technologies brings new business, financial and

regulatory risks.

As we introduce new products and services, we may have limited experience in these newer markets and regulatory environments and

our customers may not like our new value propositions. These offerings may present new and difficult technology and regulatory

challenges, and we may be subject to claims if customers of these offerings experience service disruptions, failures or other issues.

This expanded risk increases the complexity of our business and places significant responsibility on our management, employees,

operations, systems, technical expertise, financial resources, and internal financial and regulatory control and reporting functions. In

addition, new initiatives we test through trials and pilots may not scale or grow effectively or as we expected, which could limit our

growth and negatively affect our operating results. They may also involve significant laws or regulations that are beyond our current

expertise.

With our focus on healthcare, new products and services may frequently require regulatory approvals for market introduction. The

number and diversity of regulatory bodies add complexity and may negatively impact time to market and implementation costs. For

example, the healthcare space in which we operate is highly regulated from a product safety and quality perspective, and its services

and products, including parts or materials from suppliers, are subject to regulation by various government and regulatory agencies

including, but not limited to, the U.S. Food and Drug Administration (“FDA”). Non-compliance with conditions imposed by regulatory

authorities could result in product recalls, a temporary ban on products, stoppages at production facilities, remediation costs, orders to

stop providing services, fines or claims for damages. Product safety incidents or user concerns could trigger business reviews by the

FDA or other regulatory agencies, which, if failed, could trigger these impacts.

In addition, the ongoing digitalization of Best Buy Health’s products and services, including our holding of personal health data and

medical data, increases the importance of compliance with data privacy and similar laws. The services and systems used in certain

instances subject us to privacy and information security requirements, such as the Health Insurance Portability and Accountability Act,

and could expose us to customer data privacy and information security risks, as well as business or system interruption risks. Given our

acquisition of Current Health, a care-at-home technology platform, we also are subject to the UK’s General Data Protection Regulation

(“GDPR”) and other regulatory frameworks. These and other related issues could have a material adverse impact on our financial

results and reputation.

Our focus on services exposes us to certain risks that could have a material adverse impact on our revenue and profitability,

as well as our reputation.

We offer a full range of services that complement our product offerings, including consultation, delivery, design, installation,

memberships, protection plans, repair, set-up, technical support, and health, safety and caregiving monitoring and support. Designing,

marketing and executing these services is subject to incremental risks. These risks include, for example:

• pressure on services attachment as a result of the sustained increase in consumer desire to purchase product offerings online

and through mobile applications;

• increased labor expense to fulfill our customer promises;

• increased pressure on margins from our Best Buy Totaltech membership offering, which includes incremental customer

benefits, and associated costs, compared to our previous Total Tech Support offer, and the risk that increased volumes will not

fully compensate for lower margins, or for loss of revenue and profit from revenue streams that are now included as benefits;

• pressure on traditional labor models to meet the evolving landscape of offerings and customer needs;

• use of third-party services that do not meet our standards or comply with applicable labor and independent contractor

regulations, leading to potential reputational damage and liability risk;

• increased risk of errors or omissions in the fulfillment of services;

• unpredictable extended warranty failure rates and related expenses;

• employees in transit using company vehicles to visit customer locations and employees being present in customer homes,

which may increase our scope of liability;

• the potential for increased scope of liability relating to managed services offerings;

• employees having access to customer devices, including the information held on those devices, which may increase our

responsibility for the security of those devices and the privacy of the data they hold;

• the engagement of third parties to assist with some aspects of construction and installation, and the potential responsibility for

the actions they undertake;

• the risk that in-home services could be more adversely impacted by inclement weather, health and safety concerns, and

catastrophic events; and

• increased risk of non-compliance with new laws and regulations applicable to these services.

12

Our reliance on key vendors and mobile network carriers subjects us to various risks and uncertainties which could affect our

revenue and profitability.

We source the products we sell from a wide variety of domestic and international vendors. In fiscal 2023, our 20 largest suppliers

accounted for approximately 79% of the merchandise we purchased, with five suppliers – Apple, Samsung, HP, LG and Sony -

representing approximately 57% of total merchandise purchased. We generally do not have long-term written contracts with our

vendors that would require them to continue supplying us with merchandise. Our profitability depends on securing acceptable terms

with our vendors for, among other things, the price of merchandise we purchase from them, funding for various forms of promotional

programs, payment terms, allocations of merchandise, development of compelling assortments of products, operation of vendor-

focused shopping experiences within our stores and terms covering returns and factory warranties. While we believe we offer

capabilities that these vendors value and depend upon to varying degrees, our vendors may be able to leverage their competitive

advantages ⎯ for example, their financial strength, the strength of their brands with customers, their own stores or online channels or

their relationships with other retailers ⎯ to our commercial disadvantage. The potential adverse impact of these factors can be

amplified by price transparency (which can limit our flexibility to modify selling prices) and a highly competitive retail environment.

Generally, our ability to negotiate favorable terms with our vendors is more difficult with vendors where our purchases represent a

smaller proportion of their total revenues and/or when there is less competition for those products. In addition, vendors may decide to

limit or cease allowing us to offer certain categories, focus their marketing efforts on alternative channels or make unfavorable changes

to our financial or other terms.

We are also dependent on a relatively small number of mobile carriers to allow us to offer mobile devices with carrier connections. The

competitive strategies utilized by mobile network carriers can have a material impact on our business, especially with ongoing

consolidation in the mobile industry. For example, if carriers change the structure of contracts, upgrade terms, qualification

requirements, monthly fee plans, cancellation fees or service levels, the volume of upgrades and new contracts we sign with customers

may be reduced, adversely affecting our revenue and profitability. In addition, our carriers may also serve customers through their own

stores, websites, mobile applications and call centers or through other competing retail channels.

Demand for the products and services we sell could decline if we fail to maintain positive brand perception and recognition

through a focus on consumer experience.

We operate a portfolio of brands with a commitment to customer service and innovation. We believe that recognition and the reputation

of our company and our brands are key to our success. Operational factors, such as failure to deliver high quality services,

uncompetitive pricing, failure to meet delivery promises or business interruptions, could damage our reputation. External factors, such

as negative public remarks or accusations, could also be damaging. Third parties may commit fraud while using our brand without our

permission, possibly harming brand perception or reputation. The ubiquity of social media means that customer feedback and other

information about our company are shared with a broad audience in a manner that is easily accessible and rapidly disseminated.

Damage to the perception or reputation of our brands could result in, among other things, declines in revenues and customer loyalty,

decreases in gift card and service plan sales, lower employee retention and productivity and vendor relationship issues, all of which

could materially adversely affect our revenue and profitability.

Failure to effectively manage strategic ventures, alliances or acquisitions could have a negative impact on our business.

We may decide to enter into new joint ventures, partnerships, alliances or acquisitions with third parties (collectively, “new ventures”).

Assessing the viability of new ventures is typically subject to significant uncertainty, and the success of such new ventures can be

adversely affected by many factors, including, for example:

• different and incremental business and other risks of the new venture not identified in our diligence assessments;

• failure to attract, motivate and retain key employees of the new venture;

• uncertainty of forecasting financial performance;

• failure to integrate aspects of the new venture into our existing business, such as new product or service offerings or

information technology systems;

• failure to maintain appropriate internal controls over financial reporting;

• failure to generate expected synergies, such as cost reductions;

• unforeseen changes in the business environment of the new venture;

• disputes or strategic differences with key employees or other third-party participants in the new venture; and

• adverse impacts on relationships with vendors and other key partners of our existing business or the new venture.

If new ventures are unsuccessful, our liquidity and profitability could be materially adversely affected, and we may be required to

recognize material impairments to goodwill and other assets acquired. New ventures may also divert our financial resources and

management’s attention from other important areas of our business.

13

Failure to effectively manage our real estate portfolio may negatively impact our operating results.

Effective management of our real estate portfolio is critical to our omnichannel strategy. Failure to identify and secure suitable locations

for our stores and other facilities could impair our ability to compete successfully and our profitability. Most of our properties are leased

under multi-year contracts. As such, it is essential that we effectively evaluate a range of factors that may influence the success of our

long-term real estate strategy. Such factors include, for example:

• changing patterns of customer consumption and behavior, particularly in light of an evolving omnichannel environment;

• our ability to adjust store operating models to adapt to these changing patterns;

• the location and appropriate number of stores, supply chain and other facilities in our portfolio;

• the interior layout, format and size of our stores;

• the products and services we offer at each store;

• the local competitive positioning, trade area demographics and economic factors for each of our stores;

• the primary term lease commitment and long-term lease option coverage for each store; and

• the occupancy cost of our stores relative to market rents.

If we fail to effectively evaluate these factors or negotiate appropriate terms, or if unforeseen changes arise, the consequences could

include, for example:

• closing stores and abandoning the related assets, while retaining the financial commitments of the leases;

• incurring significant costs to remodel or transform our stores;

• operating stores, supply chain or service locations that no longer meet the needs of our business; and

• bearing excessive lease expenses.

These consequences could have a material adverse impact on our profitability, cash flows and liquidity.

For leased property, the financial impact of exiting a location can vary greatly depending on, among other factors, the terms of the

lease, the condition of the local real estate market, demand for the specific property, our relationship with the landlord and the

availability of potential sub-lease tenants. It is difficult for us to influence some of these factors, and the costs of exiting a property can

be significant. In addition to rent, we are typically still responsible for taxes, insurance and common area maintenance charges for

vacant properties until the lease commitment expires or is terminated. Similarly, when we enter into a contract with a tenant to sub-

lease property, we usually retain our obligations as the master lessee. This leaves us at risk for any remaining liability in the event of

default by the sub-lease tenant.

Operational Risks

Interruptions and other factors affecting our stores and supply chain, including in-bound deliveries from our vendors, may

adversely affect our business.

Our stores and supply chain assets are a critical part of our operations, particularly in light of industry trends and initiatives, such as

ship-from-store and the emphasis on fast delivery when purchasing online. We depend on our vendors’ abilities to deliver products to us

at the right location, at the right time and in the right quantities. We also depend on third parties for the operation of certain aspects of

our supply chain network. The factors that can adversely affect these aspects of our operations include, but are not limited to:

• interruptions to our delivery capabilities;

• failure of third parties to meet our standards or commitments;

• disruptions to our systems and the need to implement new systems;

• limitations in capacity;

• global supply chain impacts that could hinder our vendors’ ability to meet our demand for product volumes and timing;

• increased levels of inventory loss due to organized crime, theft or damage;

• risk to our employees and customers arising from burglary or robbery from our stores or other facilities;

• consolidation or business failures in the transportation and distribution sectors;

• labor strikes, slow-downs or labor shortages, including as a result of an increasingly competitive job market, affecting our

stores or impacting ports or any other aspect of our supply chain;

• diseases, pandemics (including COVID-19), outbreaks and other health-related concerns; and

• increasing transportation costs.

It is important that we maintain optimal levels of inventory in each store and distribution center and respond rapidly to shifting demands.

Any disruption to, or inefficiency in, our supply chain network, whether due to geopolitical conflicts, the COVID-19 pandemic or other

factors, could damage our revenue and profitability. The risks associated with our dependence on third parties are greater for small

parcel home deliveries because of the relatively small number of carriers with the scope and capacity required by our business. The

continuing growth of online purchases for delivery increases our exposure to these risks. If we fail to manage these risks effectively, we

could experience a material adverse impact on our reputation, revenue and profitability.

14

We utilize third-party vendors for certain aspects of our operations, and any material disruption in our relationships or their

services may have an adverse impact on our business.

We engage key third-party business partners to support various functions of our business, including, but not limited to, delivery and

installation, customer warranty, information technology, web hosting and cloud-based services, customer loyalty programs, promotional

financing and customer loyalty credit cards, gift cards, technical support, transportation, insurance programs and human resource

operations. Any material disruption in our relationships with key third-party business partners or any disruption in the services or

systems provided or managed by third parties could impact our revenues and cost structure and hinder our operations, particularly if a

disruption occurs during peak revenue periods.

Our exclusive brands products are subject to several additional product, supply chain and legal risks that could affect our

operating results.

Sales of our exclusive brands products, which include Best Buy Essentials, Dynex, Insignia, Modal, Platinum and Rocketfish branded

products, as well as products such as Jitterbug and Lively branded products, represent an important component of our product offerings

and our revenue and profitability. Most of these products are manufactured by contract manufacturers in China and Southeast Asia.

This arrangement exposes us to the following additional potential risks, which could have a material adverse effect on our operating

results:

• we have greater exposure and responsibility to consumers for warranty replacements and repairs as a result of exclusive

brands product defects, and our recourse to contract manufacturers for such warranty liabilities may be limited in foreign

jurisdictions;

• we may be subject to regulatory compliance and/or product liability claims relating to personal injury, death or property

damage caused by exclusive brands products, some of which may require us to take significant actions, such as product

recalls;

• we have experienced and may continue to experience disruptions in manufacturing and logistics due to the COVID-19

pandemic, and we may experience disruptions in manufacturing or logistics in the future due to inconsistent and unanticipated

order patterns, our inability to develop long-term relationships with key manufacturers, other diseases or pandemics,

unforeseen natural disasters or geopolitical crises, such as the conflict in Ukraine and this conflict’s potential impact on global

geopolitical tensions, including with China or between China and Taiwan;

• we may not be able to locate manufacturers that meet our internal standards, whether for new exclusive brands products or for

migration of the manufacturing of products from an existing manufacturer;

• we may be subject to a greater risk of inventory obsolescence as we do not generally have return-to-vendor rights;

• we are subject to developing and often-changing labor and environmental laws for the manufacturing of products in foreign

countries, and we may be unable to conform to new rules or interpretations in a timely manner;

• we may be subject to claims by technology or other intellectual property owners if we inadvertently infringe upon their patents

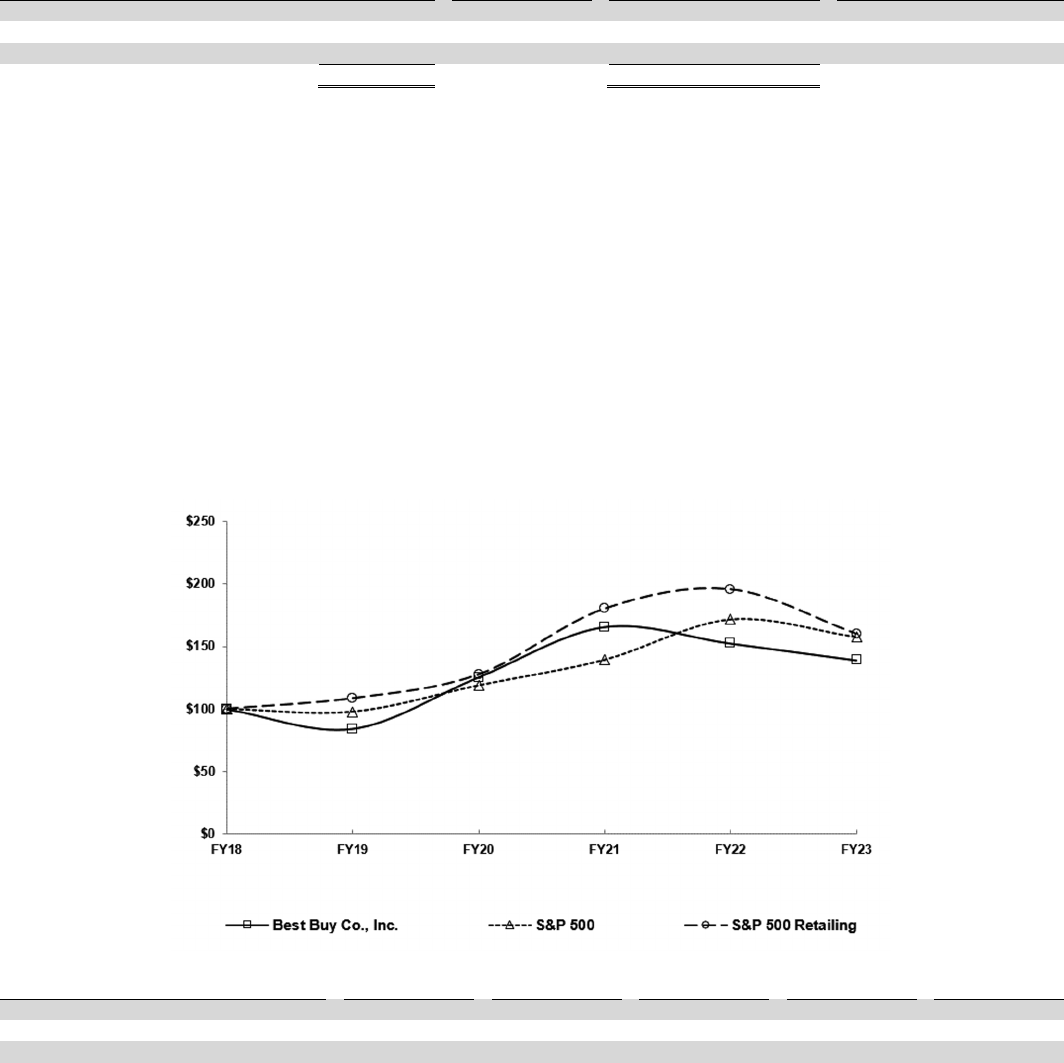

or other intellectual property rights, or if we fail to pay royalties owed on our exclusive brands products;