GUIDELINES FOR SERVICE PROVIDER SALE OF BUSINESS

Provided for information to guide LHINs and contracted service providers – November

2017.

A. OVERVIEW

A LHIN (or more than one LHIN) may be notified by a service provider that the service provider

is selling all or a portion of its business. Typically, this is highly confidential information that

should not be shared with other LHINs without the consent of the service provider.

There are two types of sale that will impact the LHIN, a sale of assets owned by the service

provider or a sale of the majority of the shares of the service provider. Under the 2007 Clinical

Services Template Agreement and the 2009 Equipment and Supplies Template Agreement,

prior to completing a sale of business a service provider under contract with a LHIN must i)

obtain written consent from the LHIN(s) to an assignment of the contract to the purchaser (in an

asset sale) or ii) obtain written consent from the LHIN(s) to the change of control of the service

provider (in a sale of shares).

There is standard consent documentation that is to be used for each of these processes. Each

process (asset sale and share sale) requires a different type of consent document. The LHIN

should note that the current service provider, buyer and the LHIN will need to sign the

documentation. Generally this will require the assistance of legal counsel and the legal services

are often paid for by the service provider or the purchaser. In addition, the LHIN will need to

conduct financial and other due diligence on the purchaser before giving consent. HSSOntario

will assist in the due diligence exercise where current information on the buyer and/or seller

exists as a result of the prequalification process. Consent is often conditional upon the service

provider retaining the staff that are in existence at the time of the sale.

B. PROCESS

Generally, senior managers are first contacted about the sale of a business and any work that is

to be completed by the LHIN is done by the contract managers. We recommend that the

following process be followed when a LHIN is contacted about the sale of business of one of its

service providers:

1) Find out as much information about the transaction as possible from the service

provider. Ask the following questions:

It is a share purchase or an asset purchase?

When is the anticipated closing date for the transaction?

Who is the purchaser?

2) Contact Director, Quality and Education at Health Shared Services Ontario who will

assist with coordination across all LHINs involved and, engage LHIN Legal on behalf

of the LHINs.

3) The LHIN will want to request financial information, experience information and legal

information from the purchaser prior to approving the transaction. Refer to the

attached checklist as an example of information to be requested. The checklist lists

information that is similar to the information obtained from applicants in HSSOntario’s

central prequalification process. Note that the checklist is only a basic list and

Service Provider Sale of Business Guidelines (November 2017) Page 2 of 4

additional information may be necessary depending on the transaction. Request this

information from the service provider as soon as possible and review all disclosed

information.

4) LHIN legal will work with the LHINs to draft the appropriate consents. The following

information will be required from each LHIN:

A list of each of the contracts (including any all contracts in effect and any

amendments and extensions to such contracts) that a LHIN has with the

service provider.

Name of the individual(s) at the LHIN who will sign the consent (signing

authority).

5) Once the LHIN has signed off on the language of the consent, LHIN legal will

circulate the consents to counsel for the service provider.

6) Once finalized through any negotiation, the consents are signed by the LHIN. Note,

execution of consents may occur concurrently (ie: LHIN may not be the last to sign

the document; however, execution of the consents must occur prior to closing of the

transaction.

C. PREQUALIFIED ENTITIES

If the buyer has been prequalified as part of HSSOntario’s prequalification process for providers

of clinical services and medical equipment and supplies, some of the due diligence information

may not be required. This information may have already been submitted and reviewed by

HSSOntario as part of the prequalification process (for example, with respect to previous

experience, the buyer will have an experience rating from HSSOntario). If the buyer has been

prequalified, HSSOntario will recommend to the LHINs what, if any, due diligence material will

not be required from the buyer.

The LHIN and any prequalified service provider should be aware that if a sale of business

transaction results in a significant change to a Service Provider that, immediately prior to the

transaction, is prequalified, (such as, for example, all of the assets are transferred out of the

entity, the entity is dissolved, etc.), the entity’s prequalification status may be adversely affected

by the transaction and the Service Provider will need to apply to the HSS Ontario for

prequalification prior to participating in any subsequent RFP process initiated by a LHIN.

Questions may be forwarded to prequalification@hssontario.ca or call 416-750-1720.

Service Provider Sale of Business Guidelines (November 2017) Page 3 of 4

Due Diligence Checklist

Note: The following are due diligence questions that would be appropriate to ask a

buyer.

FINANCIAL

1. Most recent audited financial statements of the buyer (in the case of an asset sale) or the

buyer and the target company (in the case of a share sale).

2. Any proforma balance sheet prepared for the post-transaction entity.

3. If the buyer is not a current LHIN provider, audited financial statements for its two fiscal

years immediately prior to the closing date of the transaction, and if the most recent audited

statement will be more than 6 months old as of the closing date of the transaction, any

interim financial statements produced since the audited financial statements.

EXPERIENCE

Asset Sale

1. Does the buyer have any other current contracts with a LHIN? What is the value (in dollars

and, if applicable, hours or visits) of all current LHIN contracts?

2. Does the buyer have any equivalent experience (hospital, clinic, hospice, long-term care

home or retirement home) and if so what is the value of the contract (in dollars and, if

applicable, hours or visits).

3. What is the buyer's intention regarding the service provider's current staff.

4. If a buyer does not have a LHIN contract or equivalent experience, what is the buyer’s plan

for delivery the services?

Share Sale

1. Does the buyer have any current contract(s) with a LHIN? What is the value (in dollars and,

if applicable, hours or visits) of all current LHIN contracts?

2. What is the buyer's intention regarding transition and integration of the new business (i.e.

keep as a separate business, division, integrate into existing business etc)?

TRANSITION

1. What is the buyer’s plan for transition?

Service Provider Sale of Business Guidelines (November 2017) Page 4 of 4

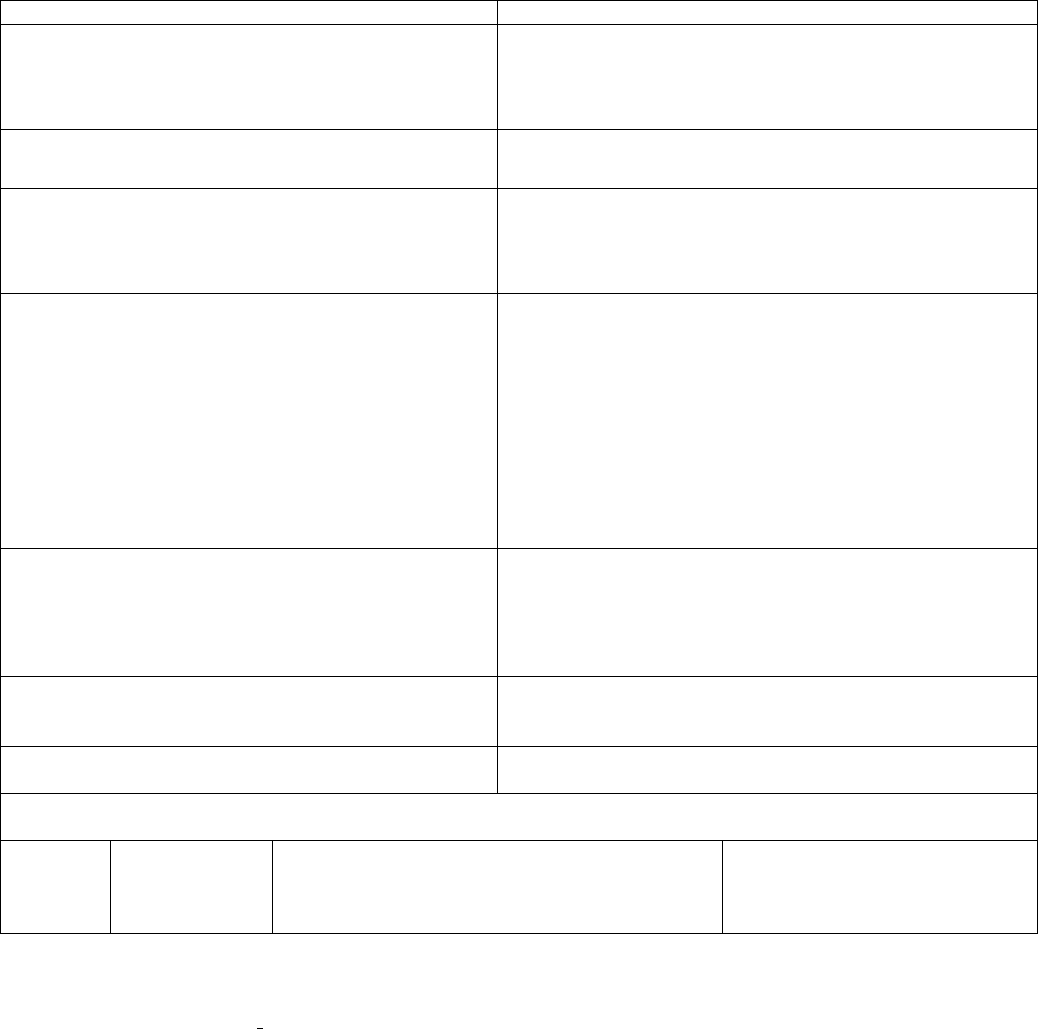

LEGAL

1. The buyer should provide details regarding the following litigation matters for the three year

period prior to the transaction:

Description Required

Buyer’s Disclosure

Provide details of any labour relations strikes or

labour relations actions that may materially adversely

affect the buyer’s ability to deliver the Services as

described in the Services Agreement with the LHIN.

Provide details of any violation of wage or other fair

labour practices and standards by the buyer.

Provide details of any occurrences of default on a

contract, or disqualification in a LHIN RFP process

(not a simple failure to proceed in the RFP process)

or being prohibited from providing services to a LHIN.

Provide details of any contract that the buyer (or an

affiliate of the buyer) has failed to complete, in which

the buyer (or an affiliate of the buyer) has been

terminated or in which the buyer (or an affiliate of the

buyer) has received formal written notification that the

buyer (or an affiliate of the buyer) has committed a

material breach.

Include any Quality Improvement Notices (QIN)

issued, date opened, LHIN involved, and a

description of the issue(s).

Provide details of any conviction or investigation of

the buyer (or an affiliate of the buyer) for a violation of

the criminal law or any other regulations or

requirements relating to professional matters or any

other matters relevant to its business.

Provide details of any administrative or regulatory

offences, charges or penalties imposed on the buyer

and the outcome of such.

Provide details of any insolvency, bankruptcy or

similar applications by or against the buyer.

State any complete or ongoing lawsuits, arbitrations or legal actions arising from contracts undertaken by the

buyer (or an affiliate of the buyer).

Year

Award FOR or

AGAINST

Buyer (or

affiliate)

Name of client, cause of litigation, and matter in

dispute

Disputed amount (current value

in Canadian dollars)

[Note to LHINs: If the buyer has significant operating affiliates, these entities should also

provide legal disclosure.]

2. The buyer should indicate whether any of the litigation matters disclosed is covered by

insurance.