Prepared by:

August 2019

Short-Term & Long-Term

Incentive Plans

Executive Benefits Network

833 East Michigan Street | Suite 1480

Milwaukee, WI 53202

Phone 414.431.3999

Fax 414.431.9689

ebn-design.com

The “Why” for Nonqualified Benefit Plans

Nonqualified benefit plans are implemented to recruit, retain and reward key employees. Properly

implemented plans motivate and reward employees to work towards common company goals while retaining

employees with a long-term outlook. These plans enable companies to provide appropriate retirement

benefits with a more targeted and efficient use of benefit dollars. There are a few different plans to consider

when looking at a nonqualified retention plan. These include: Short-Term Incentive Plan (STIP), Long-Term

Incentive Plan (LTIP), Supplemental Executive Retirement Plan (SERP), Voluntary Deferral Plan and a Split

Dollar Plan. Specifically, we will be focusing on Short-Term and Long-Term Incentive Plans providing an

overview of each plan, advantages and a sample design structure.

Short-Term and Long-Term Incentive Plans

The best way for these plans to recruit, retain and reward your employees is implementing both an STIP and

LTIP. The two plans complement each other and can be very effective if designed properly. STIPs should be

used to motivate key employees to execute the company goal’s and make good operating decisions to

maximize performance over the course of the year. LTIPs are developed to achieve long-term growth and

increase the value of the organization over a long period of time. These plans are not governed by the

Employee Retirement Income Security Act of 1974 (ERISA). They are simply bonus plans for key employees.

2

Short-Term Incentive Plan

The objective of an STIP is to reward key employees for their individual

contribution for achieving the company’s short-term business strategies and

goals set by the compensation committee to increase the company’s

profitability. This plan is similar to a cash incentive plan. STIP metrics are

determined by a compensation committee and can be measured both

financially, such as revenue growth or maximizing profit or non-financially,

with goals that align with the company strategy, such as meeting safety or

quality assurance hurdles or the development of a new product.

Employer Benefits of STIPs:

Provides greatest “pay for performance” flexibility

Each contribution has its own vesting schedule (i.e. 5 year rolling vesting)

Plan costs are offset indirectly through increasing profitability

Employee Benefits of STIPs:

Participant is rewarded based on a percentage of base pay (i.e. 5% to 25%)

being contributed on a pre-tax basis

Contributions grow on a tax-deferred basis tied to a fixed or variable rate

index (selected by the employer)

Distributions at the end of each vesting cycle provide employee a

meaningful payout while employed making the benefit more relevant than

a retirement-based benefit

3

Objectives of Incentive Plans

Offer a reward for exceeding set goals

Provide a market-competitive cash compensation opportunity

Assist in recruiting and retaining key employees critical to the company’s

success

Support and reward the achievement of the company and individual results

Build a strong, performance-based culture across the company

A Short-Term Incentive

Plan rewards key

employees for their

individual contribution

for achieving the

company's short-term

business strategies

and goals.

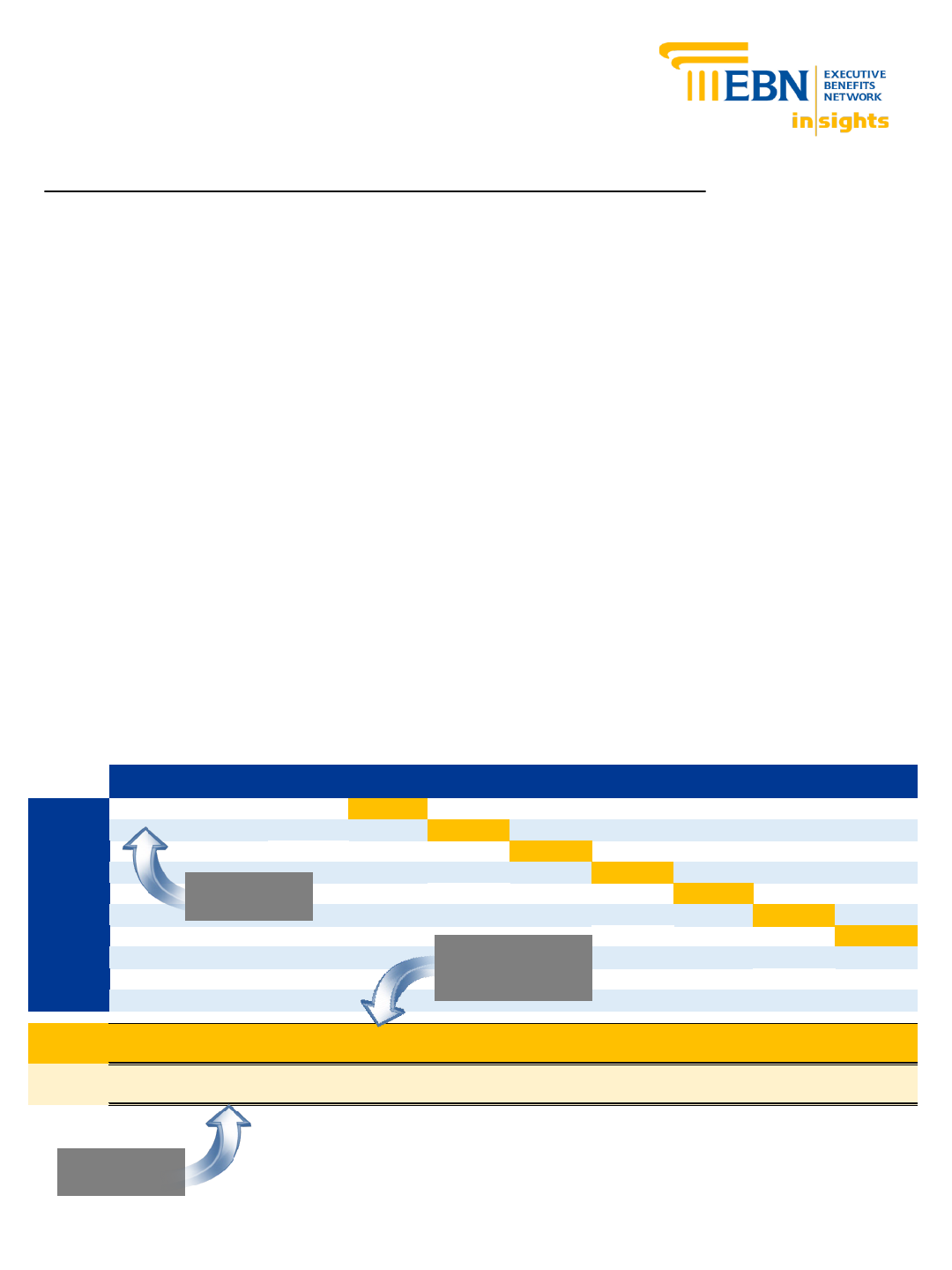

Sample Case Study: Short-Term Incentive Plan for Future Leaders

Scenario:

CEO and Board have identified several key individuals to be future leaders of the bank

Bank is in a competitive urban marketplace, where retention is a challenge and recruiting key talent is

equally as hard

Company pays competitive salary and cash bonuses, but has no long-term retention plans in place for

this group

Traditional deferred compensation programs have little power for this group due to the number of

years they have to wait to receive the funds

4

End of

Plan Year

1 2 3 4 5 6 7 8 9 10

1 $10,000 $10,450 $10,920 $11,412 $0 $0 $0 $0 $0 $0

2 0 $10,300 $10,764 $11,248 $11,754 $0 $0 $0 $0 $0

3 0 $0 $10,609 $11,086 $11,585 $12,107 $0 $0 $0 $0

4 0 0 0 $10,927 $11,419 $11,933 $12,470 $0 $0 $0

5 0 0 0 0 $11,255 $11,762 $12,291 $12,844 $0 $0

6 0 0 0 0 0 $11,593 $12,114 $12,660 $13,229 $0

7 0 0 0 0 0 0 $11,941 $12,478 $13,039 $13,626

8 0 0 0 0 0 0 0 $12,299 $12,852 $13,431

9 0 0 0 0 0 0 0 0 $12,668 $13,238

10 0 0 0 0 0 0 0 0 0 $13,048

$0 $0 $0 $11,412 $11,754 $12,107 $12,470 $12,844 $13,229 $13,626

$10,000 $20,750 $32,293 $33,262 $34,259 $35,287 $36,346 $37,436 $38,559 $39,716

Payout

Amount

Unvested

Balance

Benefit paid out first

of the year after

4-year vesting

Serves as a

Golden Handcuff

Employer

Contribution

Assumptions:

Annual Employer Contribution:

$10,000 (10% of pay)

Cost of Living Adjustment:

3%

Annual Interest Crediting Rate:

4.5%

Vesting Schedule:

4-year rolling vesting

Benefit Payout:

Lump Sum

Long-Term Incentive Plan

Similar to an STIP, the purpose of an LTIP is to reward and retain key

employees providing to the company's achievement in their goals and

objectives. LTIPs are focused on the company’s long-term goals and

accomplishments. Typically, LTIPs are a mix of equity (ie. stock options,

performance shares, etc.) and a cash component. This plan allows the key

employee help achieve the performance goals of the company in order to earn

more for themselves in either compensation or stock in the future.

LTIP’s are beneficial for those key employees who are loyal to the company in

hopes that they will stay for years. The drawback of an LTIP is that if the

benefit is so far out, it appears to be unreachable to that key employee. They

may find another opportunity that has a more immediate compensation

payout.

Employer Benefits of LTIPs:

Contributions are pre-tax and all account values grow on a tax-deferred

basis

Vesting reduces costs on short-term participation

Plan costs are offset indirectly through increased profitability

Provides greatest “pay for performance” flexibility

Employer can determine an annual interest crediting rate to be added to

the account values

Employee Benefits of LTIPs:

Employer provides personal wealth accumulation

Executives are financially rewarded for contributing to company’s success

Provided with a meaningful supplemental retirement benefit

5

Long-Term Incentive

Plans allow key

employees help

achieve performance

goals of the company

in order earn more

for themselves.

10%

Annual Projected Vested Unvested

Employer

Benefit Account Account Account

Contribution

Accrual Balance Balance Balance

1 $100,000

$10,000 ($10,000) $0 $10,000 $0 $10,000

2 103,000

10,300 (10,707) 0

20,707 0 20,707

3

106,090 10,609 (11,453) 0 32,160 0 32,160

4 109,273 10,927 (12,238) 0 44,398 0 44,398

5 112,551

11,255 (13,064) 0 57,462 0

57,462

6 115,927

11,593 (13,934) 0 71,395 7,140 64,256

7 119,405 11,941 (14,849) 0 86,245 17,249 68,996

8 122,987

12,299 (15,812) 0 102,057 30,617 71,440

9 126,677 12,668 (16,826)

0 118,883 47,553 71,330

10 130,477 13,048 (17,891)

0 136,774 68,387 68,387

11 134,392 13,439 (19,012) 0 155,785 93,471

62,314

12 138,423 13,842 (20,189) 0 175,975 123,182 52,792

13 142,576 14,258 (21,427) 0 197,402 157,921 39,480

14 146,853 14,685 (22,728)

0 220,130 198,117 22,013

15 151,259 15,126 (24,094) 0

244,224 244,224 0

16 155,797 15,580 (25,530) 0

269,754 269,754 0

17 160,471 16,047 (27,037) 0 296,791 296,791 0

18 165,285 16,528 (28,620) 0 325,411 325,411 0

19 170,243 17,024 (30,282) 0 355,693 355,693 0

20 175,351 0 (13,690) (39,613) 329,770 329,770 0

21 180,611 0 (12,487) (43,215) 299,043 299,043 0

22 186,029 0 (11,236) (43,215) 267,064 267,064 0

23 191,610 0

(9,933) (43,215) 233,782 233,782 0

24 197,359 0 (8,577) (43,215) 199,144 199,144 0

25 203,279 0 (7,166) (43,215) 163,095 163,095 0

26 209,378 0 (5,697) (43,215)

125,577 125,577 0

27 215,659 0 (4,168) (43,215) 86,531 86,531 0

28 222,129 0 (2,578) (43,215) 45,894 45,894 0

29 228,793 0 (922) (43,215) 3,601 3,601 0

30 235,657 0 (0) (3,601) 0 0 0

Projected

Salary

Benefit

Payment

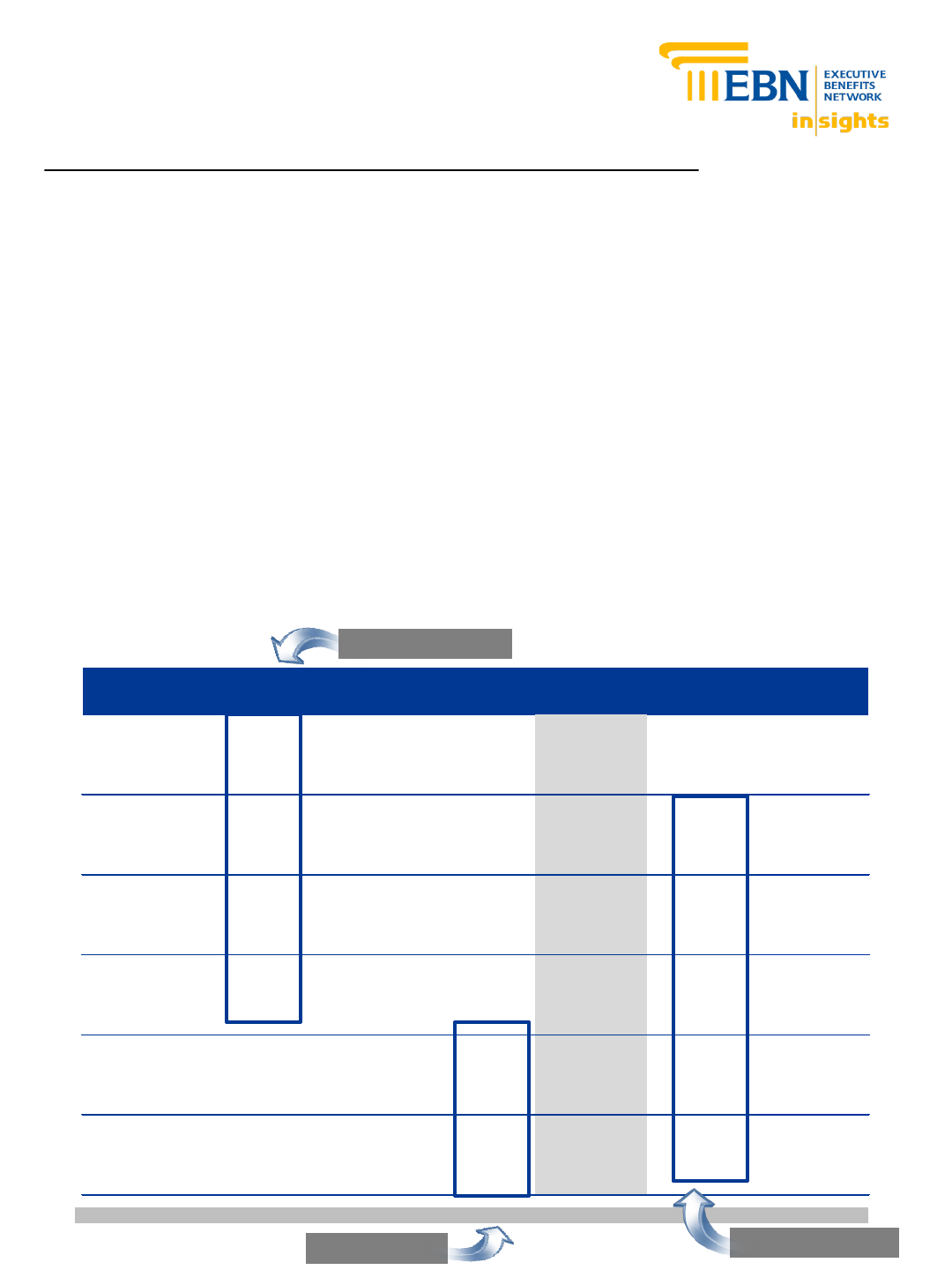

Sample Case Study: Long-Term Incentive Plan for Future Leaders

Scenario:

CEO and Board have identified several key individuals to be future leaders of the bank

Company is in a competitive urban marketplace, where retention is a challenge and recruiting key

talent is equally as hard

Company pays competitive salary and cash bonuses, but has no long-term retention plans in place for

this group

Company wants to provide their future leaders an extra retirement benefit

6

Assumptions:

Annual Employer Contribution:

$10,000 (10% of pay)

Cost of Living Adjustment:

3%

Annual Interest Crediting Rate:

4%

Vesting Schedule:

0% Years 1-5; 10% per year after

Benefit Payout:

Paid out in 10 equal annual installments

Employee Benefit

Employer Contribution

.

Retention Component

$251,169 ($432,147) ($432,147)

Conclusion

In order to implement one of these plans, the company has to determine its overall goals and objectives. This

will help determine if both an STIP and LTIP would work for their company, or if only one would be necessary.

In order to determine which may be best, consider the following:

What are competitors offering?

What are the ages and generations of your key employees?

What attracts your employees to the company?

What are your key employees future goals with the company?

Do your key employees appear loyal and satisfied with the company?

As mentioned, STIPs and LTIPs compliment one another by providing a ‘reachable’ incentive coupled with a

longer term incentive.

About Executive Benefits Network (EBN):

As the leading industry advisor, EBN specializes in the customized design, administration, and informal financing

of Nonqualified Executive Compensation and Benefit Plans (Deferred Compensation Plans), as well as the

procurement of Bank Owned Life Insurance (BOLI) programs to attract, retain, and reward key executive

talent. We emphasize the importance of education and build long-lasting relationships with clients in all 50

states, and we have access to the highest rated insurance companies in the nation. Lastly, we believe that no

two companies are alike in their needs; therefore, customization of executive benefit and compensation plans is

paramount to a successful program.

7

ABOUT THE AUTHORS

David is the Co-Founder of Executive Benefits Network and a 33-year veteran of the financial services industry.

David is a frequent speaker across the banking industry as an expert in the area of Nonqualified executive

benefit plans and Bank Owned Life Insurance programs. David is the Chairman of The American College

Foundation, Director of the Association Advanced Life Underwriting (AALU), , Trustee of the Village of River Hills,

President of the Milwaukee Country Club and Past-President of the Milwaukee Winter Club Youth Hockey

Organization. He is a member of the Indiana Bankers Association, Wisconsin Bankers Association, Bank Holding

Company Association, the Society of Financial Service Professionals and the MDRT Association’s Court of the

Table.

Pat is a Co-Owner and Managing Director of Executive Benefits Network and a 19-year veteran of the financial

services industry. Prior to entering the financial services industry, Pat worked as a senior accountant in audit for

KPMG in the bank service area and as an attorney for Michael Best & Friedrich LLP where he concentrated on

general corporate and securities law. Pat’s career focus is in the BOLI/COLI marketplace, as well designing

creative strategies for executive compensation planning, business succession planning and estate planning. Pat

is a shareholder and Director of a bank in Iowa and is an active member in the State Bar of Wisconsin. He is a

frequent speaker in industry meetings and seminars. He is a member of the Community Bankers of Iowa, Iowa

Bankers Association and Wisconsin Bankers Association.

R. David Fritz Jr., CLU

®

Managing Partner

dfritz@ebn-design.com

Office: (414) 431-9688

Patrick J. Marget, JD, CPA, CFP

®

, CLU

®

Managing Director

pmarget@ebn-design.com

Office: (414) 431-9681

8