1

The Cleantech

Revolution

It’s exponential, disruptive, and

now

Kingsmill Bond,

Sam Butler-Sloss,

Daan Walter

June 2024

2

Executive Summary

• So exponential growth of cleantech will continue. By 2030,

we will be installing 1,000 GW of solar a year and selling 6,000

GWh of batteries a year, making possible the COP goal of tripling

renewable capacity. Electrification rates will double to 0.5% a

year, and efficiency gains will increase to over 3% a year.

• The fossil fuel system faces inexorable decline. Renewables

will drive fossil fuels out of electricity generation, electrification

will push fossils out of final energy, and efficiency will reduce

fossil waste. Some 75% of fossil fuel demand is exposed to

rapidly growing cleantech alternatives, so stranded assets are

inevitable.

• Wider implications of change. The goals of the Paris

Agreement are feasible, and the Global South will continue to

leapfrog to cleantech.

• This is the pivot decade. When cleantech costs become

irresistible, the renewable capacity is built, fossil fuel demand

reaches the end of its plateau, and the transition is priced into

markets.

• Now is the time to act. We need to build out renewables and

electrify energy use, make good bets on small modular

technologies, and harvest the enormous efficiency opportunity.

The direction of change is inevitable, but the speed is up to us.

• The energy system is being transformed by the exponential forces of

renewables, electrification, and efficiency.

• The orthodox view of slow change is wrong. New clean technologies

beat old fossil commodities because clean technologies' costs fall over

time on learning curves, they are universal, and they grow quickly.

• Exponential change has been remarkable in the past decade.

Cleantech costs have fallen by up to 80 percent, while investment is up

nearly tenfold and solar generation has risen twelvefold. Electricity has

become the largest source of useful energy, and the deep force of

efficiency has reduced energy demand by a fifth.

• Change is led by China. Half the growth in cleantech is from China, but

exponential growth is also happening in the OECD and across the Global

South as Asia electrifies.

• Red flags across the fossil fuel system. New fossil electricity capacity

peaked in 2010, oil and gas capex in 2014, and internal combustion

engine (ICE) car sales in 2017. Fossil demand peaked for industry in 2014,

for buildings in 2018, most likely for electricity in 2023, and will shortly

peak in transport.

• The drivers of growth are more powerful than the barriers. Falling

cleantech costs, the energy security of eternal renewables, Chinese

leadership, and a race to the top will continue to overwhelm a fragile

fossil fuel system which wastes two-thirds of its primary energy and fails

to pay for its externality costs.

4

4

Introduction

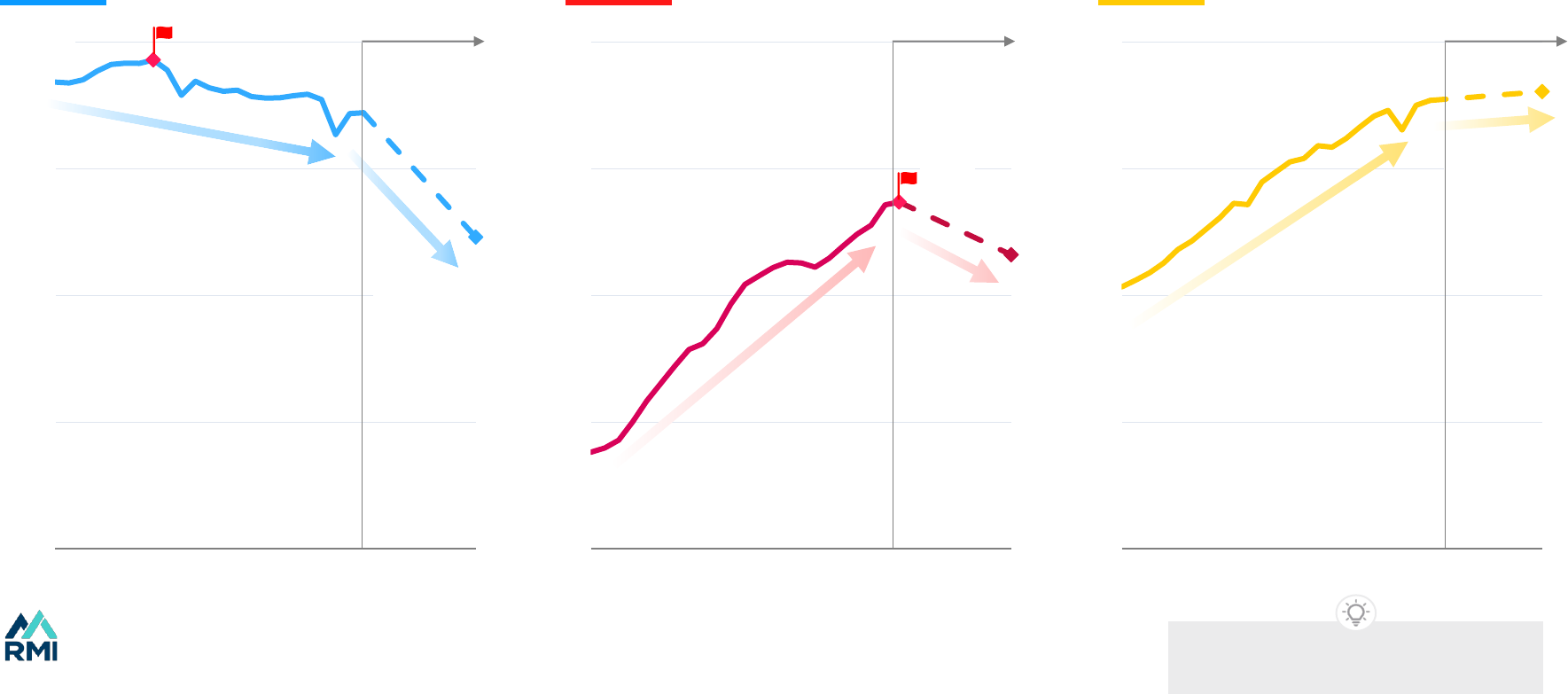

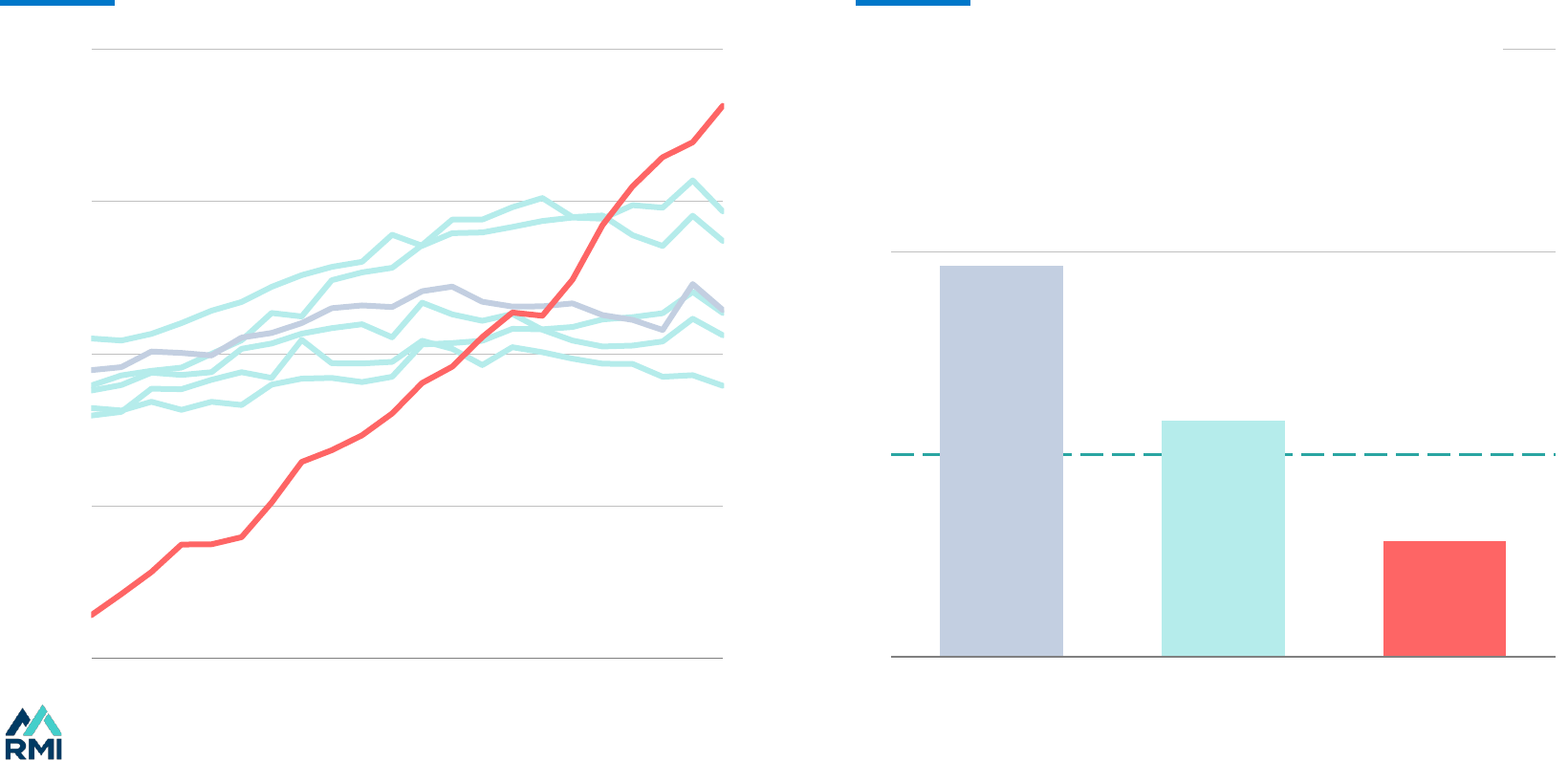

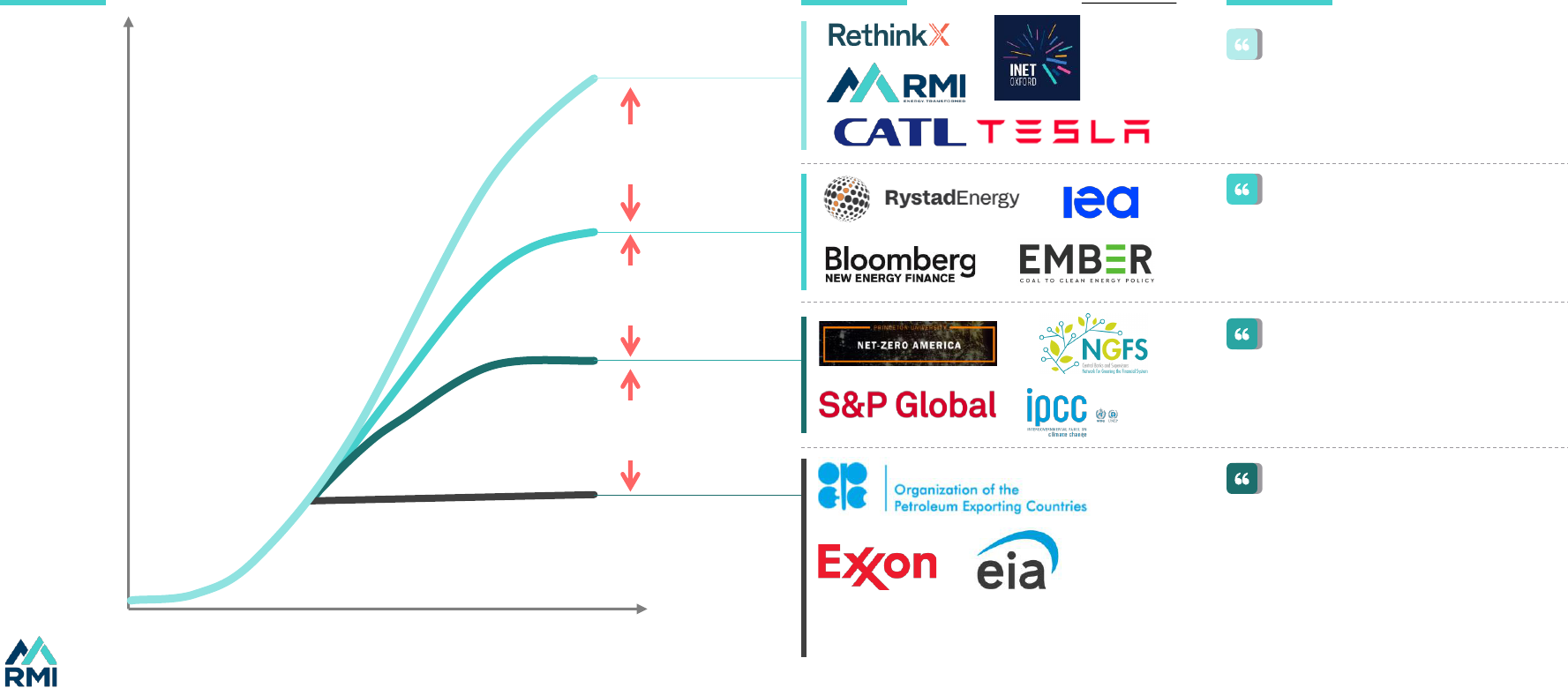

• There are two main perspectives on the energy transition: the old incumbent view

of business-as-usual; and the new insurgent view of exponential change.

• At heart this is the longstanding battle of commodities versus technologies. Design

and technologies beat commodities because they enjoy learning curves and are

limitless. So costs fall over time, and growth is exponential.

• New energy comes from manufactured, modular, scalable, clean technologies; old

energy is from centralized, heavy, dirty commodities.

• Old energy forecasting has failed in the face of the new energy reality. Linear

forecasts constrained by barriers to growth have consistently been overwhelmed

by exponential change.

• There are three key levers in the energy transition: Renewables; Electrification; and

Efficiency.

Index

1

55

2000 2010 2020 2030 2040 2050

0

100

200

300

400

500

600

2000 2010 2020 2030 2040 2050

0

100

200

300

400

500

600

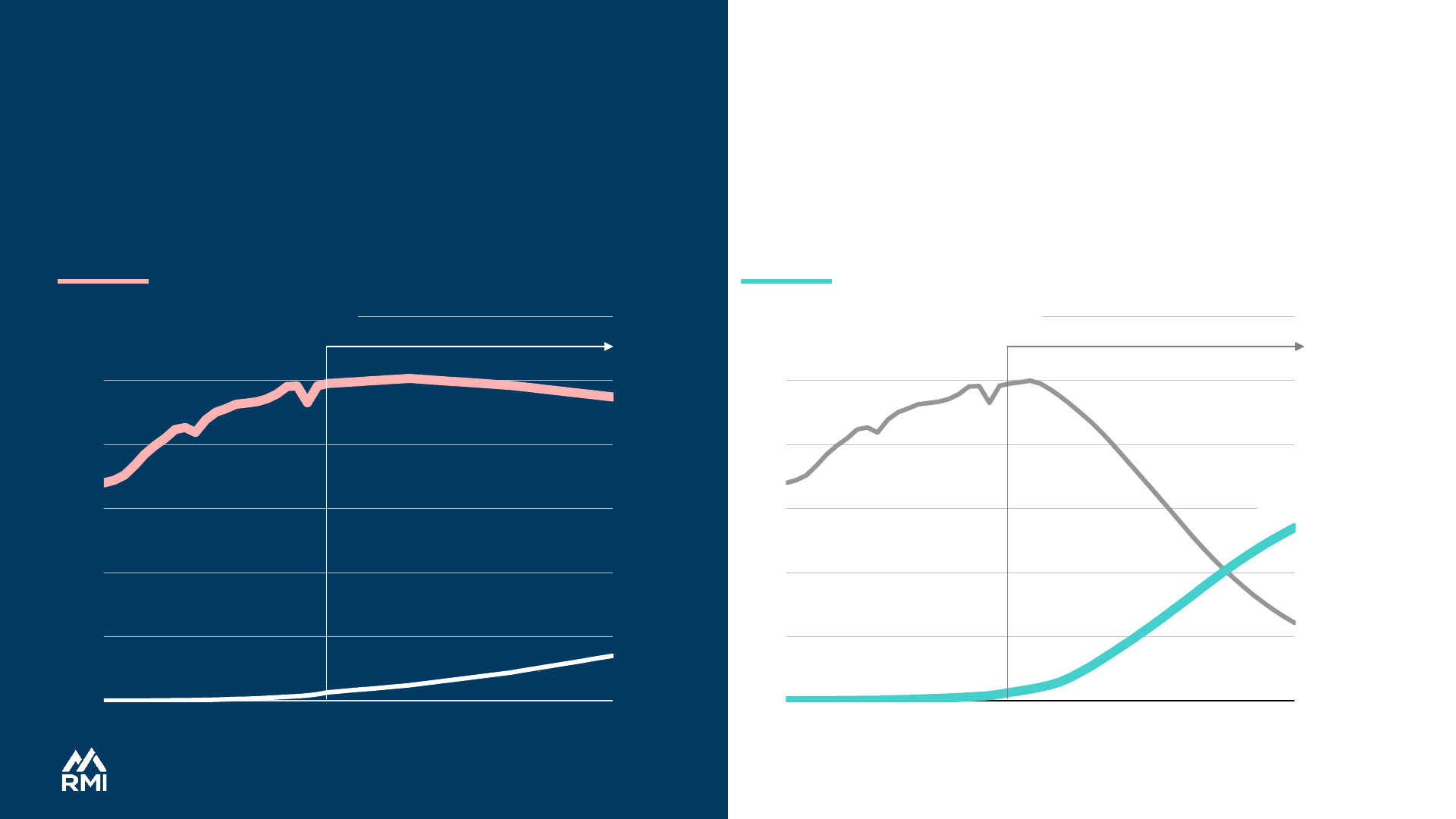

The old commodities narrative of business-as-usual:

reducing fossil fuel demand will be slow, expensive, and painful

The two visions of the

energy future

Source: Exxon Mobil Global Outlook 2023.

The new technology narrative of exponential and beneficial

change: a shift to a cheaper, faster, and distributed energy system

The old guard’s energy outlook

The new technology insurgent’s energy outlook

EJ primary energy demand EJ primary energy demand

Solar and wind

Fossil fuels

Solar and wind

Fossil fuels

Source: Rystad Energy 1.6°C Scenario.

OutlookOutlook

6

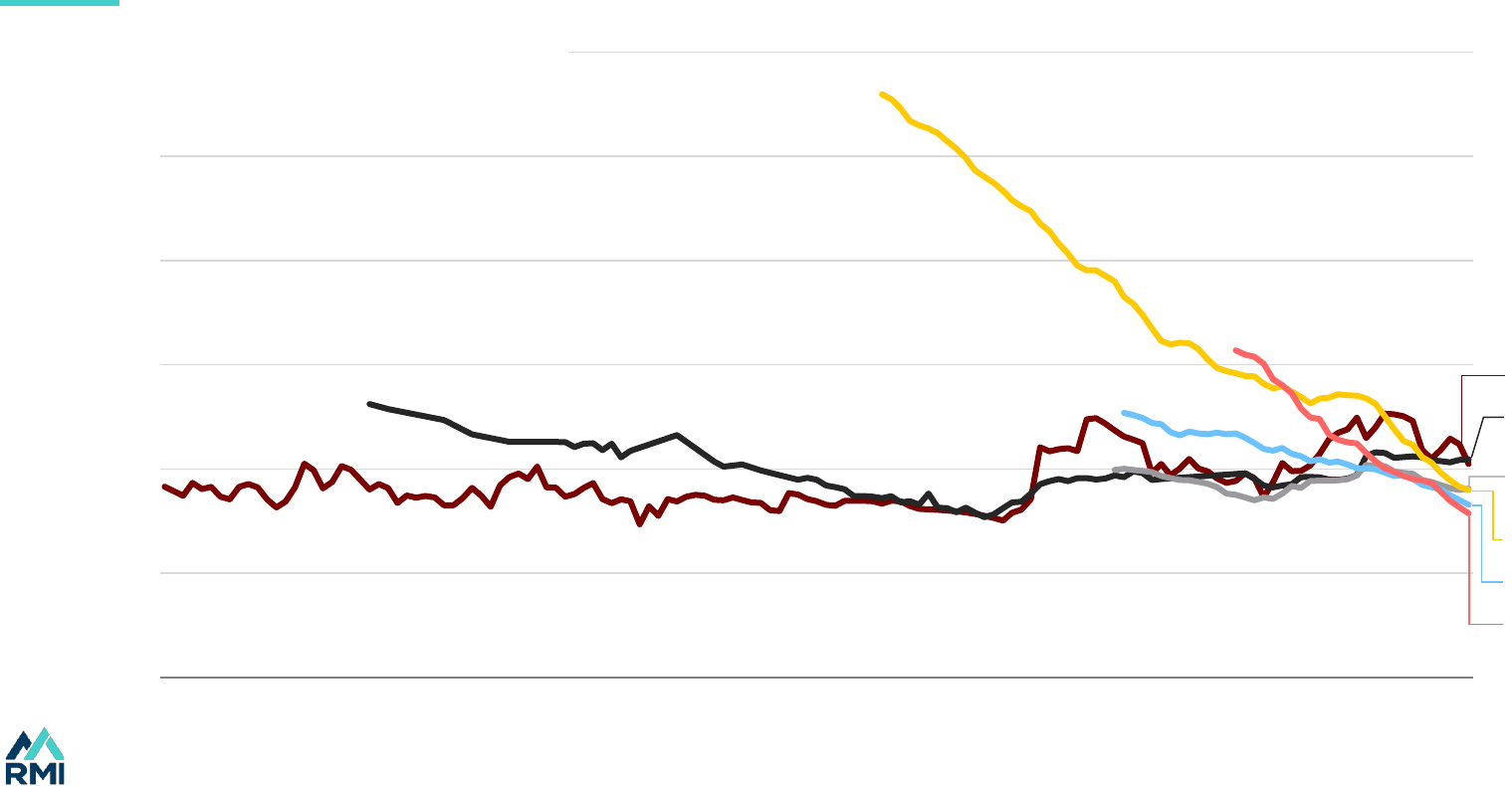

Source: Way et al. 2022. Individual fossil fuel technologies of course do have learning curves; but because of depletion and cartels, fossil fuel prices have not shown structural decline over time.

1

10

100

1,000

10,000

100,000

1,000,000

1880 1900 1920 1940 1960 1980 2000 2020

Useful energy costs, $/MWh

Oil

Coal (electricity)

Natural gas

(electricity)

Wind

Solar

Batteries

Historical costs of energy sources

Manufactured technologies (e.g., solar and wind) enjoy cost learning curves; (fossil) commodities don’t

Technologies beat commodities on costs

7

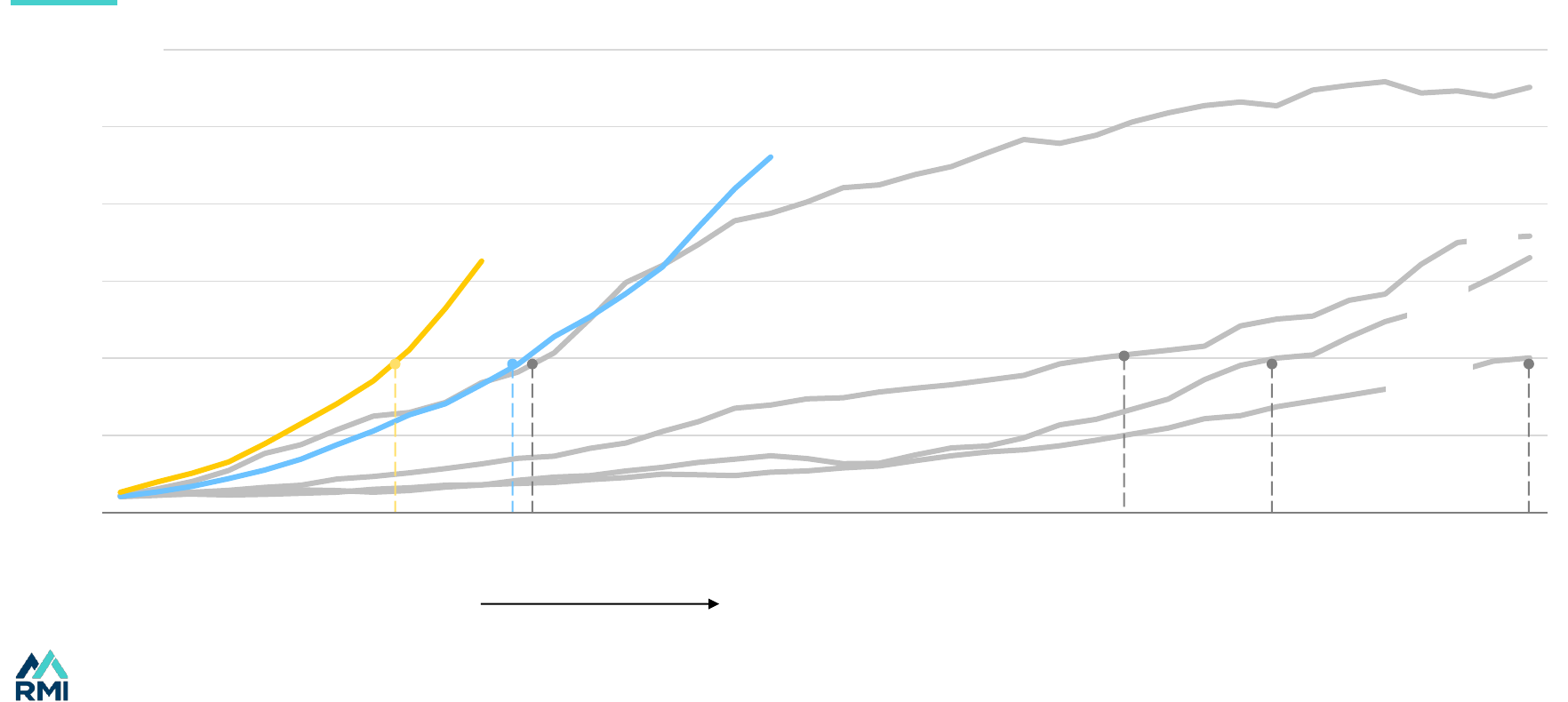

Manufactured technologies grow fast; commodities grow slowly

Technologies beat commodities on speed

Source: Ember Global Electricity Review 2024; Wind and solar generation data from Ember annual electricity data, nuclear, gas, coal and hydro generation data from Pinto et al. (2023). This graphic

is inspired by a chart from Shell featured in Nat Bullard’s deck. In 2024, nuclear has a 10–15 year lead time.

0

500

1,000

1,500

2,000

2,500

3,000

0 5 10 15 20 25 30 35

8 years

(to 2021)

12 years

(2017)

12 years

(1983)

28 years

(1981)

32 years

(1957)

39 years

(1967)

Years since generating 100 TWh

TWh

Nuclear

Gas

Coal

Hydro

Solar

Wind

Electricity generation after reaching 100 TWh

88

New energy is fundamentally different to old energy

1 Sir Nicholas Stern, “The greatest market failure the world has seen.”

THE AGE OF CARBON THE AGE OF RENEWABLES

Finite Eternal

Fiery, heavy molecules Obedient, light electrons

Geographically concentrated Available everywhere

Wasteful Efficient

Continuous material flow Circular

Trillions of dollars of annual rents to oligarchs No superprofits

Malthusian commodity-based system Schumpeterian technology-based system

Concentrates power Localizes and distributes power

Produced the greatest externality in history

1

100 times lower impact on nature

Kills millions from air pollution Saves millions from air pollution

Analogue Digital

Source: RMI.

9

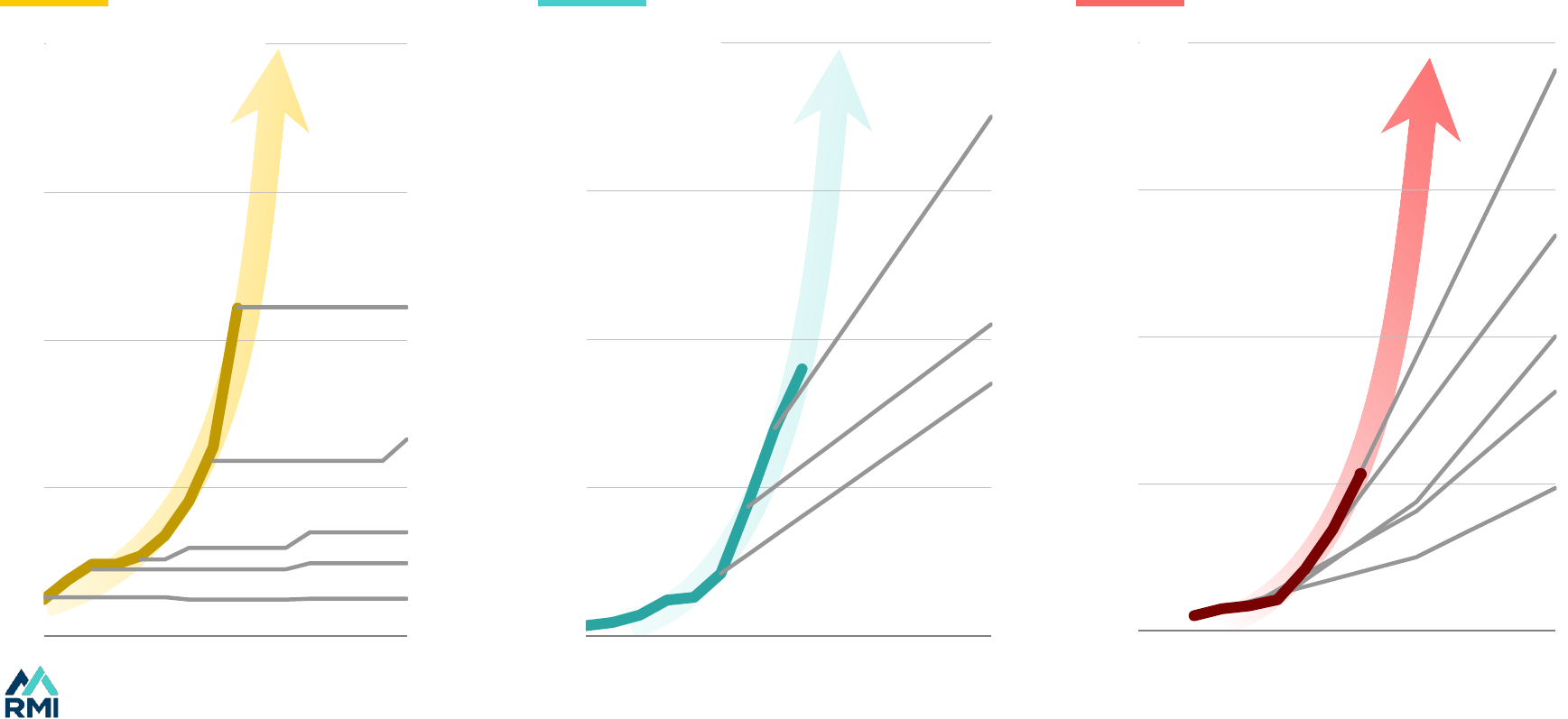

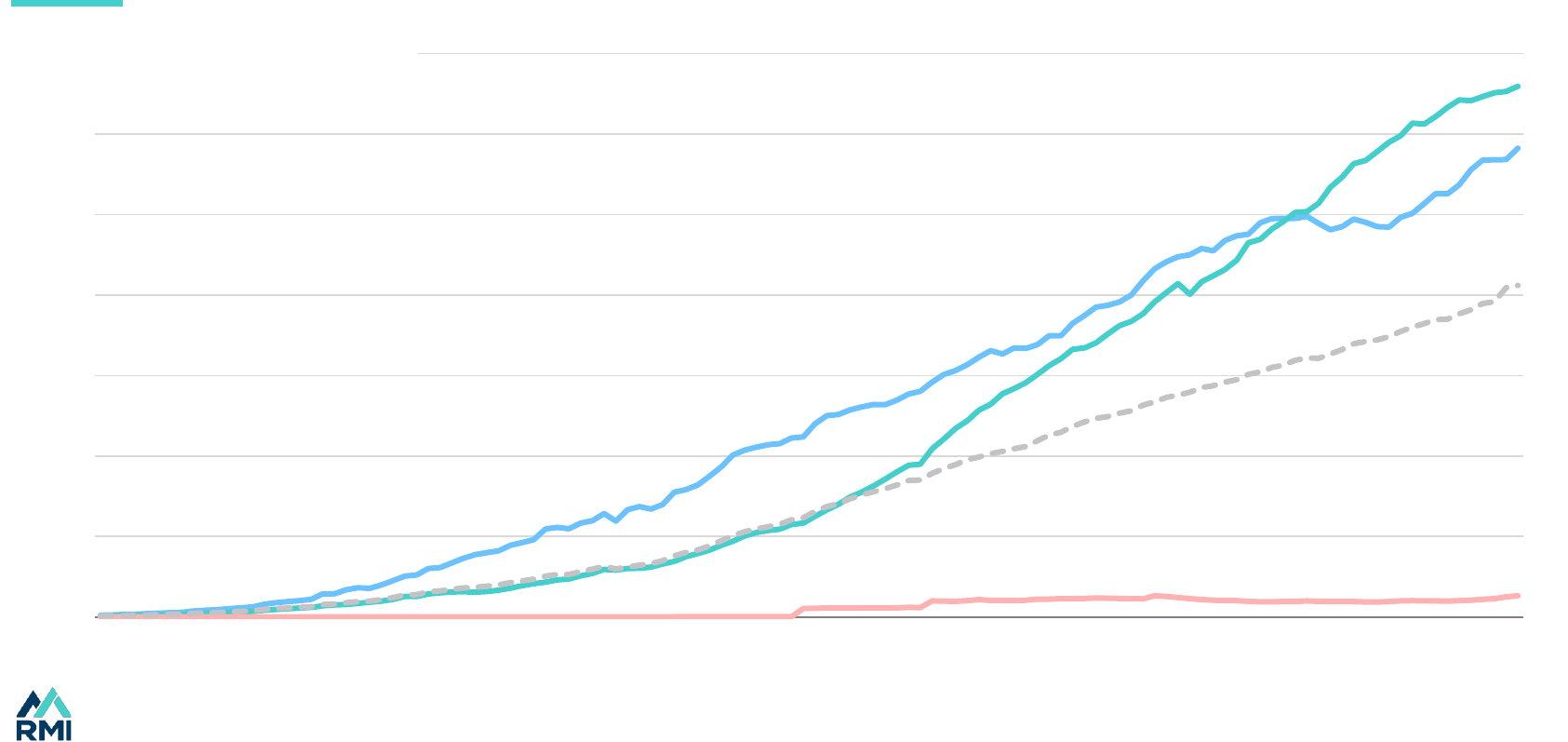

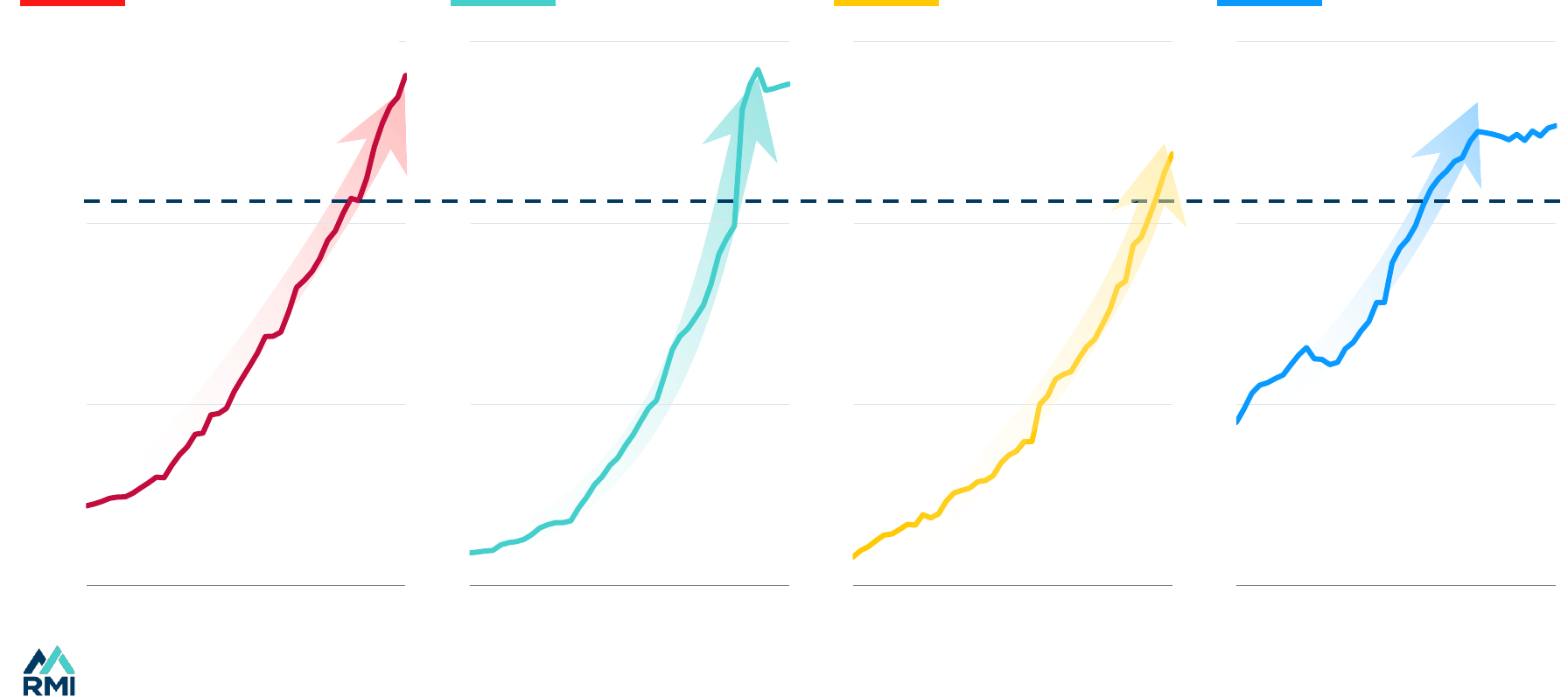

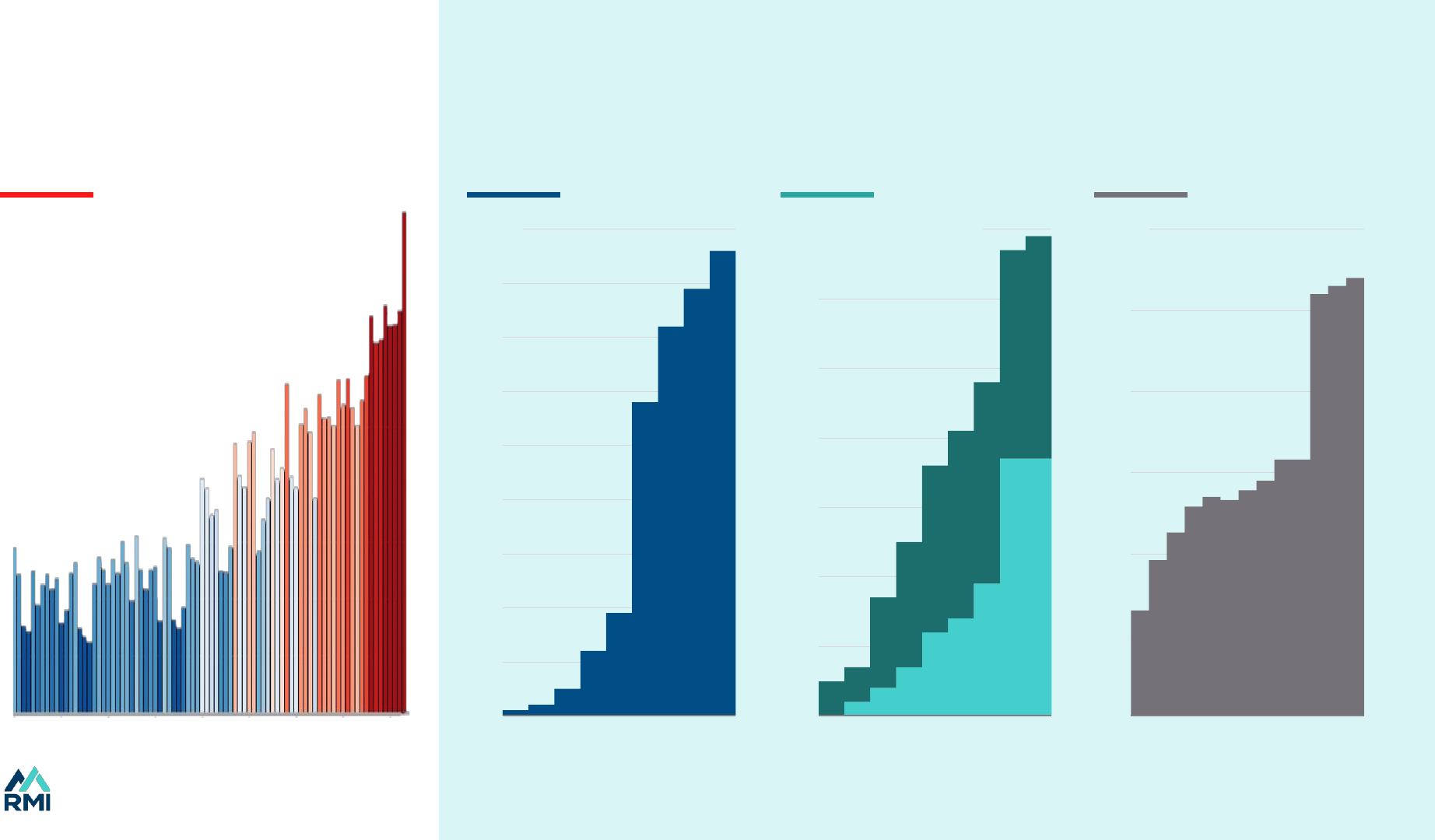

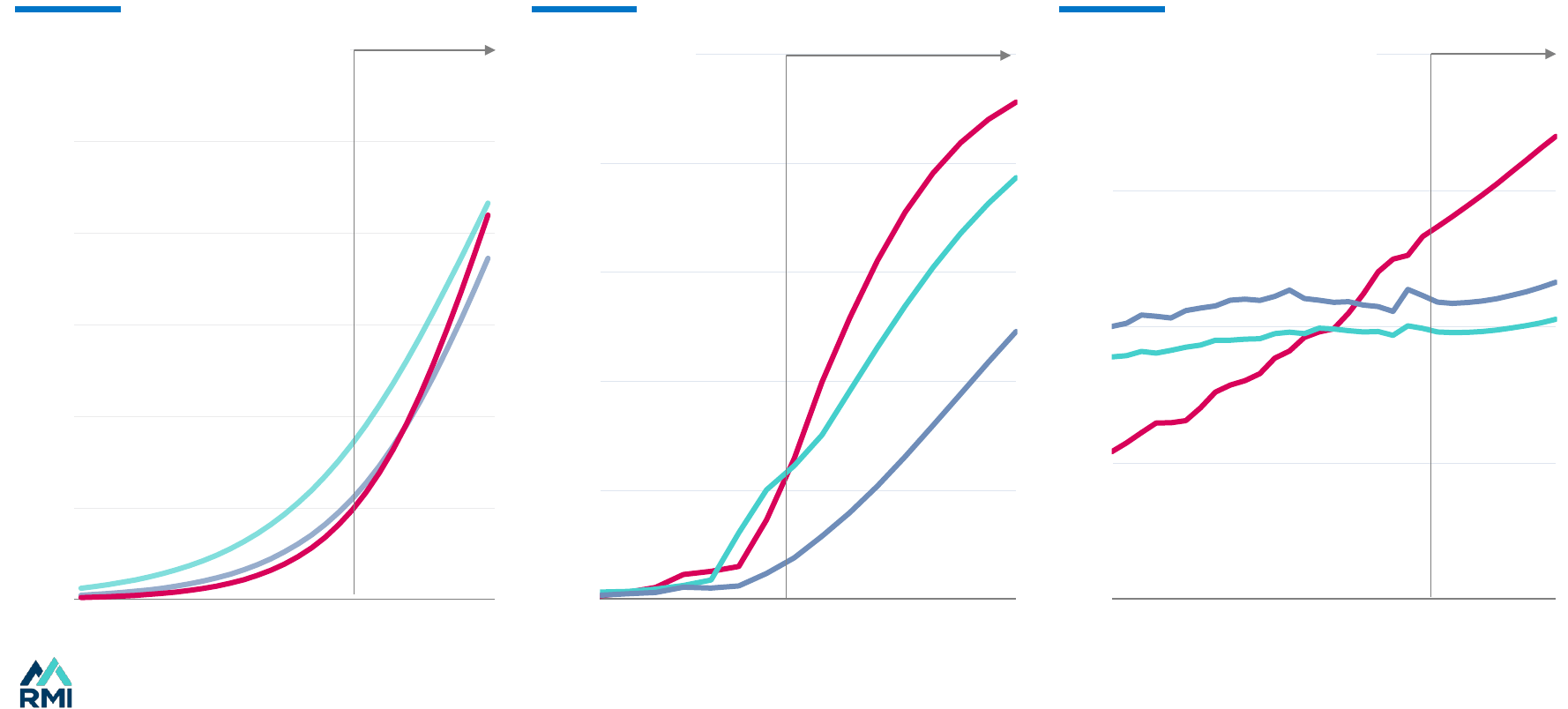

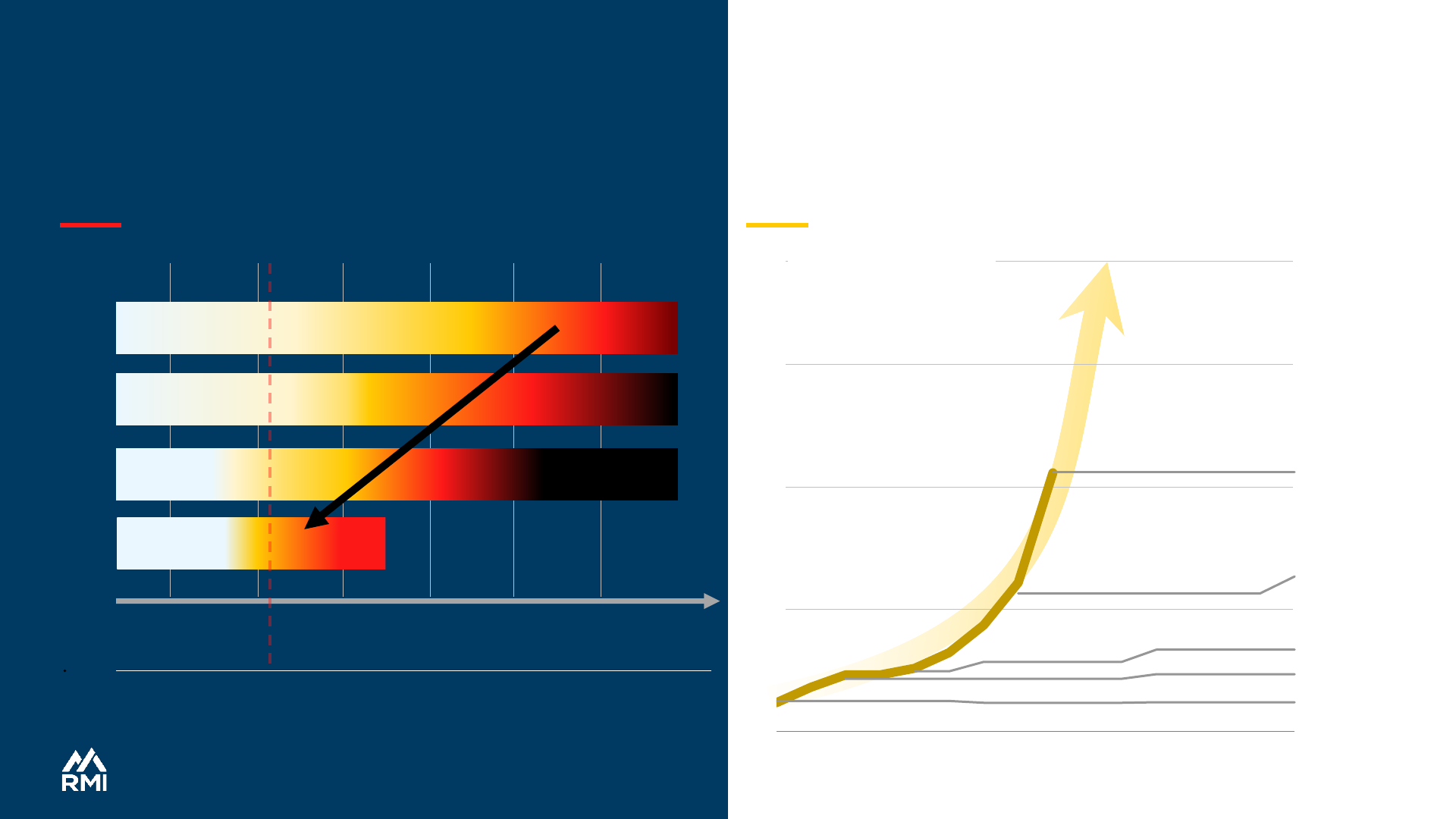

S-curve

trend

Actual

Actual

Actual

Forecasts

S-curve

trend

S-curve

trend

Forecasts

Battery sales

Source: BNEF (solar and battery actuals), IEA STEPS for WEO forecasts , RMI annotation.

New solar additions EV share of sales

Forecasts

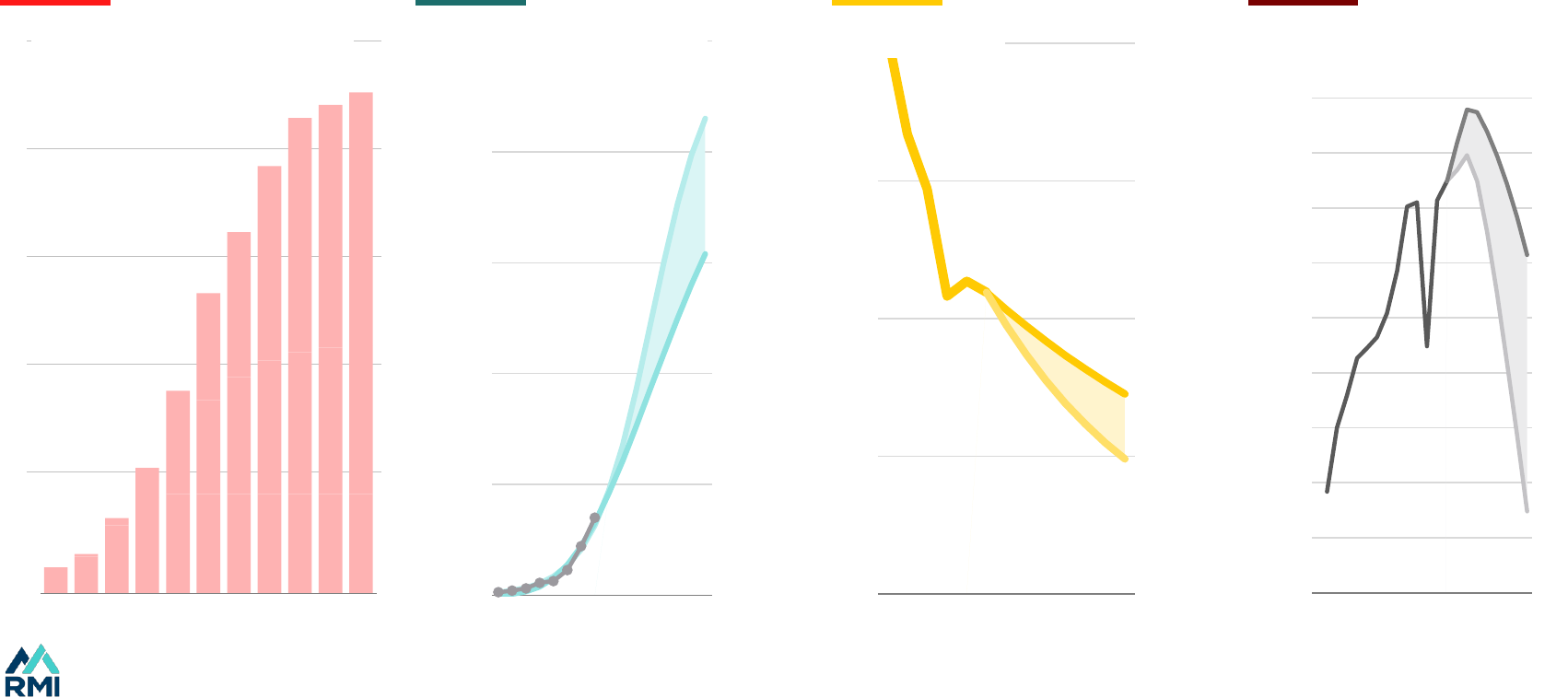

Even neutral actors modeled in linear terms. But change has been exponential

Incumbents have underestimated the speed of change

2015 2020 2025 2030

0

200

400

600

800

WEO 2016

WEO 2018

WEO 2020

WEO 2022

WEO2023

GW of annual additions

2015 2020 2025 2030

0%

10%

20%

30%

40%

of car sales EV

2021

2022

2023

2015

2020

2025

2030

0

800

1,600

2,400

3,200

GWh

2021

2022

2023

2019

2018

10

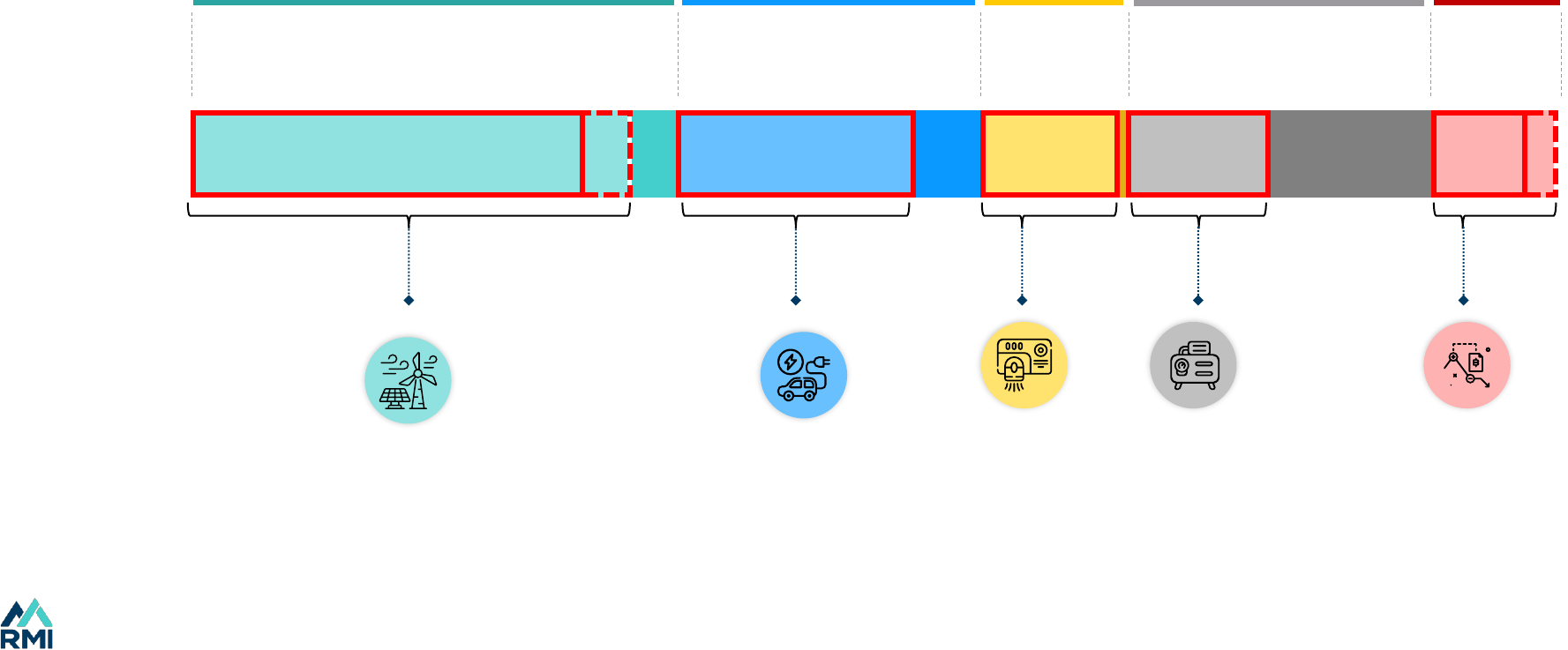

There are three big levers of change

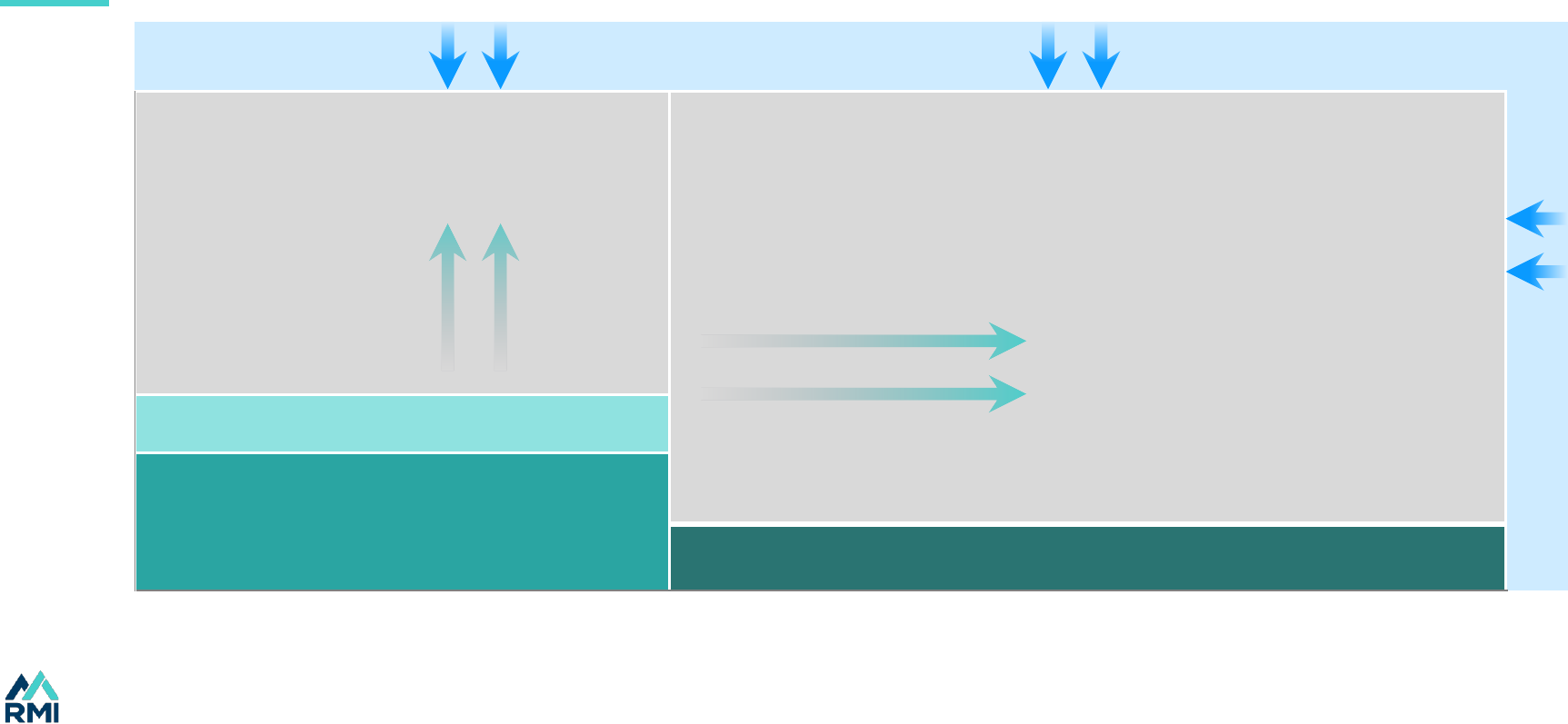

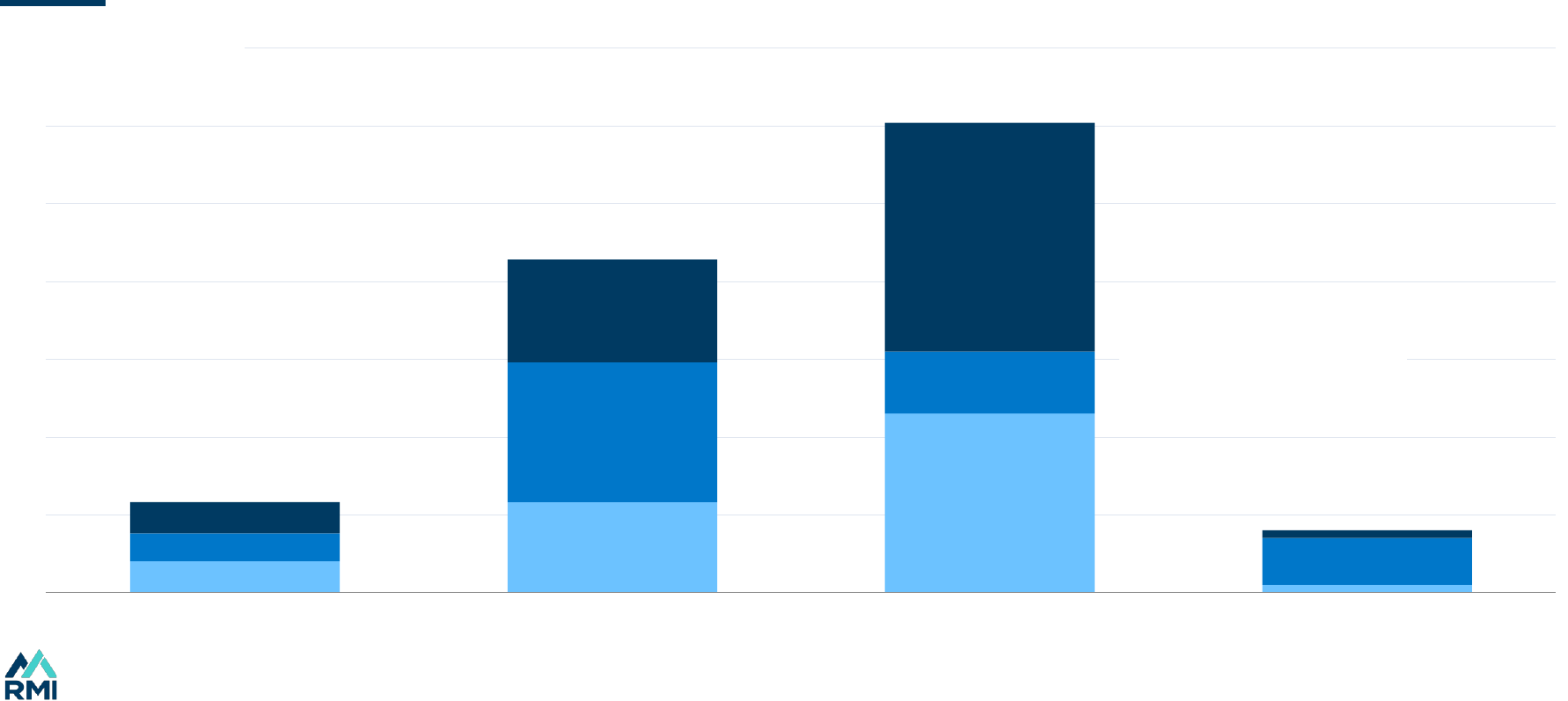

Source: IEA WEO 2023. The primary energy split is the amount of primary energy going to electricity (electrons) or other (molecules).

Global energy demand in 2022

80%

60%

40%

100%

20%

0%

Electrons Molecules

Share of primary energy

Fossil fuels

Share of final energy

Fossil fuels

Renewables

Electrification

Other clean

Solar and wind

Biomass

1

2

Efficiency

3

Renewables, electrification, and efficiency are rapidly transforming the energy system

11

11

Index

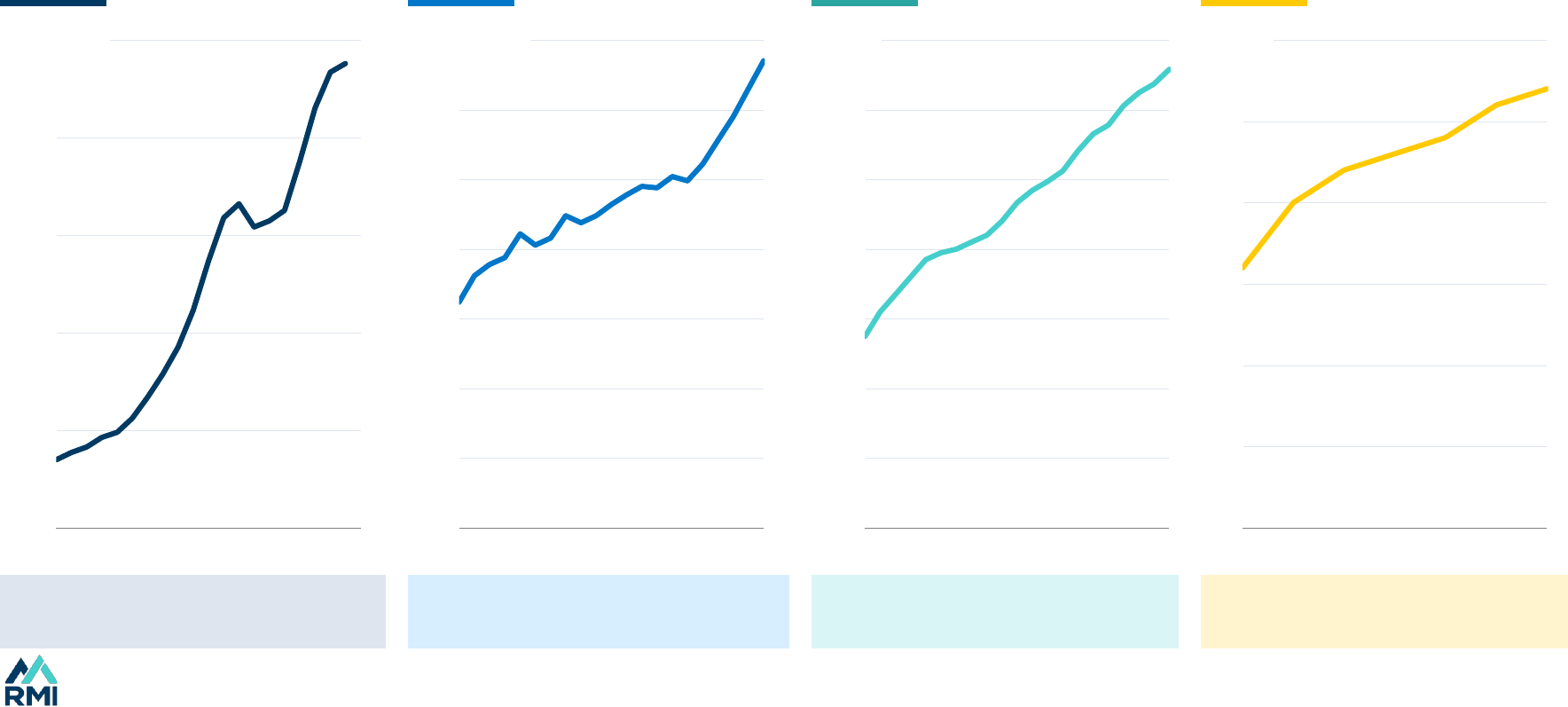

Exponential growth so far

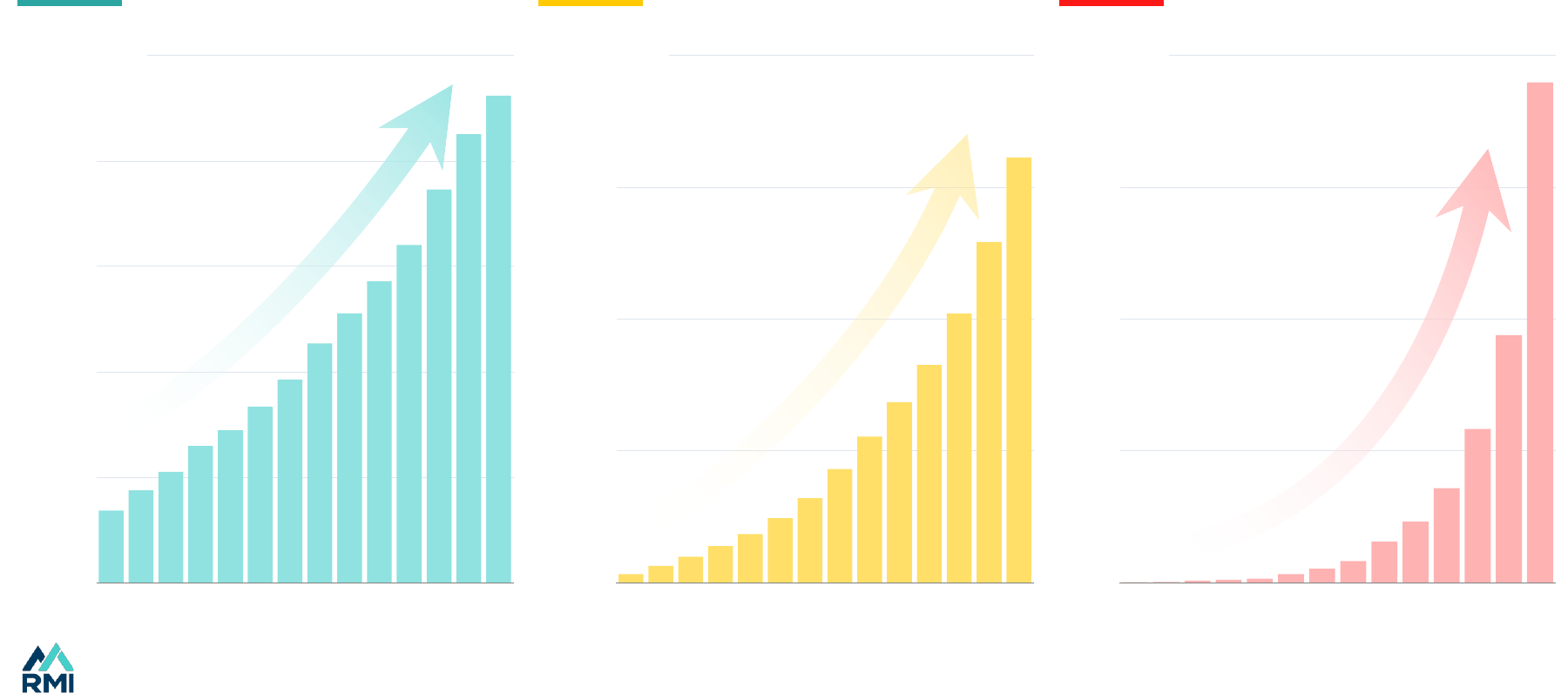

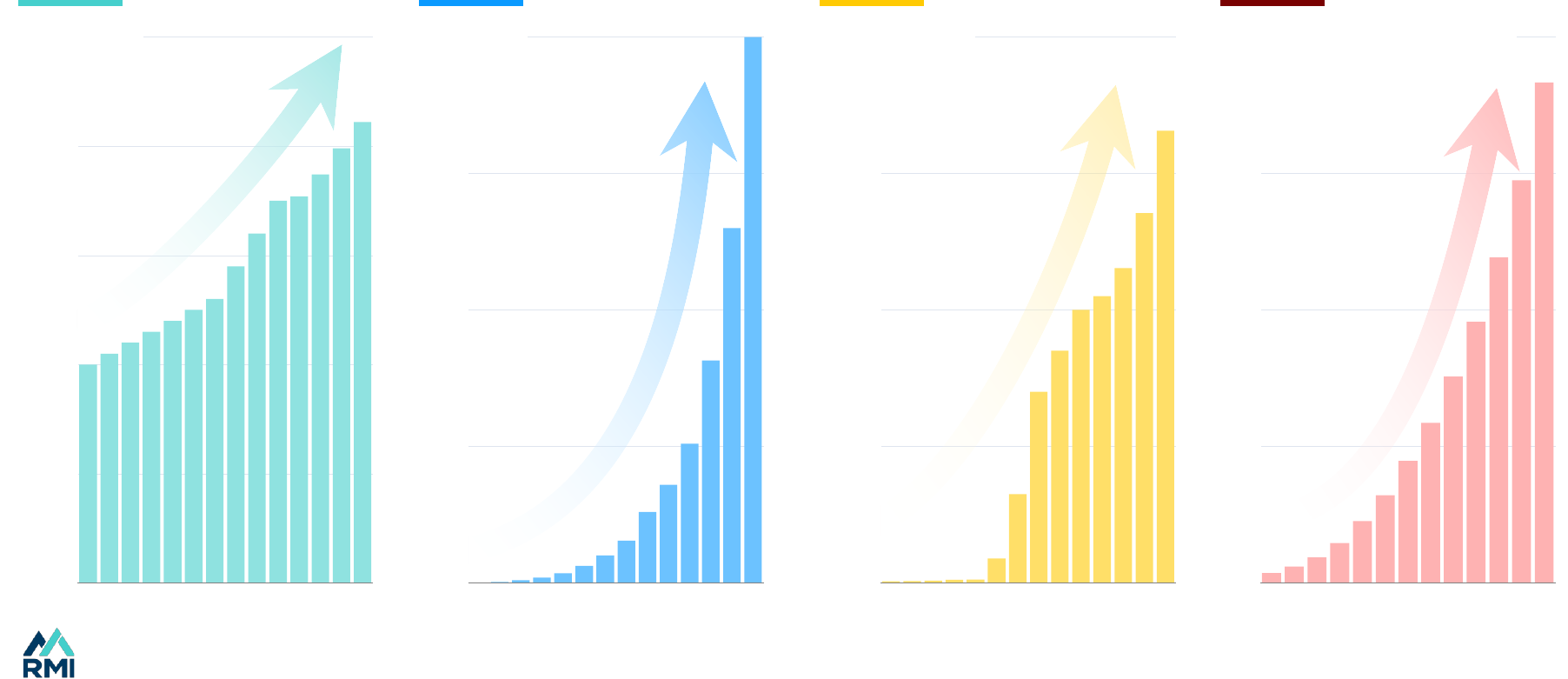

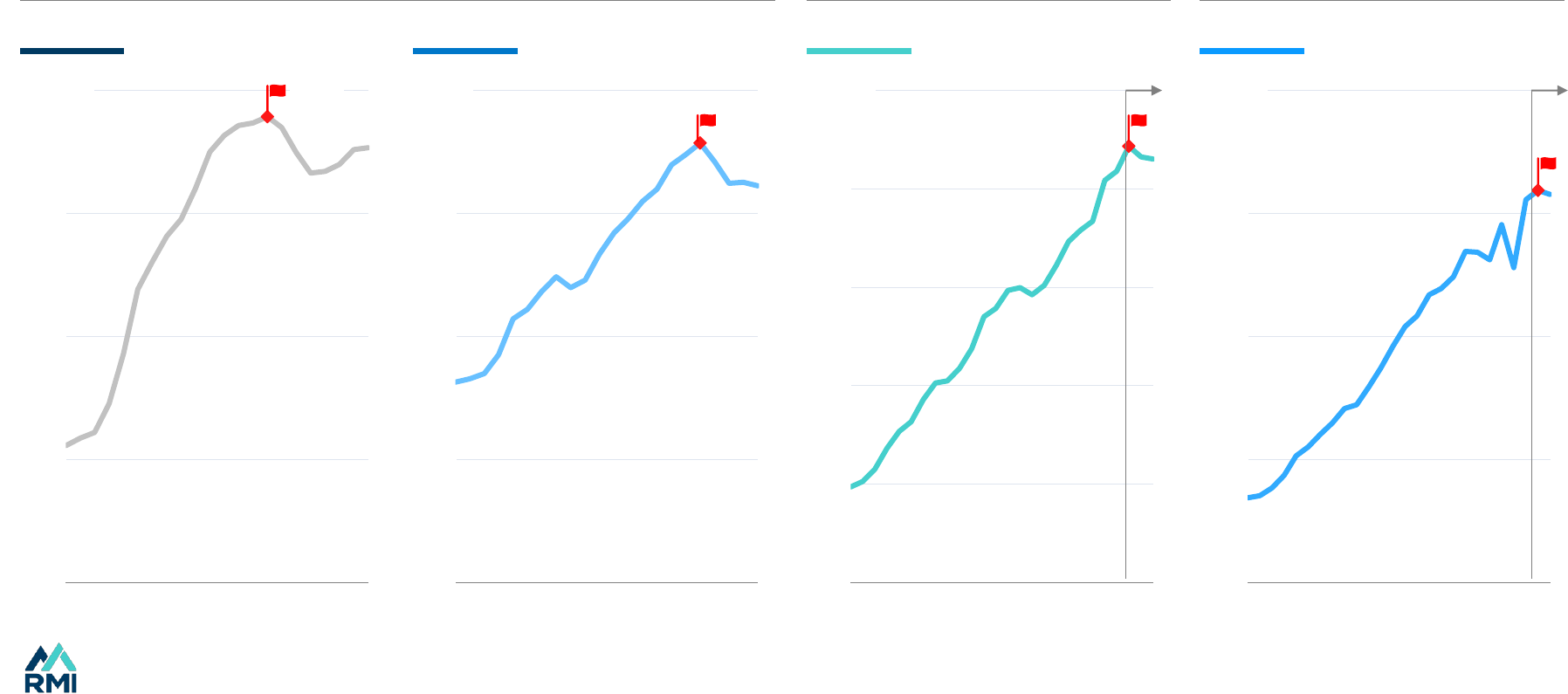

• There is clear evidence three drivers of changes are growing exponentially:

renewables, electrification, and efficiency.

• Cleantech costs fall by around 20% for every doubling in deployment and have

fallen by up to 80% in a decade.

• Capital is pouring into cleantech. Getting to the first trillion of annual investment

took decades; the second trillion will take only 4 years.

• Solar generation is doubling every 2-3 years and battery storage every year. Solar

is poised to deploy the largest amount of generation capacity, and batteries are

about to overtake pumped hydro.

• The supply chain is already in place for enough solar and batteries for net zero.

• Electricity supply has been growing inexorably for a century and is now the largest

supplier of useful energy.

• Efficiency is the deep force of the energy transition, saving one fifth of total demand

over the last decade.

• China leads the exponential story and is poised to be the first major electrostate.

Exponential change is happening in the OECD and across the Global South as Asia

leapfrogs the OECD in electrification.

2

12

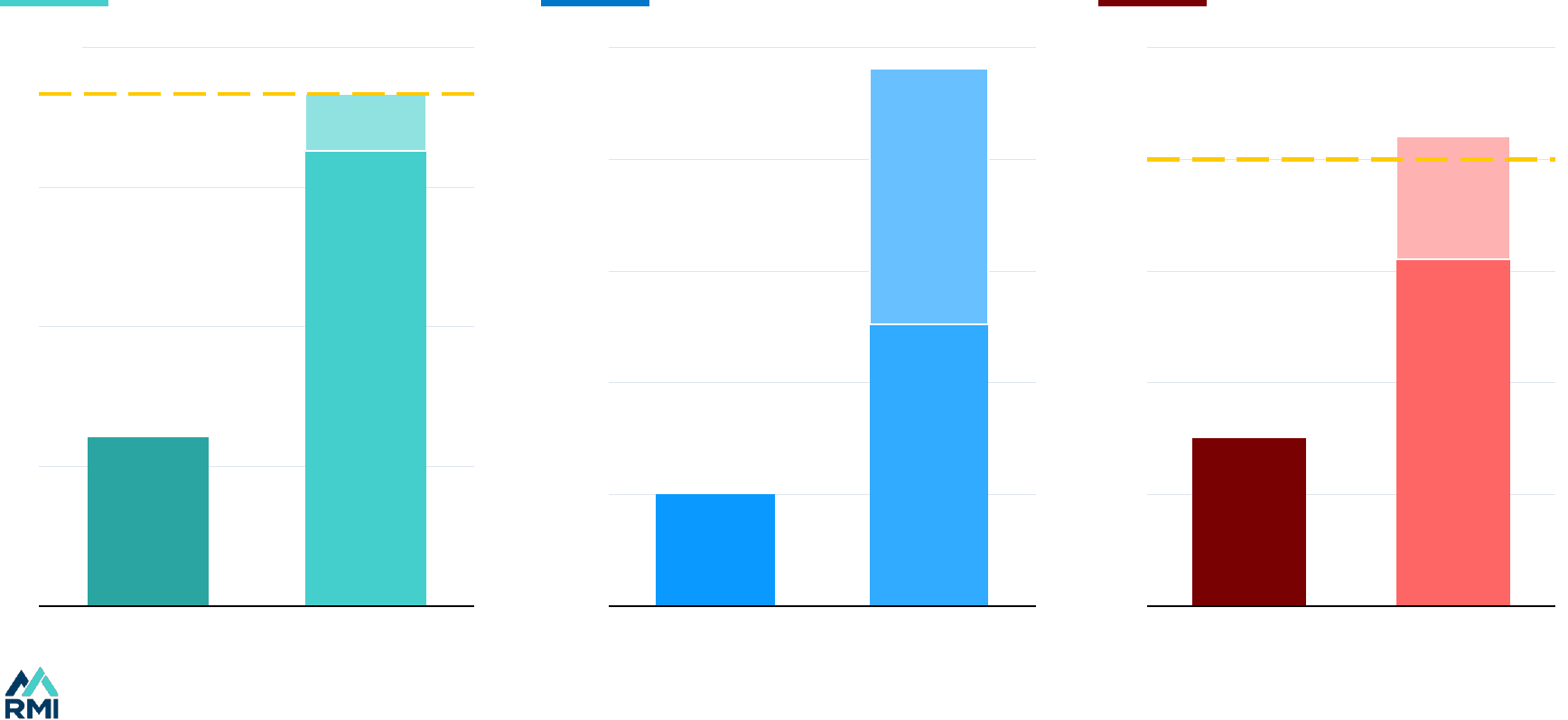

2013 2023

-76%

0

50

100

150

200

250

300

2013 2023

-70%

0

100

200

300

400

500

2013 2023

-79%

ICE car sticker price break-even

ICE car TCO

break-even

Fossil fuel range (marginal cost)

Fossil fuel range (LCOE)

Clean technology costs fall by around 20% for every doubling of deployment — Wright’s Law

Cleantech costs have fallen rapidly

Source: BNEF, RMI ranges.

$/kWh (2022 real)$/MWh LCOE (2022 real)

Offshore

Onshore

Wind Solar Battery costs

13

The first cleantech trillion took decades; the second trillion will happen in four years

Capital has poured into cleantech

Source: BNEF.

0

500

1,000

1,500

2,000

2005 2010 2015 2020 2023

$ billion

Cleantech investment

14

0

500

1,000

1,500

2,000

2010 2015 2020

28%

Global solar generation has been doubling every 2–3 years, and battery storage capacity every year

Leading to exponential growth in renewables

Source: IEA, BNEF; Note: CAGR is the compound annual growth rate between 2013 and 2023.

0

50

100

150

200

2010 2015 2020

Wind generation Solar generation Battery storage

0

500

1,000

1,500

2,000

2,500

2010 2015 2020

TWh TWh GWh

CAGR

68%

CAGR

14%

CAGR

15

Solar

0

50

100

150

200

250

300

2010 2012 2014 2016 2018 2020 2022 2024

0

500

1,000

1,500

2,000

2,500

3,000

2000 2005 2010 2015 2020 2025

Expected

Solar will shortly overtake every other type of capacity, and battery storage will leapfrog pumped hydro

Solar and batteries are taking over

Source: BNEF, IEA.

Solar

GW total storage capacity

Battery

storage

Bioenergy

Nuclear, Oil

Hydro

Coal

Gas

GW total generation capacity

Pumped

hydro

storage

Batteries

Expected

16

Source: IEA, BNEF.

0

4

8

12

16

2020 2022 2024 2026 2028

0

500

1,000

1,500

2,000

2020 2022 2024 2026 2028

Solar module manufacturing capacity Battery manufacturing capacity

TWh

GW

Needed by 2030 in net-zero scenario

The supply chain is in place

Companies already plan to construct more solar and battery capacity by 2030 than is needed to reach net zero

17

Buildings and industry have been electrifying for 120 years; now transport joins the party

A century of electrification

Source: IIASA, IEA WEB.

Electricity share of final energy demand by sector

Industry

Buildings

Total

Transport

0%

5%

10%

15%

20%

25%

30%

35%

1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020

of final energy demand

18

Electricity is the largest supplier of useful energy

Electricity is the new King of Energy

Note: All sectors excluding non-energy uses. Estimates for useful energy differ, and here we have taken data from IIASA, which has prepared the most detailed data we have seen.

Oil

Electricity

0

10

20

30

40

50

60

70

1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010

Useful energy supply

Natural gas

Coal

EJ

Useful energy is the

total energy left after

all processing and

conversion losses.

Source: IIASA.

19

The global stock of EV cars and digital devices has been doubling every 2 years

We are poised to electrify the rest of the system

Source: IEA, Carbon Brief for heat pumps.

0

3

6

9

12

2010 2015 2020

0

100

200

300

400

2010 2015 2020

0

10

20

30

40

2010 2015 2020

0

50

100

150

200

250

2010 2015 2020

Heat pumps EV cars EV trucks

Digitally enabled

automated devices

billion connected devices

thousandmillion million

20

Efficiency gains since 2010 have reduced energy demand growth more than any other factor

Efficiency is the Deep Force of change

Source: IEA WEB, IEA WEO, RMI calculations. Energy efficiency here is simply defined as the difference between GDP growth and energy demand growth.

0

20

40

60

80

100

120

140

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Efficiency gains

EJ per year avoided since 2010

Avoided energy

Efficiency gains over the

last decade were one fifth

of primary energy

demand in 2022 of 632 EJ

21

China has been electrifying at 10 percentage points per decade, nine times faster than the rest of the world

China has become the first major electrostate

Notes: IIASA data to 1971, IEA onward.

Source: IIASA, IEA WEB. WEB defines final energy slightly differently than WEO.

0%

5%

10%

15%

20%

25%

30%

1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020

China

Electricity share of final energy

World

(ex China)

22

45

0

30

75

15

60

2015 20202010

In a decade, solar generation increased by 35 times, wind 9 times; EVs and batteries scaled even faster

Super-fast growth in China drives change

Source: IEA, BNEF.

400

300

500

200

600

100

0

2015 20202010

15

0

10

25

5

20

2015 20202010

600

0

400

1,000

200

800

2015 20202010

Solar Wind EV fleet Battery storage

GWhmillionsTWhTWh

23

0

150

300

450

600

750

2010 2015 2020

Over the past decade, solar generation went up 7 times, wind 3 times, and EVs sales up over 50 times

Exponential growth is also happening in the OECD

Source: Ember, IEA.

0

4

8

12

16

20

2010 2015 2020

0

200

400

600

800

1,000

1,200

2010 2015 2020

Solar Wind EVs

millions of EV cars in global fleet TWh TWh

24

The adoption of superior technology is not confined to the Global North

Exponential growth in emerging economies

Source: IEA.

0

30

60

90

120

2010 2015 2020

0

10

20

30

40

2010 2015 2020

0

40

80

120

160

2010 2015 2020

0

2

4

6

8

2010 2015 2020

Brazil wind Vietnam solar India solar Morocco wind

TWh TWh TWhTWh

25

1980 1990 2000 2010 2020

0%

10%

20%

30%

1980 1990 2000 2010 2020

Asia is leading the charge to electrify everything

Electric Asia

Source: IEA WEB.

1980 1990 2000 2010 2020 1980 1990 2000 2010 2020

China Vietnam Bangladesh Korea

of final energy from electricity

United States and

Europe share in 2022

26

26

Index

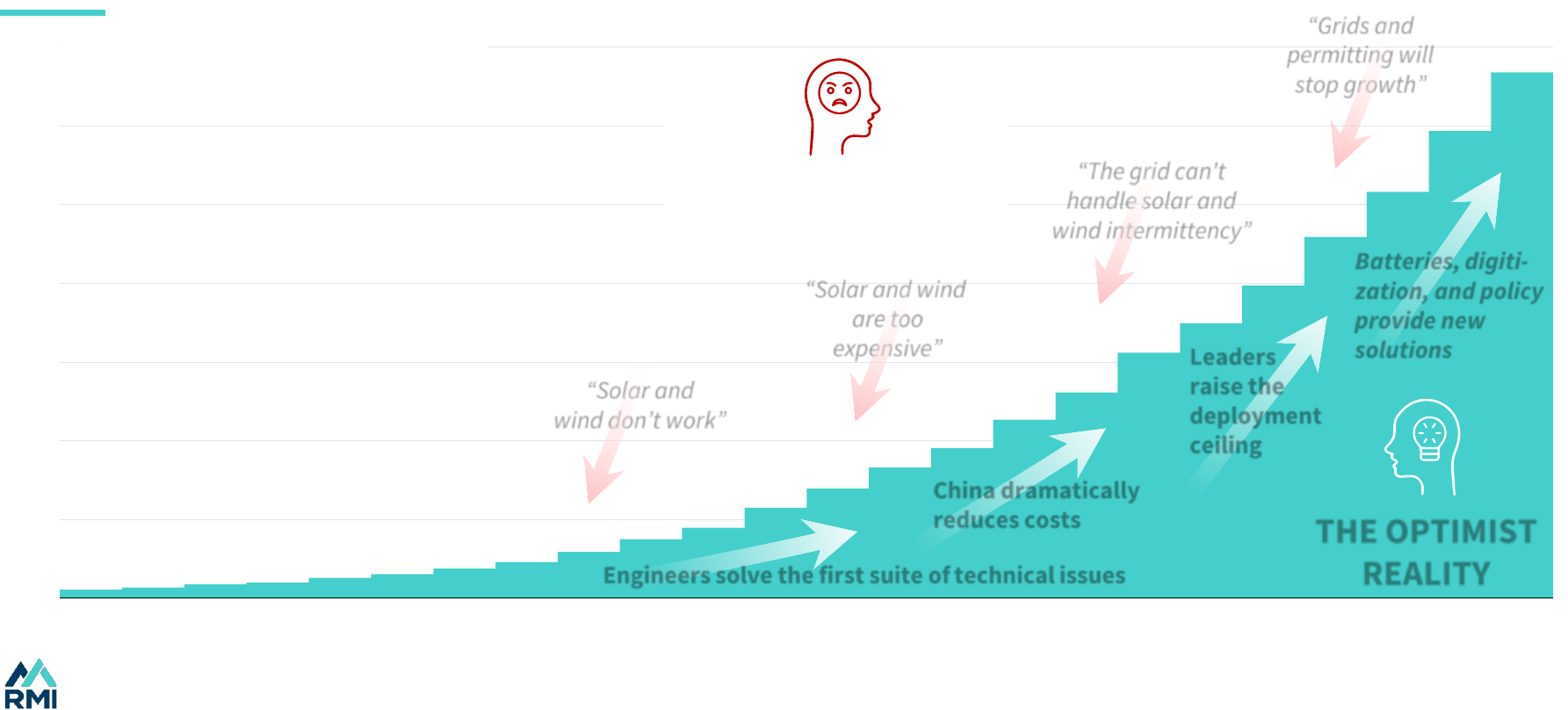

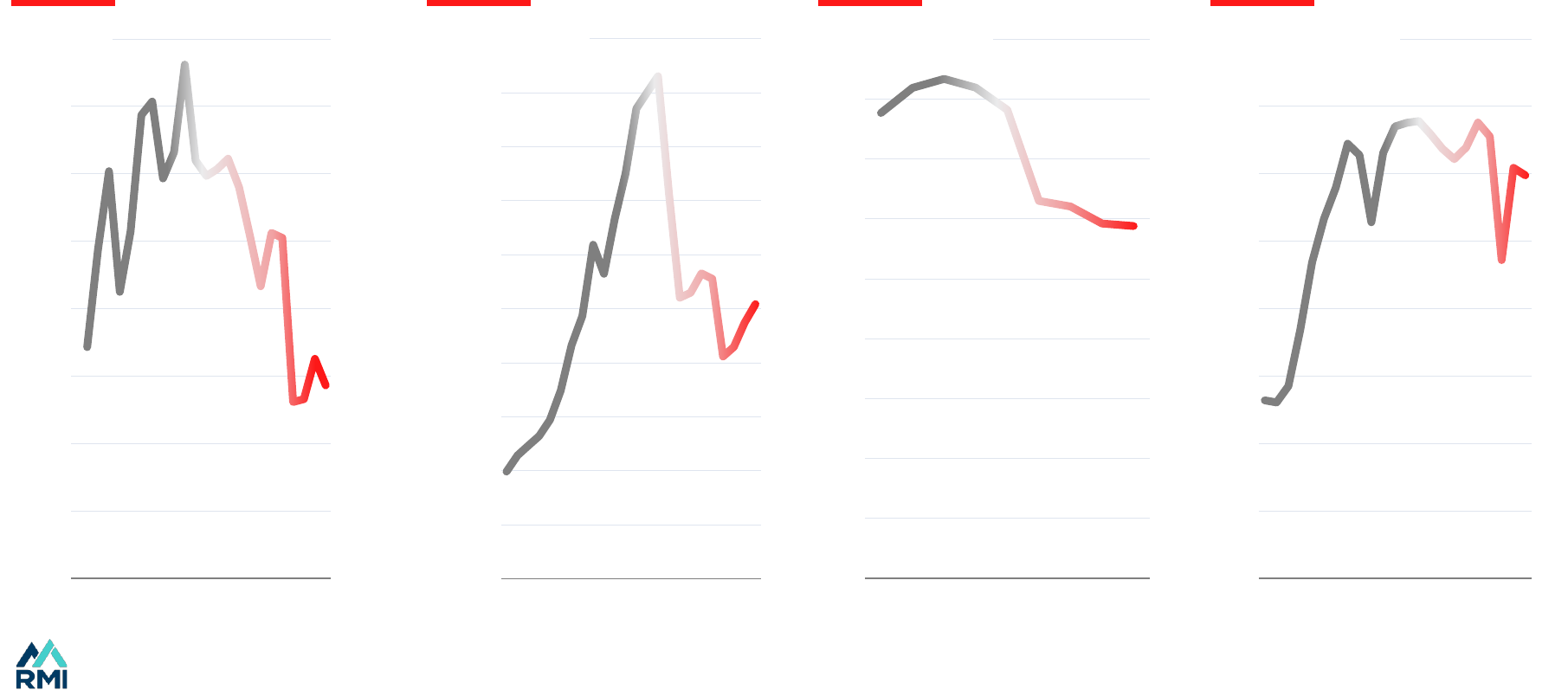

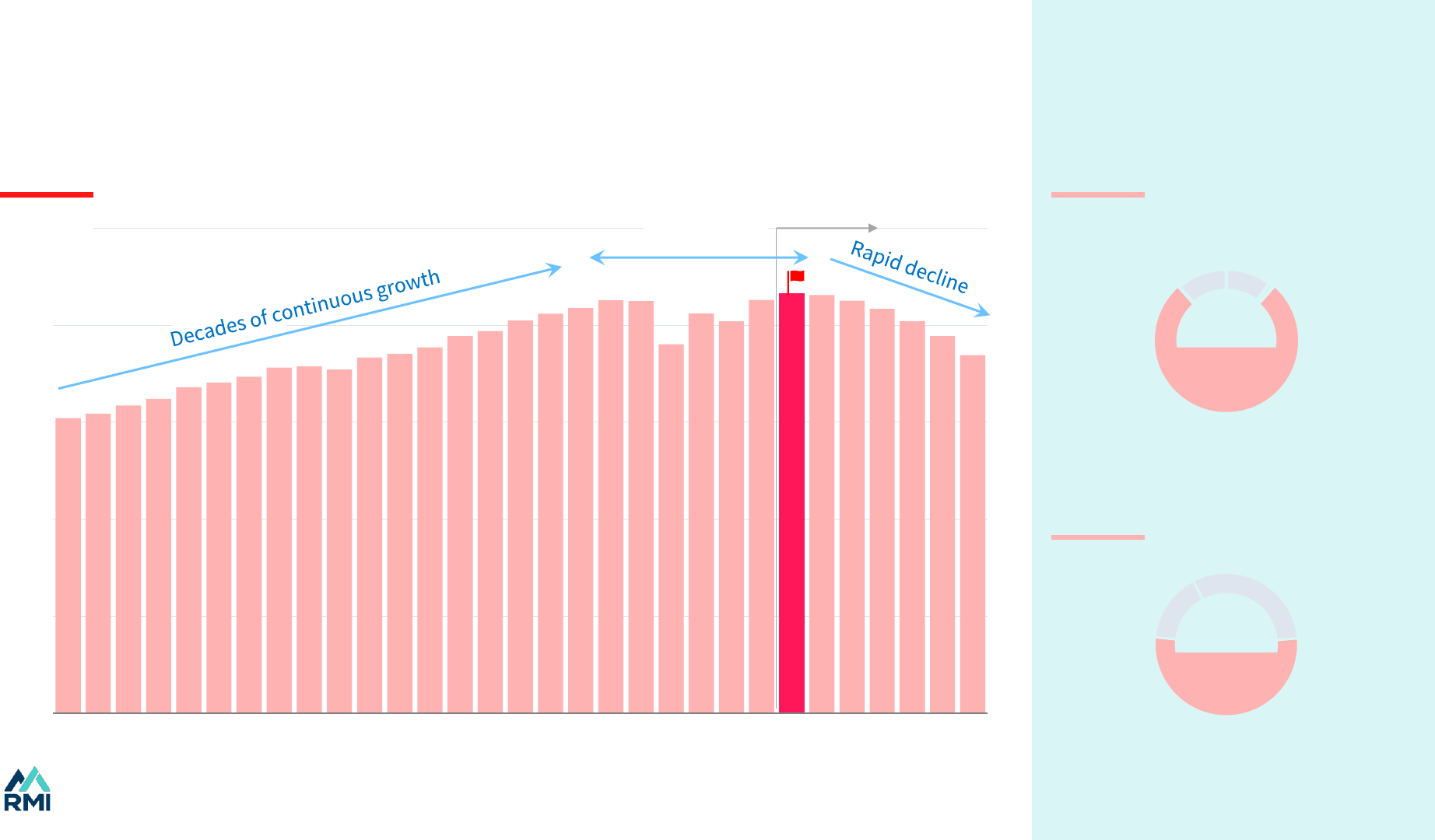

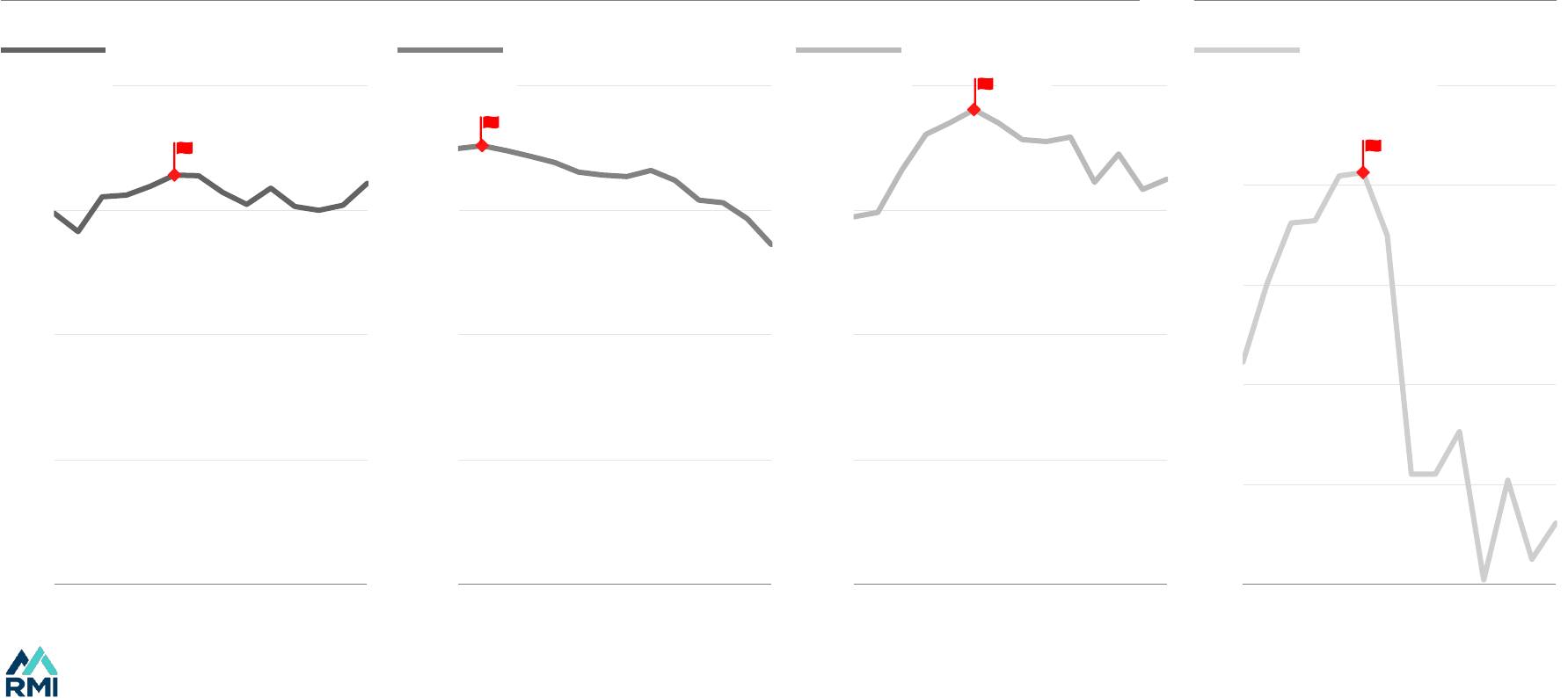

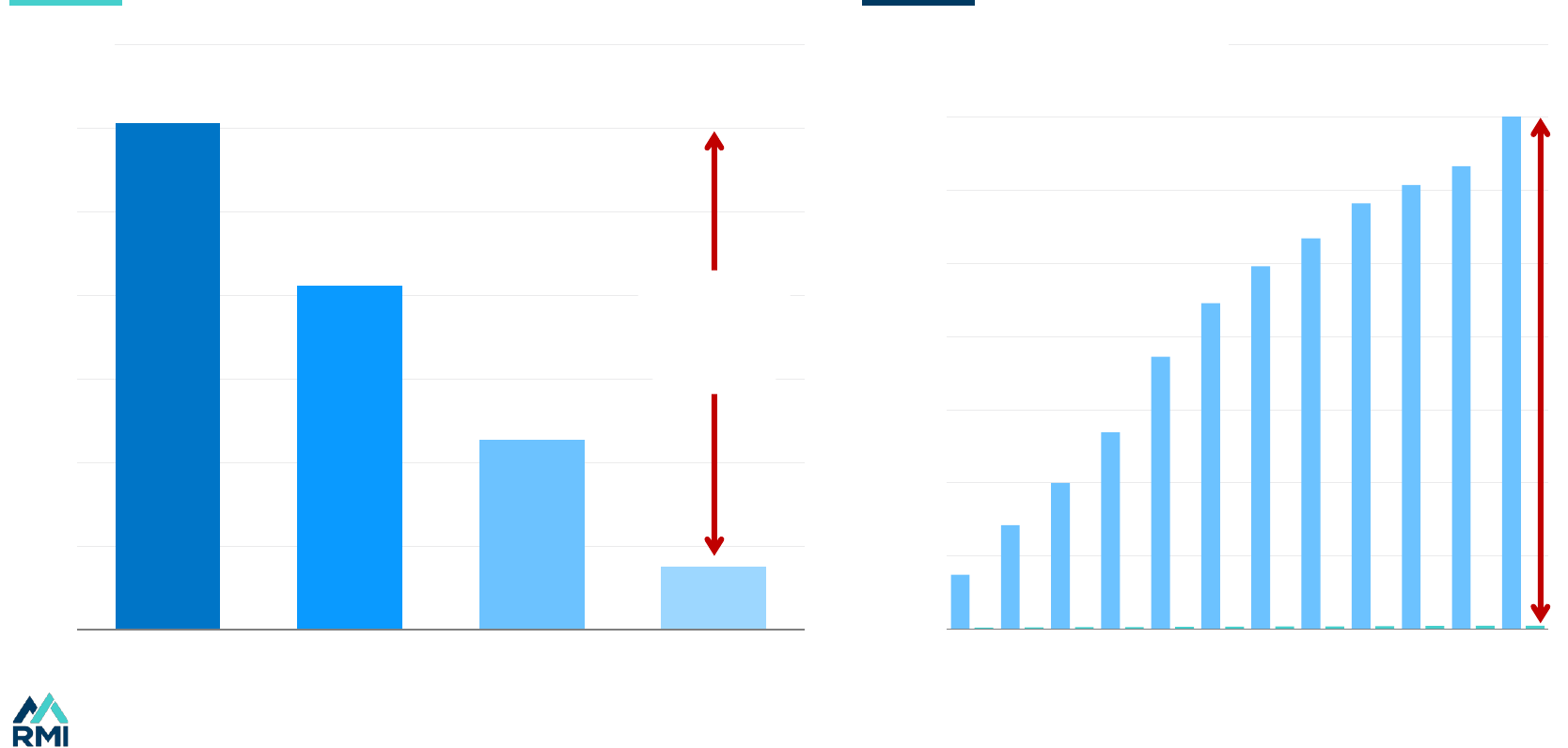

The era of peaking fossil fuel demand

• Pessimists keep raising barriers to change; optimists keep solving them.

• Early warning signals for fossils include peak new fossil fuel electricity capacity

(2010), peak capex for oil and gas (2014), peak ICE demand (2017), and peak per

capita fossil demand (2012–18).

• Global fossil fuel demand for industry peaked in 2014, and in buildings in 2018.

• Fossil fuel demand likely peaked in electricity in 2023 and will peak in transport

before the end of the decade.

• OECD fossil fuel demand peaked in 2007, and every major area of demand has

peaked in the United States.

• China is the pivot nation in the transition away from fossil fuels, and most areas of

demand have clearly peaked there.

• Peaks are showing up across the Global South, from South America to South Africa

and Thailand.

3

27

Pessimists sound clever; optimists change the world

Source: Ember.

The incumbents have been predicting the end of the transition for decades

Pessimist’s and optimist’s take on solar and wind uptake

0%

2%

4%

6%

8%

10%

12%

14%

2000 2005 2010 2015 2020 2023

“Solar and

wind don’t work”

“Solar and wind

are too

expensive”

“The grid can't

handle solar and

wind intermittency”

of generation from solar and wind

THE OPTIMIST

REALITY

“Grids and

permitting will

stop growth”

THE PESSIMIST

STORY

Engineers solve the first suite of technical issues

China dramatically

reduces costs

Leaders

raise the

deployment

ceiling

Batteries, digiti-

zation, and policy

provide new

solutions

28

0

100

200

300

400

500

600

700

800

900

1,000

2000 2010 2020

As growth turns to decline

Flashing red lights all over the fossil fuel system

Source: Ember (new fossil fuel electricity generation capacity), IEA WEI (oil and gas upstream capex), BNEF (ICE sales), Energy Institute (global fossil fuel demand pp).

Note fossil fuel capacity additions are a net figure.

0

20

40

60

80

100

120

140

160

2000 2010 2020

50

52

54

56

58

60

62

64

66

2000 2010 2020

0

10

20

30

40

50

60

70

80

90

2015 2020

million cars

$ billion

GW

GJ per capita

Fossil fuel capacity additions Oil and gas capex ICE sales Fossil fuel demand

29

60

70

80

90

2000 2010 2020

120

90

80

100

110

2000 2010 2020

120

180

150

210

2000 2010 2020

40

44

42

46

2000 2010 2020

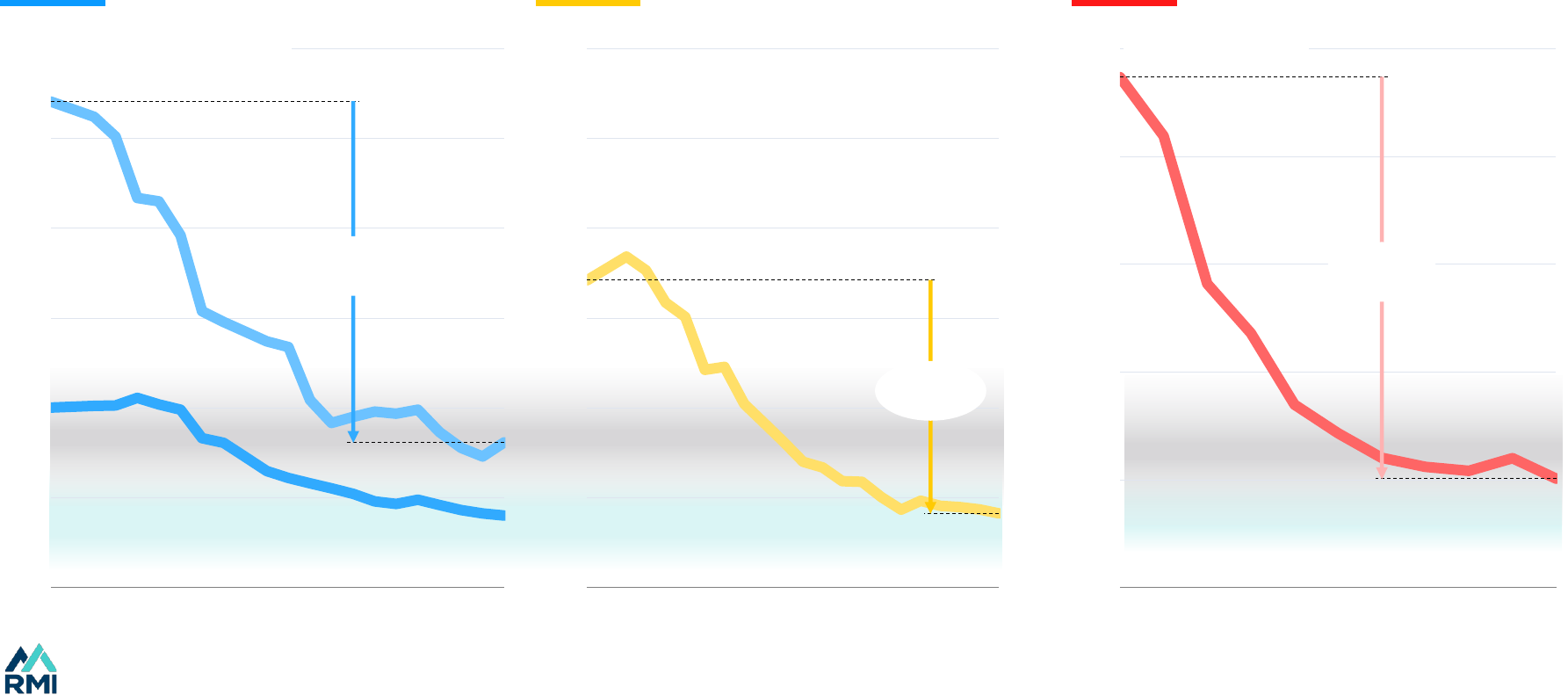

Building and industry peak fossil fuels are behind us; electricity and transport are peaking now

The era of peaking fossils is here

Source: BNEF NEO 2024 NZS.

Peak

EJ

Peak

Peak

Peak imminent: 2024/25Peaked in 2023Peaked in 2018Peaked in 2014

EJEJ EJ

Fossil fuel demand by sector

Industry Buildings Power and heat Transport

Power & transport peak last, but have

the fastest growing challengers

Future Future Future Future

Peak

30

Peak fossil fuel demand in electricity

Source: IEA Renewables 2023.

0

200

400

600

800

2000 2005 2010 2015 2020 2024E

Solar

Wind

Average increase in total electricity demand 2012–22

TWh

A little room for fossil growth

Fossil power generation in decline

Change in electricity generation

Solar and wind provided 500 out of 600 TWh of demand growth in 2023, and will break through average growth this year

31

Peak

Road

Aviation

Shipping

Rail

Road

Other

transport

Other sectors

53%

77%

Road share oil demand for

transport, 2023

Road share oil demand, 2023

Decades of growth stagnate before turning into rapid decline

A plateau in road oil demand

Source: BNEF NEO2024 NZS.

0

20

40

60

80

100

2000 2005 2010 2015 2020 20302025

Road oil demand

EJ

Outlook

The demand

plateau

32

OECD fossil fuel demand for final energy peaked in 2005 and for electricity generation in 2007

OECD fossil fuel demand peaked a generation ago

Source: IEA WEB.

0

20

40

60

80

100

120

1990 2000 2010 2020

0

20

40

60

80

100

120

1990 2000 2010 2020

0

20

40

60

80

100

120

1990 2000 2010 2020

Peak

Fossil fuels for final energy Fossil fuels for electricity generation Fossil fuels for non-energy

EJ

Peak

Peak

33

Fossil fuel demand across sectors peaked more than 15 years ago

United States — every major sector is past peak fossil demand

Source: BNEF NEO 2024.

Electricity Transport Buildings Industry

0

10

20

30

40

2000 2010 2020

EJ

0

5

10

15

20

25

30

2000 2010 2020

0

3

6

9

12

2000 2010 2020

0

2

4

6

8

10

2000 2010 2020

Peak

Peak

Peak

Peak

EJ EJ EJ

34

2000 2010 2020 2030

China is the global pivot nation

Source. IEA APS scenario.

0

50

100

150

200

2000 2010 2020 2030

EJ

Outlook

2000 2010 2020 2030

From slow decline...

From rapid

growth…

From rapid

growth...

…to

plateau

… to fast

decline

…to fast

decline

Peak

Peak

When China peaks, the world peaks

OECD

Primary fossil fuel demand by region

China Global South

China has driven two-thirds of fossil fuel

demand growth in the past decade

Outlook Outlook

35

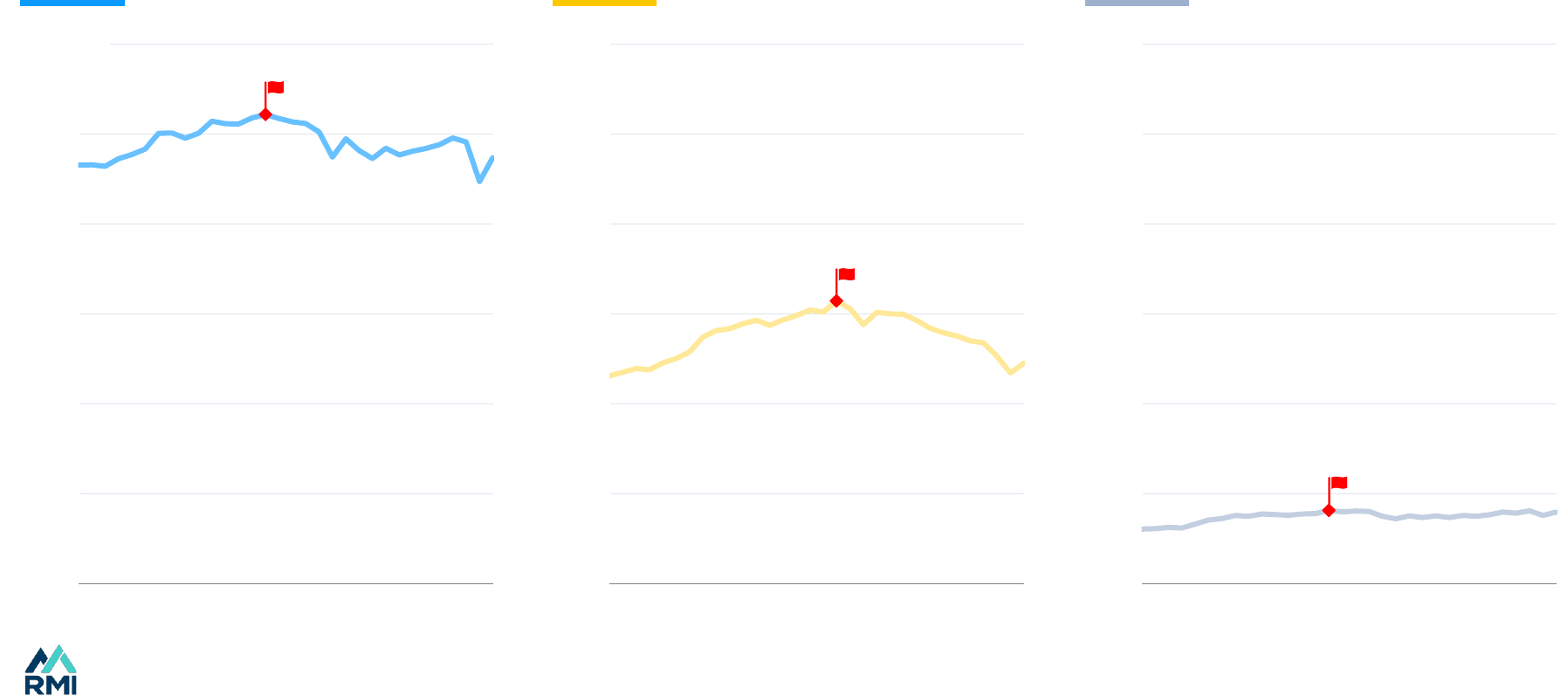

Fossil fuel demand is peaking across the Chinese system

Source: IEA WEB (past), Ember, IEA Electricity 2024 (electricity generation forecast), BNEF NZS (transport forward).

0

2

4

6

8

2000 2010 2020

0

5

10

15

20

2000 2010 2020

0

10

20

30

40

2000 2010 2020

Fossil fuels in industry Fossil fuels in buildings Fossil fuels in electricity Fossil fuels in transport

EJ

Peaking behind us Peaking now Peaking shortly

0

15

30

45

60

75

2000 2010 2020

Future Future

Peak

Peak

Peak

Peak

Peaks in industry and buildings are behind us, electricity peaked in 2023, and transport is coming soon

EJ EJ EJ

36

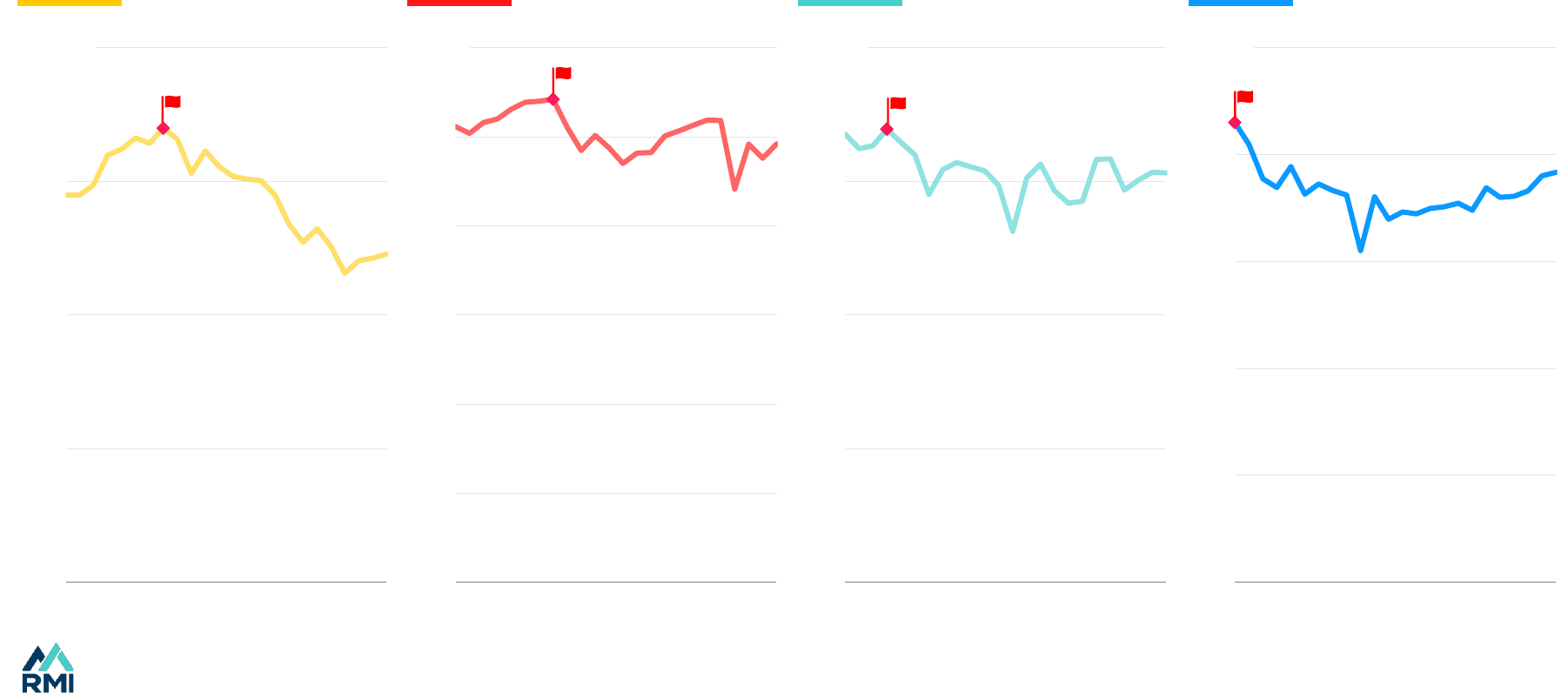

The first fossil peaks in the Global South

Source: Ember; Note coal additions are a net figure — gross additions minus retirements.

0

5

10

15

20

25

2010 2015 2020

0

200

400

600

800

2010 2015 2020

0

70

140

210

280

2010 2015 2020

South Africa Latin America

Coal capacity additions

TWh TWh GW per year

0

50

100

150

200

2010 2015 2020

TWh

Thailand India

Fossil fuel generation

The Global South is not condemned to choose technologies the North is abandoning

Peak

Peak

Peak

Peak

37

37

Index

Why rapid change will continue

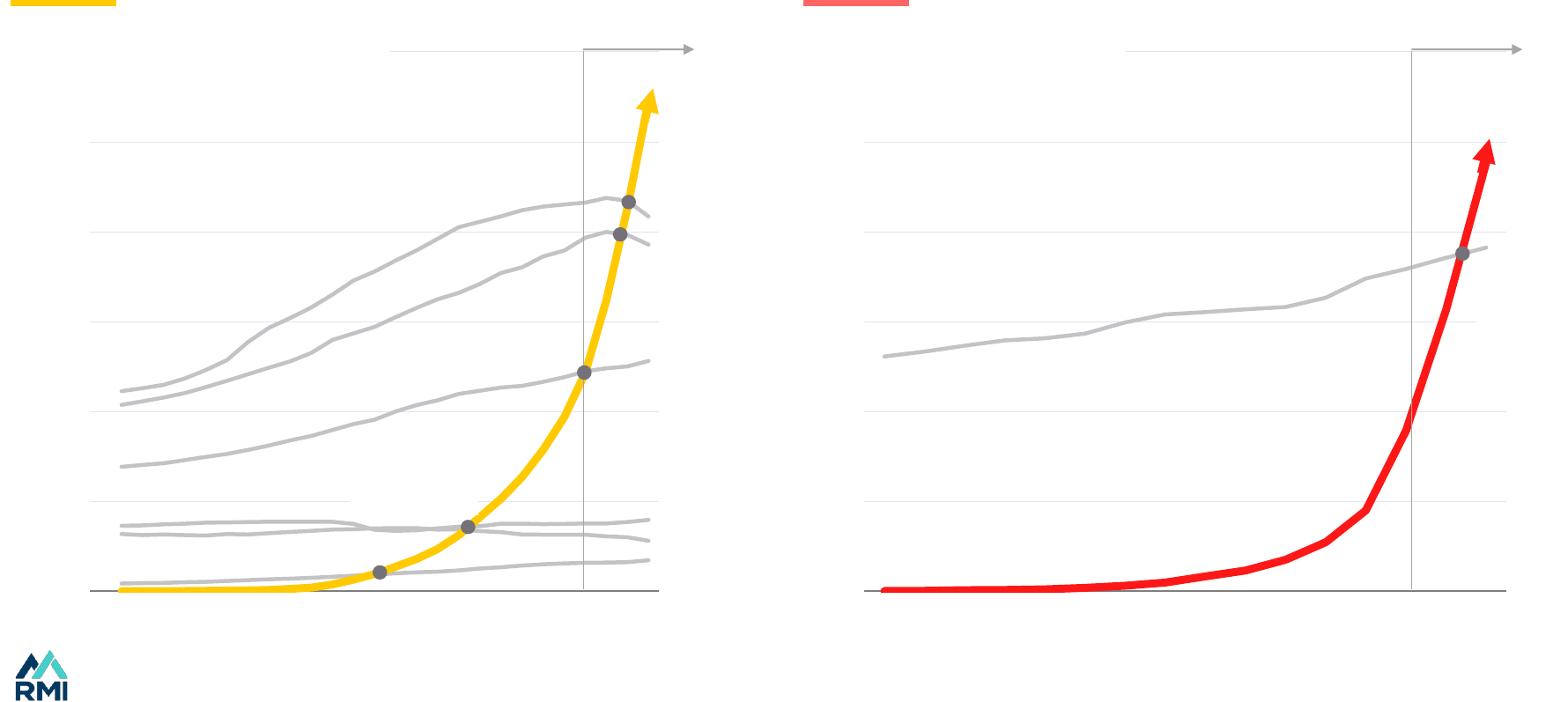

• The three drivers of change — renewables, electrification and efficiency — are self-

reinforcing.

• Cleantech costs will keep falling at around 20% for every doubling of deployment as

technology gets better and spreads around the world.

• Fossil fuels are vulnerable because they have huge unpaid externalities (up to $7

trillion a year), get large subsidies ($1 trillion a year), and waste two-thirds of their

energy.

• Cleantech provides energy security: 86% of people live in fossil-importing countries

today; renewable resources are 100 times larger than fossil fuels, and available

everywhere.

• The world’s largest energy consumer, China, lacks oil and gas, and cleantech is a

path to leadership, clean air, and zero emissions. So, China will continue to deploy

cleantech rapidly.

• There is a race to the top as others try to catch up. Cleantech is now 10% of global

GDP growth, and there is a race to lead the cleantech industries of the future.

Meanwhile, as the world burns, so policy pressure will rise.

• Clean technologies will continue to follow S-curves, cascading across sectors and

geographies. Change at the frontier is hard, but most countries can copy the leaders.

4

38

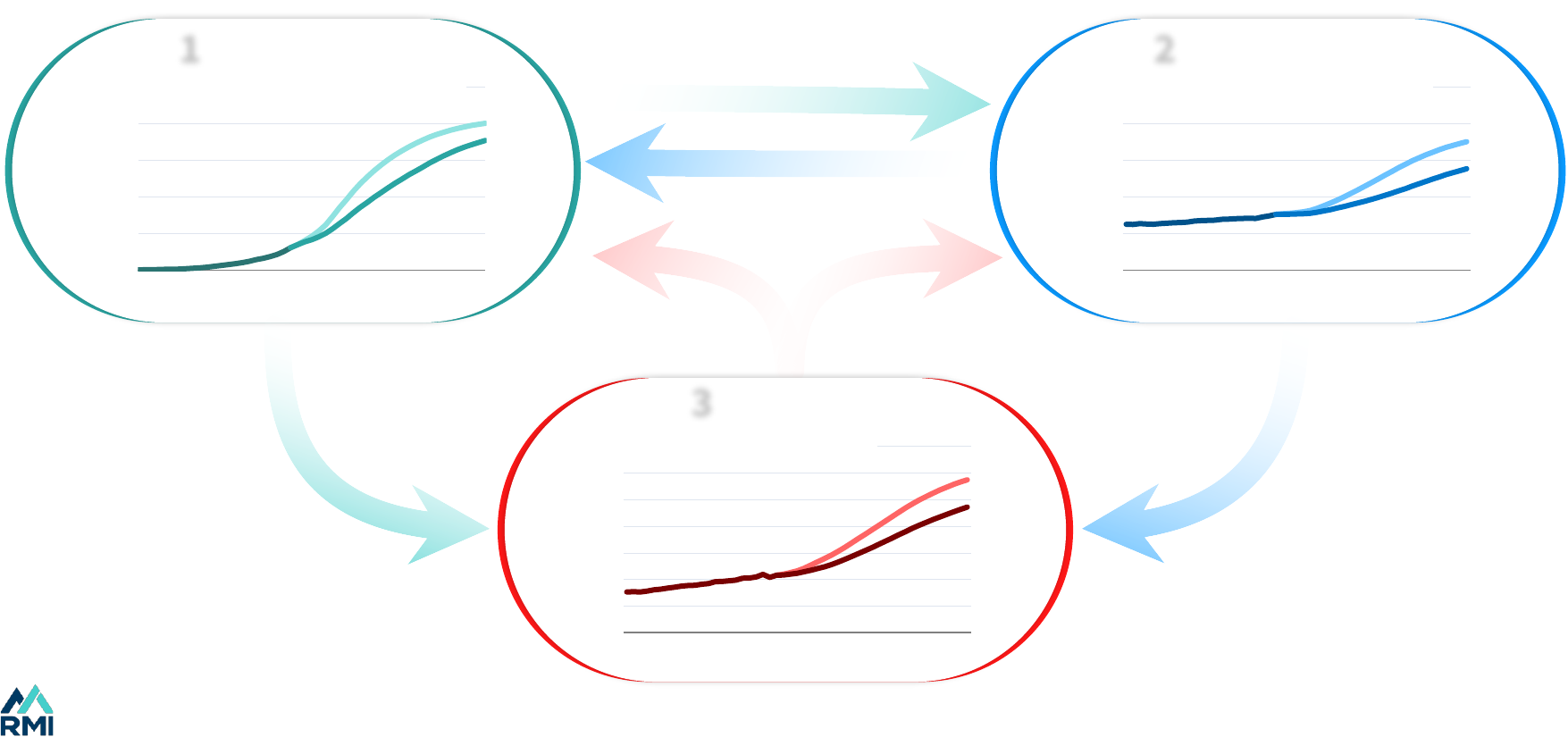

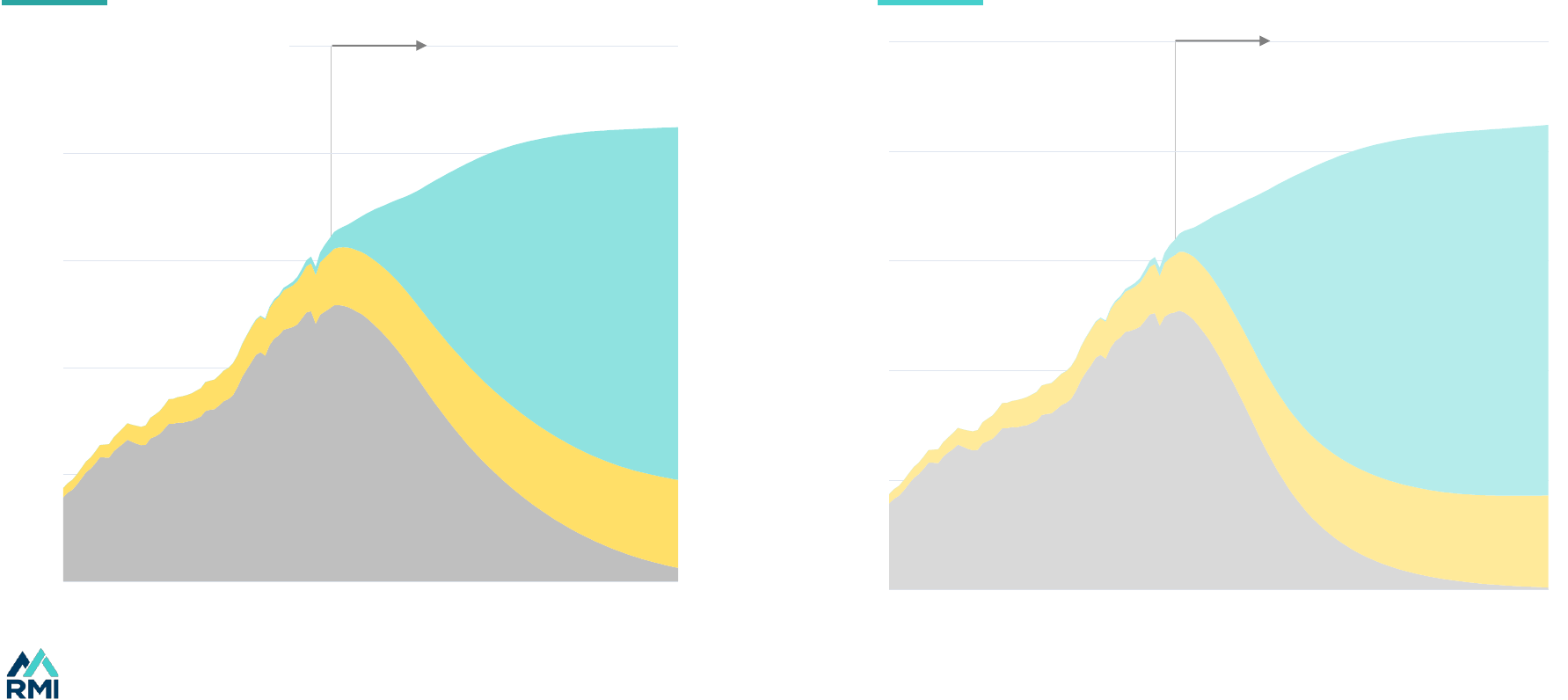

There are positive feedback loops between renewables, electrification, and efficiency

Three drivers of self-reinforcing change

Source: Rystad Energy scenarios, RMI analysis.

1

Renewables Electrification

Powers

Allows renewables to replace end-

use demand of coal, oil, and gas

0%

20%

40%

60%

80%

100%

2000 2010 2020 2030 2040 2050

0%

20%

40%

60%

80%

100%

2000 2010 2020 2030 2040 2050

2

Reduces the amount of

cleantech needed to

replace fossil fuels

Drives out inefficient fossil

supply technology

Drives out inefficient fossil

end-use technology

of electricity generation from wind and solar of useful energy demand from electricity

Efficiency

40%

45%

50%

55%

60%

65%

70%

75%

2000 2010 2020 2030 2040 2050

3

of primary demand turned useful

39

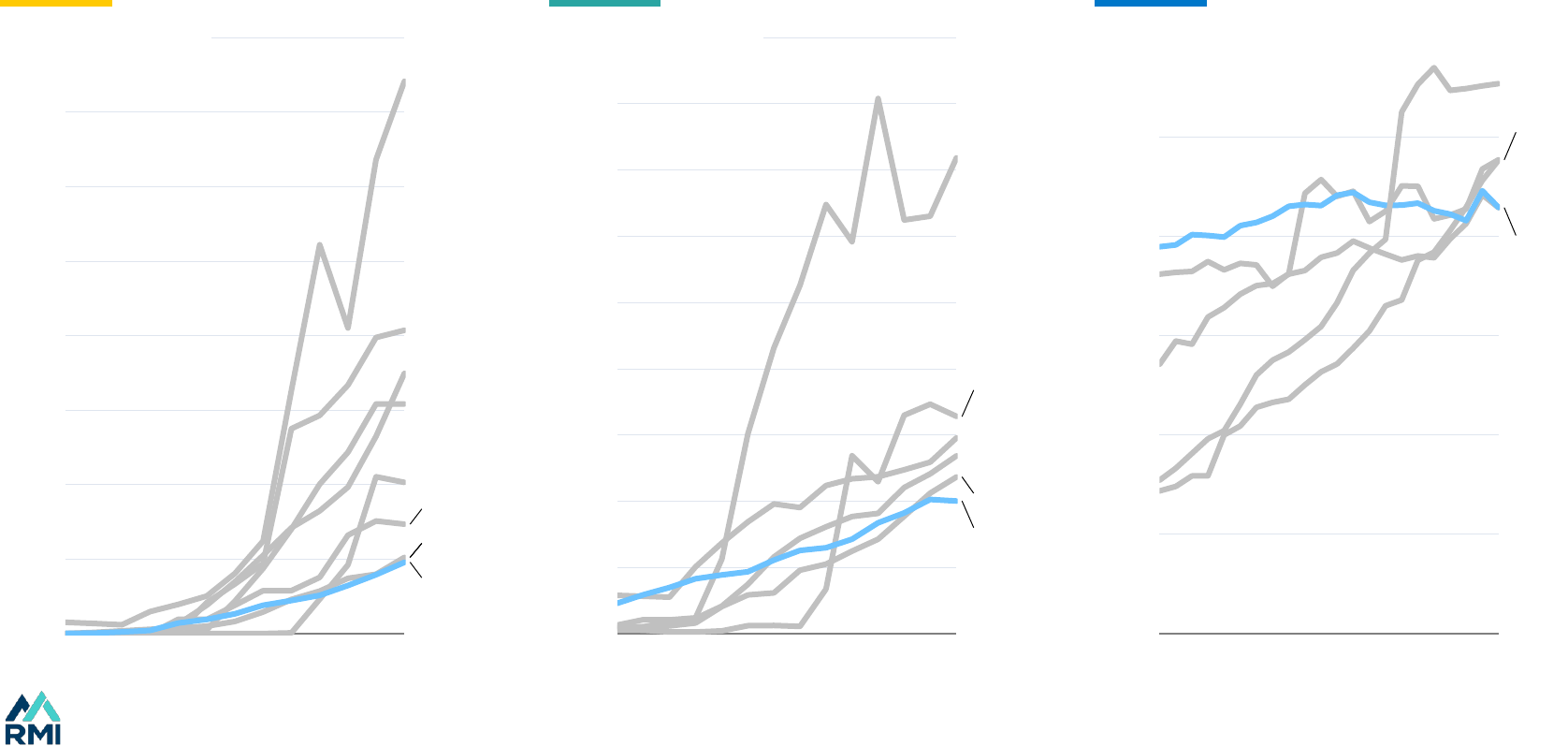

0

5

10

15

20

25

30

1995 2005 2015 2024

Cleantech keeps getting better

Sources: IRENA Patent database, RMI X-Change Batteries, US DOE, US NREL representative.

2000 2005 2010 2015 2020

0

50

100

150

200

250

2000 2005 2010 2015 2020

0

50

100

150

200

250

300

350

2005 2010 2015 2020

0

20

40

60

80

100

120

140

Cleantech patents per year Top-tier battery cell density Wind rotor diameter Solar cell efficiency

000s

Wh/kg m %

More innovation

Denser batteries open up new

sectors for batteries to play in

Bigger rotors reduce cost per

MWh

More efficient solar panels

reduce cost per MWh

More patents, higher battery density, more solar and wind generation per unit, economies of scale, new ideas, …

40

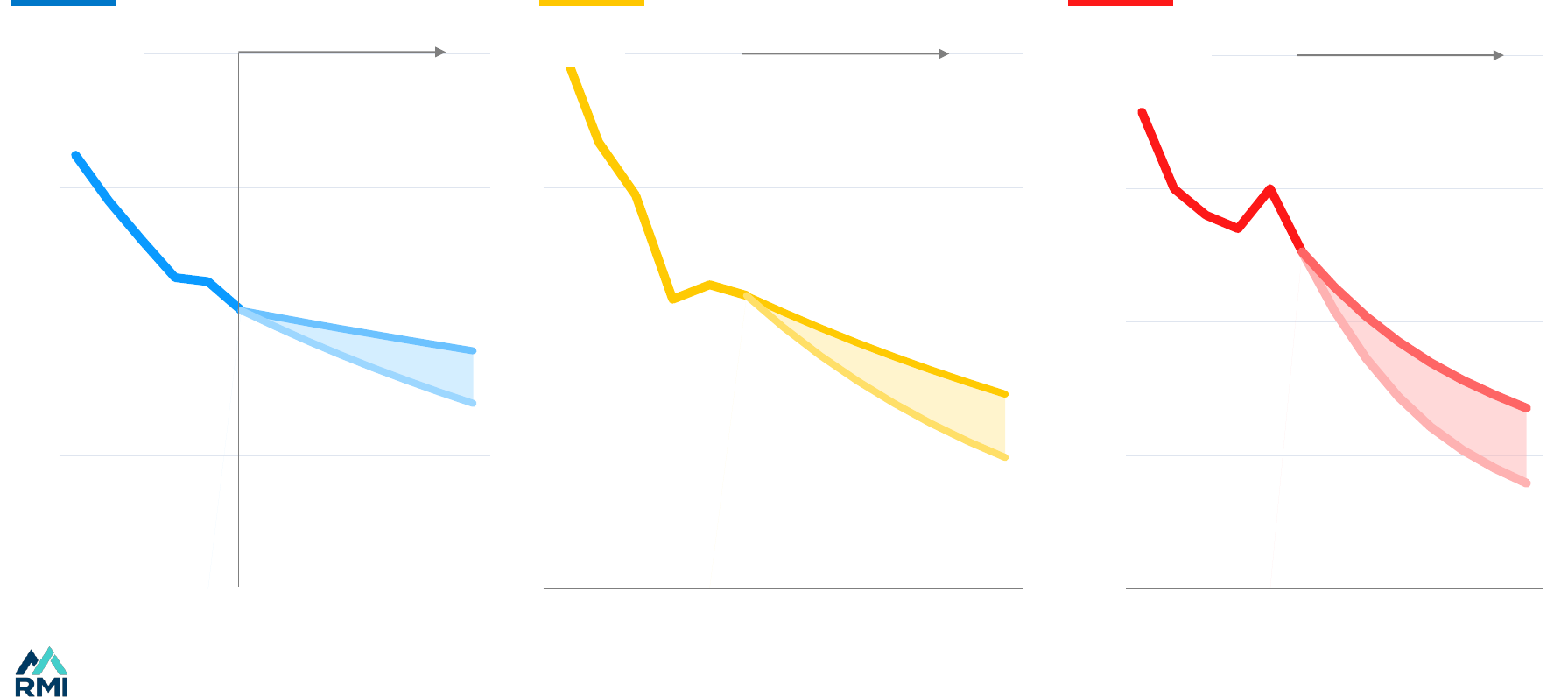

Cleantech costs will continue to fall

Source: BNEF, RMI analyses.

2018 2022 2026 2030

0

20

40

60

80

2018 2022 2026 2030

Past

Fast

Faster

Past

Fast

Faster

0

40

80

120

160

2018 2022 2026 2030

Past

Fast

Faster

Outlook Outlook

Wind costs Solar costs Battery costs

$/MWh $/MWh

$/kWh

Solar, the cheapest energy source in history, will halve in price by the end of the decade

Outlook

41

Fossil fuels impose major externalities, while collecting large rents and subsidies

The fossil fuel system is fragile

Sources: RMI, World Bank, IMF, OWID, IRENA, Lelievield et al. (2023),BMJ, IEA, IIASA.

of people live in fossil fuel-

importing countries

86%

In annual waste from energy

efficiency losses

$4.6

trillion

Annual air pollution deaths as the

result of burning fossil fuels

5–6

million

In annual fossil fuel rents

$2

trillion

Of greenhouse gases come from

burning fossil fuels

75%

In annual explicit subsidies

($7 trillion with implicit subsidies)

$1.3

trillion

42

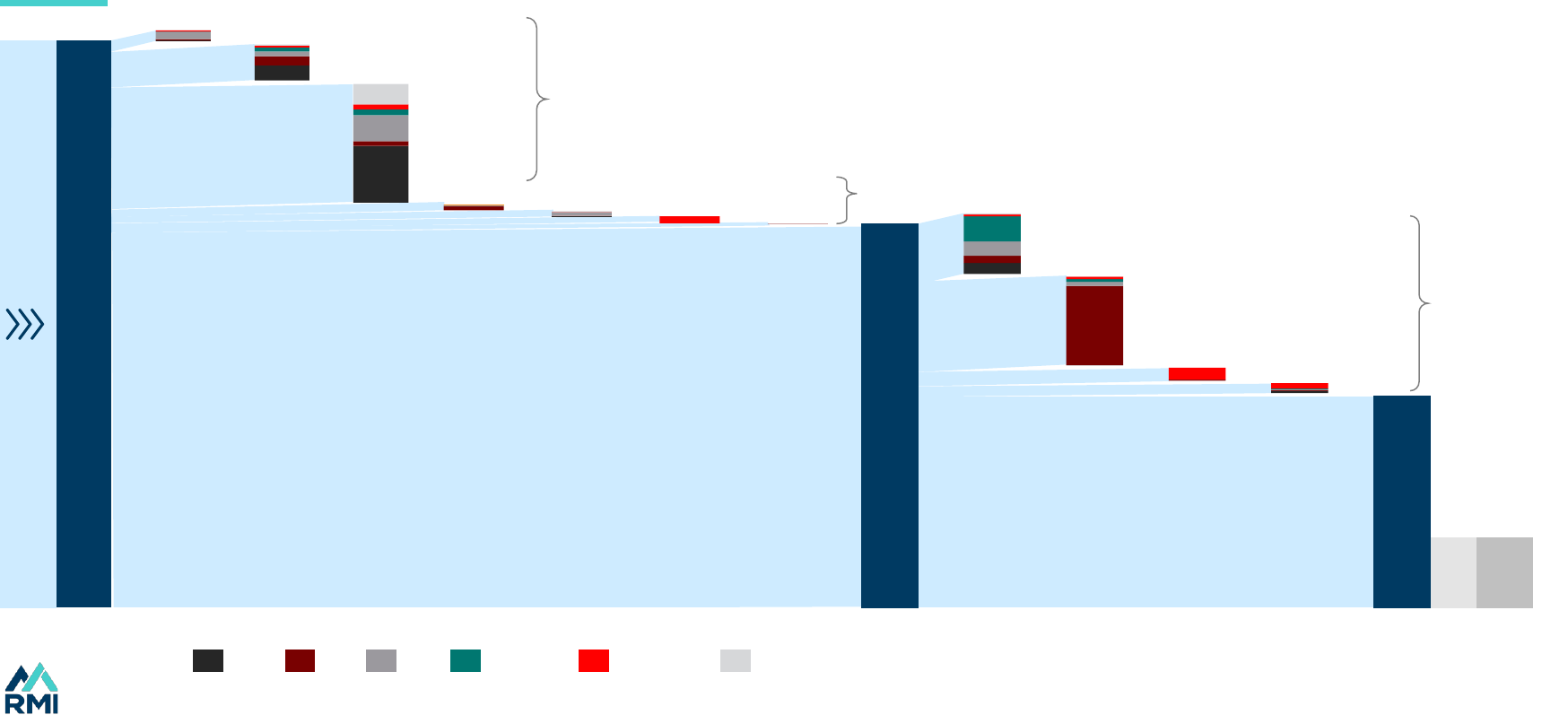

606

411

227

Sources: IEA, IIASA, RMI. For more see The Incredible Ineffciency of the Fossil Fuel System.

Coal Gas ElectricityOil OtherBiomass

Primary energy

Final energy

Energy

use losses

Energy production losses

126

Power

generation

Extraction

Fuel processing39

12

Heat

14

94

Other

Work

Light

11

65

Other

Wires

Pipes

Ships

5

<1

6

7

Energy transportation losses

Useful

energy

Energy

services

Two thirds of all fossil fuel primary energy is wasted in thermodynamic and system losses

Energy system flows, EJ, 2019

Fossil fuels are extremely inefficient

43

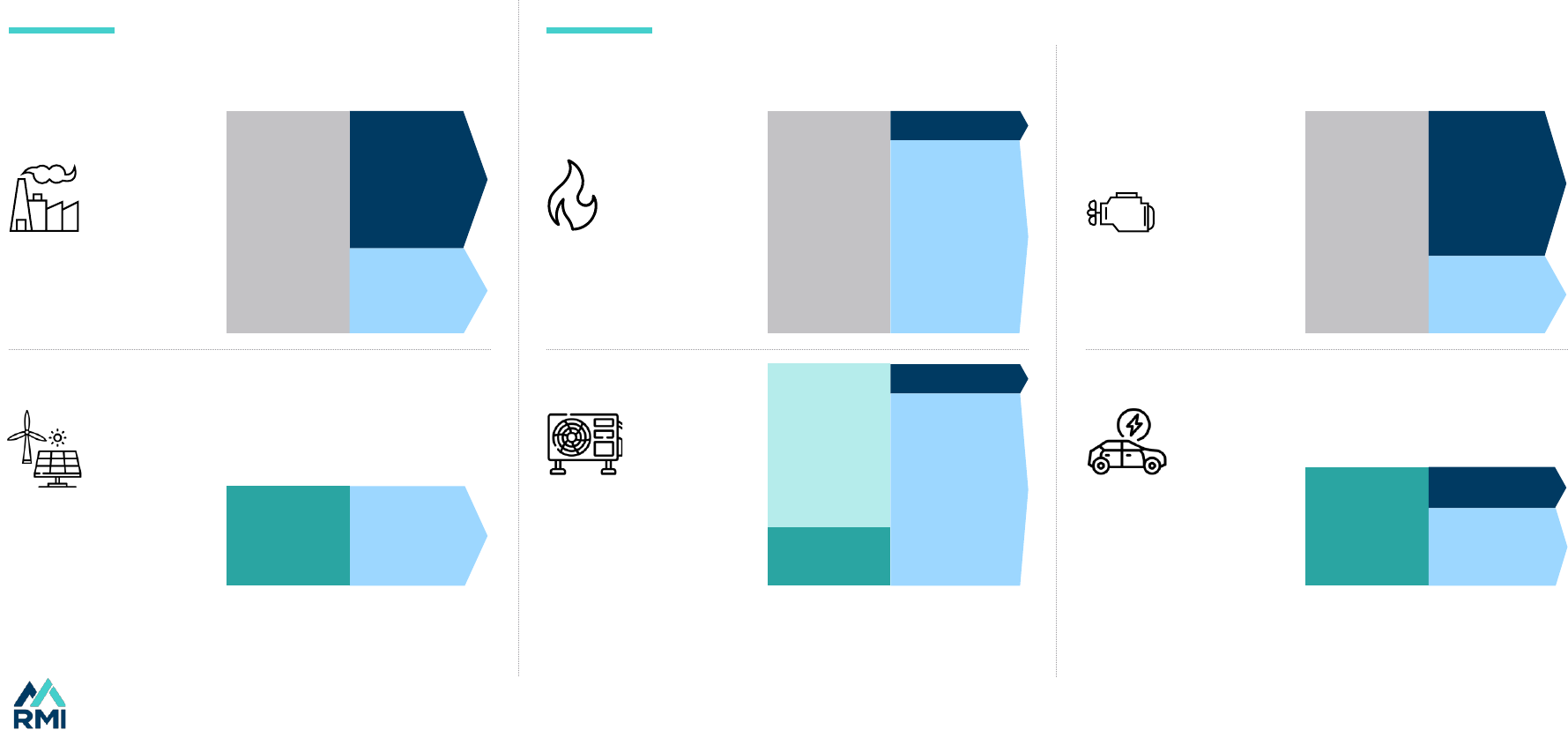

Cleantech is 3 times more efficient

Source: IEA, IIASA, RMI analysis, Adapted from Prof. Tomas Kåberger. Note: Solar and wind’s 100% efficiency represents the fact that there are no conversion losses from primary to secondary energy.

Energy useEnergy production

Electricity Heating Transport

Losses

Fuel

Electricity

Electricity

Renewable

electricity

Fuel

Losses

Propulsion

Renewable

electricity

Losses

Propulsion

Fossil thermal

30%–40% efficiency

Internal com-

bustion engine

25%–40% efficiency

Wind and solar Electric vehicle

100% efficiency 80%–90% efficiency

2–3x 2–4x

as efficient as efficient

Fuel

Losses

Heat

Losses

Heat

Renewable

electricity

Ambient

heat

Gas boiler

85% efficiency

Heat pump

300%–400%

efficiency

3–4x

as efficient

Cleantech is around 3x more efficient than fossil technologies across applications

44

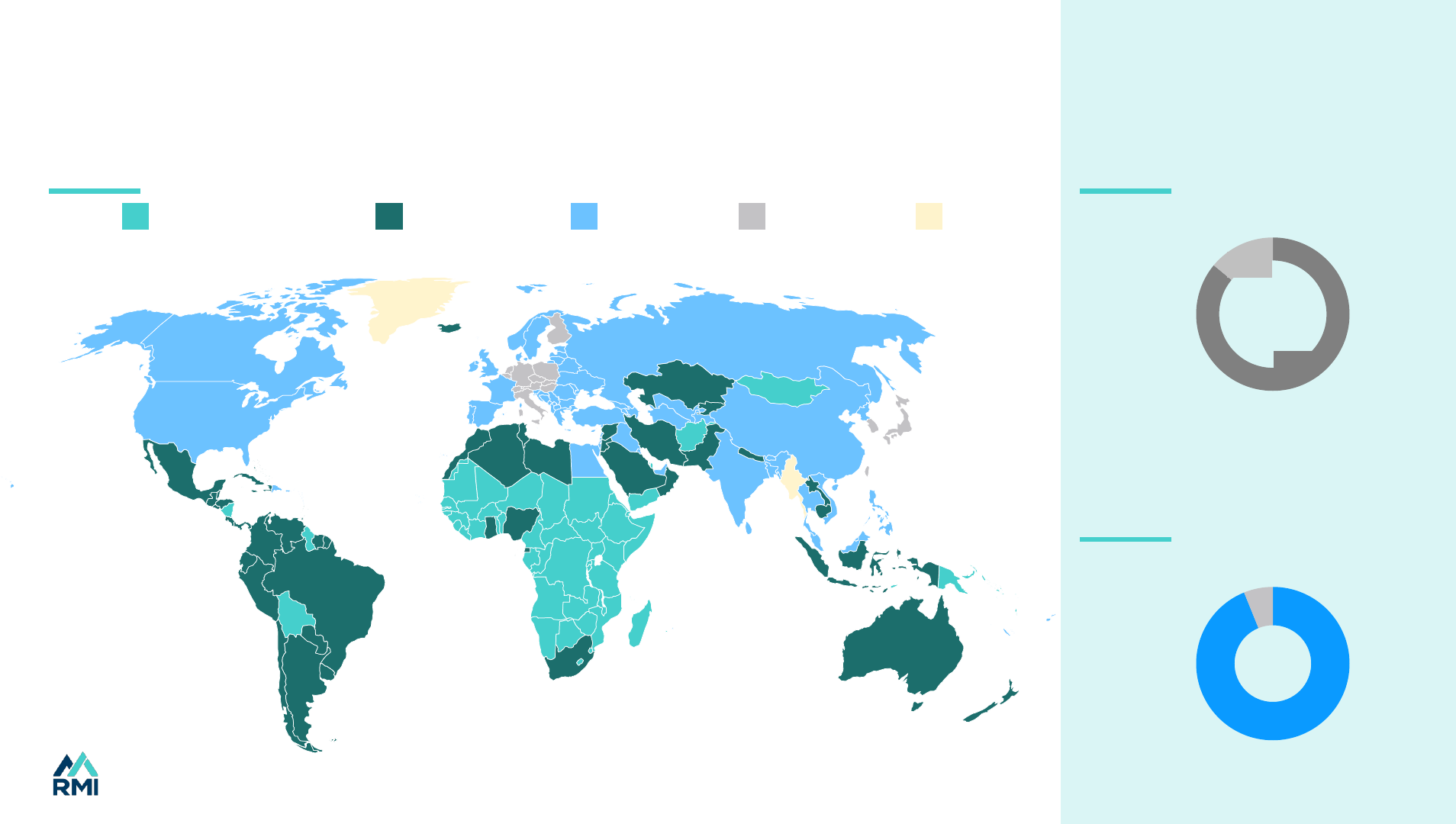

Renewables provide energy security

Source: Carbon Tracker, IRENA, Comtec, NREL, Solargis, RMI.

86%

Fossil fuel importers

14%

Fossil fuel exporters

92%

Replete to superabundant

6%

Stretched

Replete: >10x Stretched: <10xSuperabundant: >1,000x Abundant: >100x

Renewable potential as a multiple of energy demand

They are 100x bigger than fossil fuels, and every country has them

Share of population living in

countries that import fossil fuel

Share of population endowed

with replete or better

renewable resource

No data

45

Source: IRENA, IEA, BNEF. For more see X-Change: The Race to the Top.

The world’s largest energy consumer is moving fast

Patent Make

0

20

40

60

80

100

120

140

160

180

2000 2005 2010 2015 2020

1,500

1,000

2,000

500

2,500

0

2013 2017 2023

EJ electricity consumption

Clean energy patents

Battery manufacturing

capacity

000s

GWh

Deploy

0

5

10

15

20

25

30

1990 1995 2000 2005 2010 2015 2020

China

US

Europe

0

300

600

900

2000 2005 2010 2015 2020 2023E

China is leading the way to patent, make, and deploy the energy technologies of the future

GW solar and wind capacity

ElectrificationRenewables

1,200

180

China

US

Europe

46

Cleantech is now a key driver of GDP growth all over the world

Everyone wants a piece of the action

Source: IEA.

0

5

10

15

20

25

30

35

United states China European Union India

Contribution of cleantech to GDP growth, 2023

% of GDP growth

Deployment of clean

power capacity

Sales of EVs and heat

pumps

Manufacturing of clean

energy technologies

4747

10

20

15

25

5

30

0

2011 2015 2019 2023

%

Source: IEA, BNEF, World Bank/OWID.

Change is not uniform, but it is relentless at a global level

…so policy pressure will continue to rise

0

10

20

30

40

50

60

70

80

90

2015 2017 2019 2021 2023

30

50

40

60

20

70

10

0

2017 2019 2021 20232015

Net-zero targets Combustion car bans Carbon prices

The world burns…

1940 20231960 1980 2000 2010

17 °C

15.8 °C

Record temperatures

Share of

emissions

covered

National

Regional

& municipal

Share of

emissions

covered

%

countries/regions

Source: C3S. Surface temperatures.

48

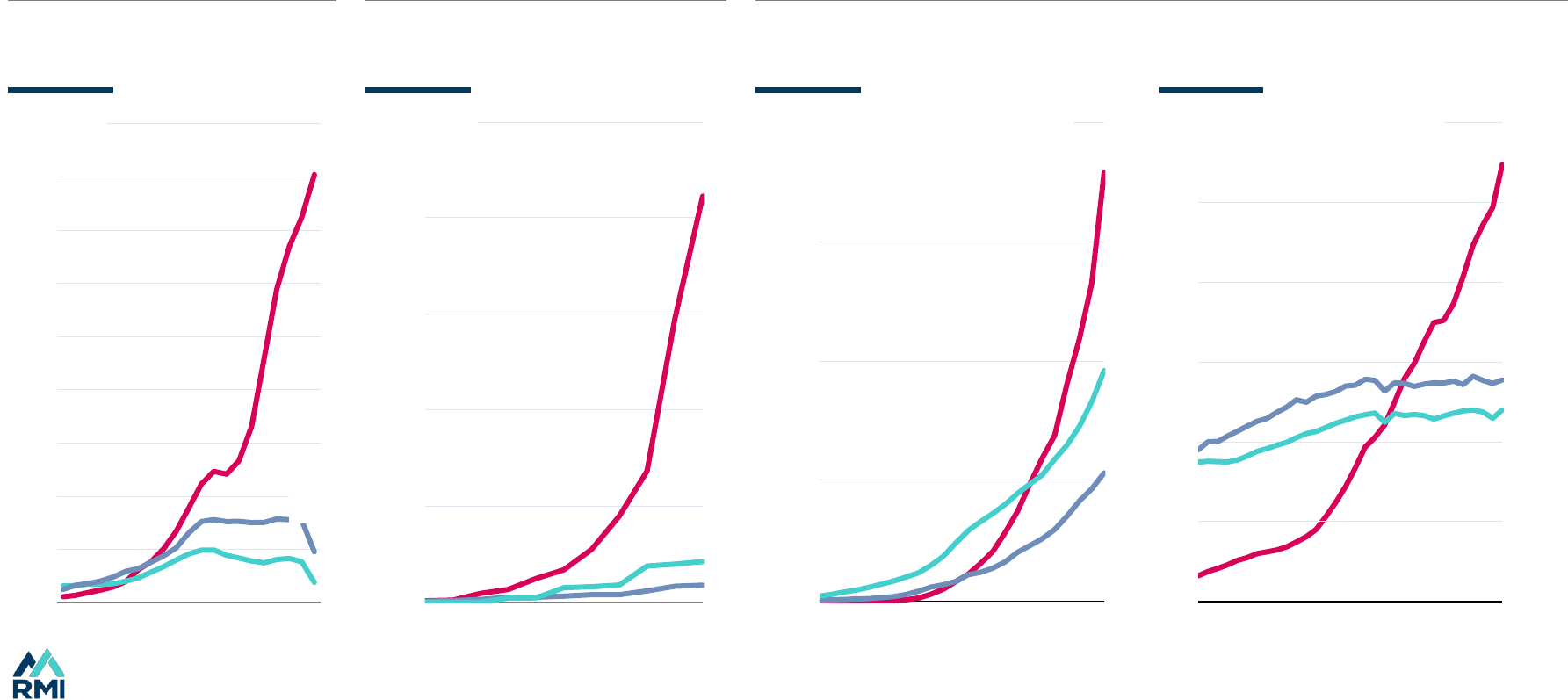

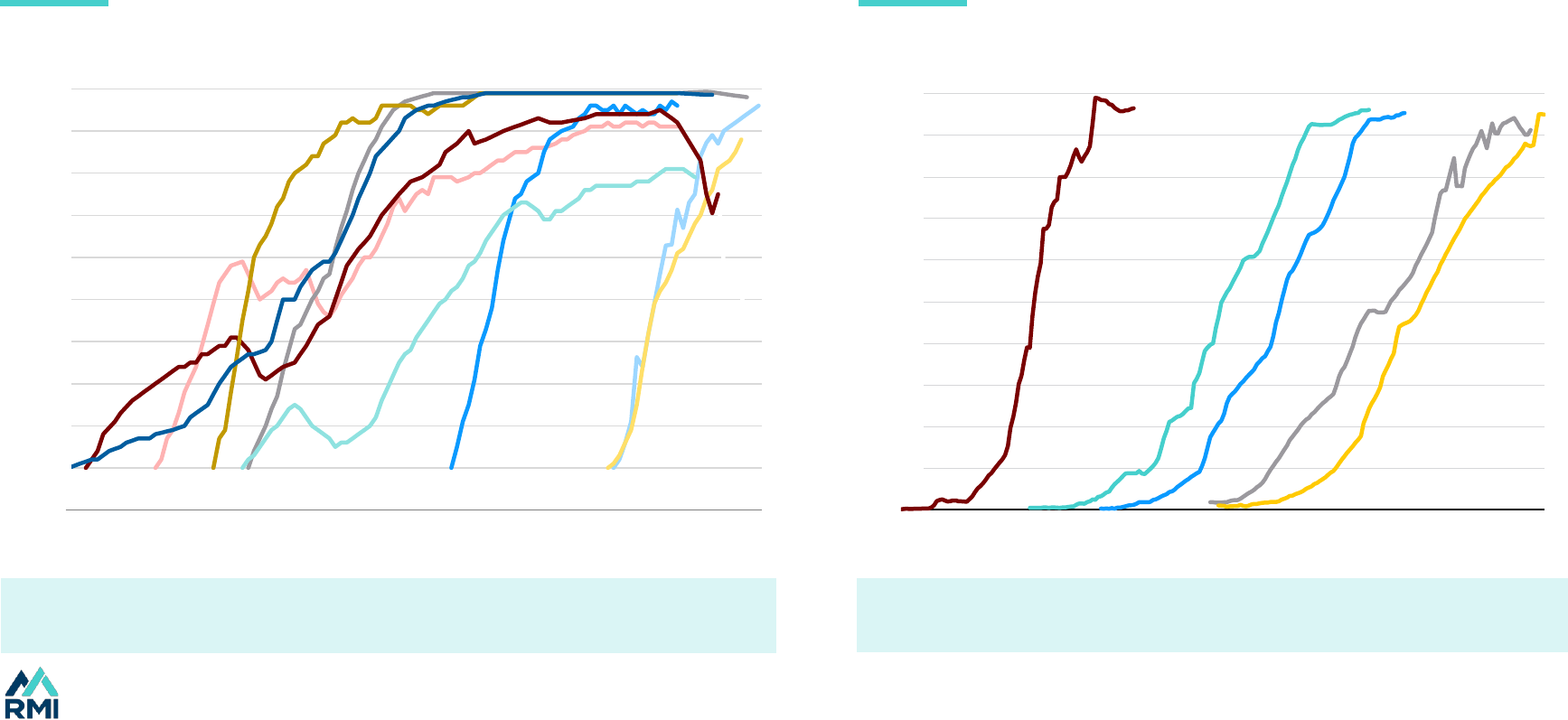

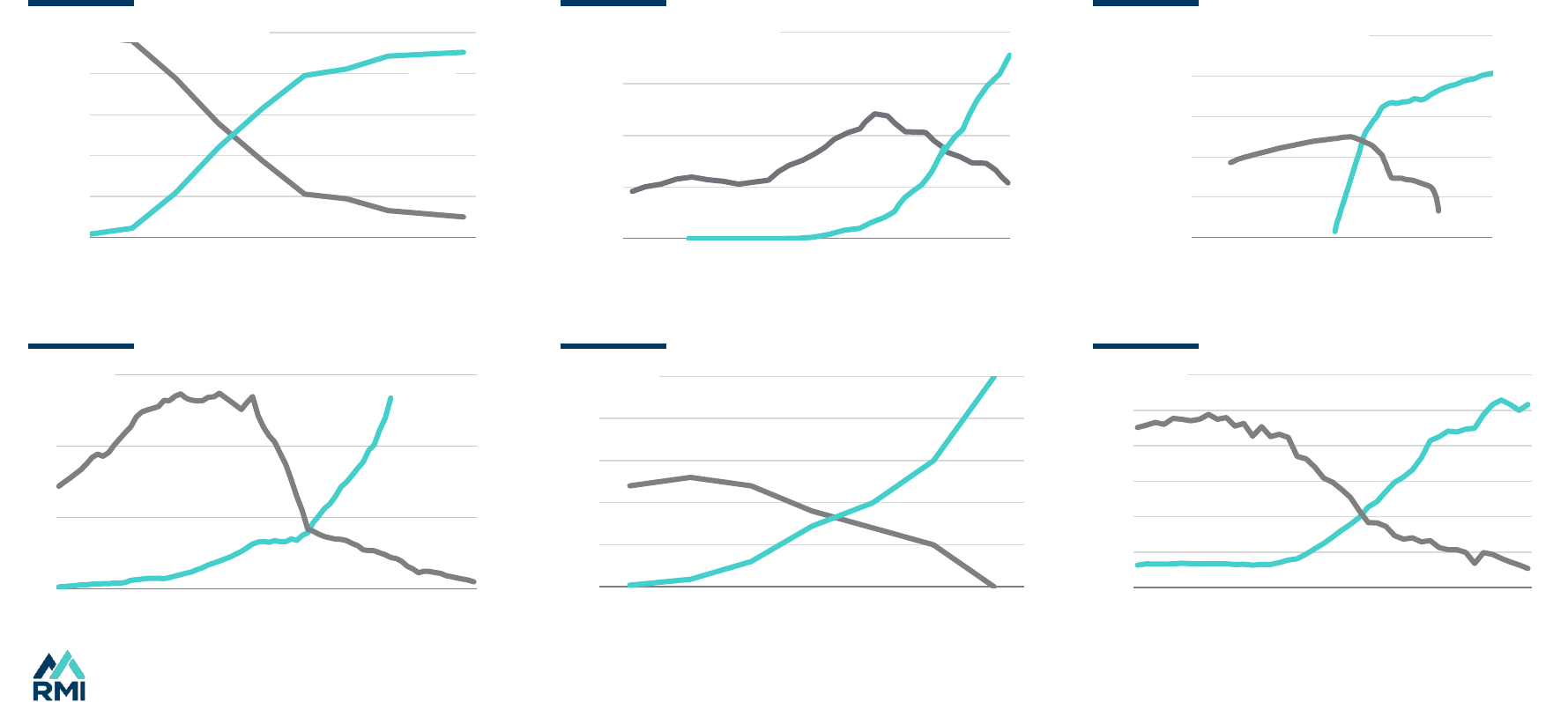

Adoption moves from early adopters to laggards up a series of S-curves. This time anyone can be a leader

Cleantech adoption resembles that of the internet

Source: OWID, Energy Institute.

Share of population using the Internet Solar and wind as a share of generation

0%

5%

10%

15%

20%

25%

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1990 1997 2004 2011 2018

North America

Europe and

Central Asia

Middle East and

North Africa

Latin America

and Caribbean

World

South Asia

Sub-Saharan

Africa

EU

China

North

America

South

America

World

Africa

Middle

East

CIS

of electricity from wind and solarof population using the internet

49

Rapid exponential growth along S-curves is a standard characteristic of

successful new technologies.

S-curve-type growth even applies to infrastructure.

Technological adoption by household in the United States Share of maximum size in the United States

Source: Comin & Hobijn via OWID (L); Grubler (R).

0

10

20

30

40

50

60

70

80

90

100

1800 1820 1840 1860 1880 1900 1920 1940 1960 1980 2000

Individual products Infrastructure systems

0

10

20

30

40

50

60

70

80

90

100

We’ve seen this movie before. We know how technology shifts work

S-curves as usual, not business as usual

1900 1910 1920 1930 1940 1950 1960 1970 1990 2000 2010

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

Canals

Railways

Telegraphs

Oil

pipelines

Roads

Radio

Car

Landline

Stove

Washing

machine

Cellphone

Internet

Color TV

Refrigerator

50

0%

20%

40%

60%

80%

100%

S. & C.

America

Japan

Other Asia

Pacific

Africa

ChinaNorth America IndiaCISEurope Middle

East

Share of electricity generation

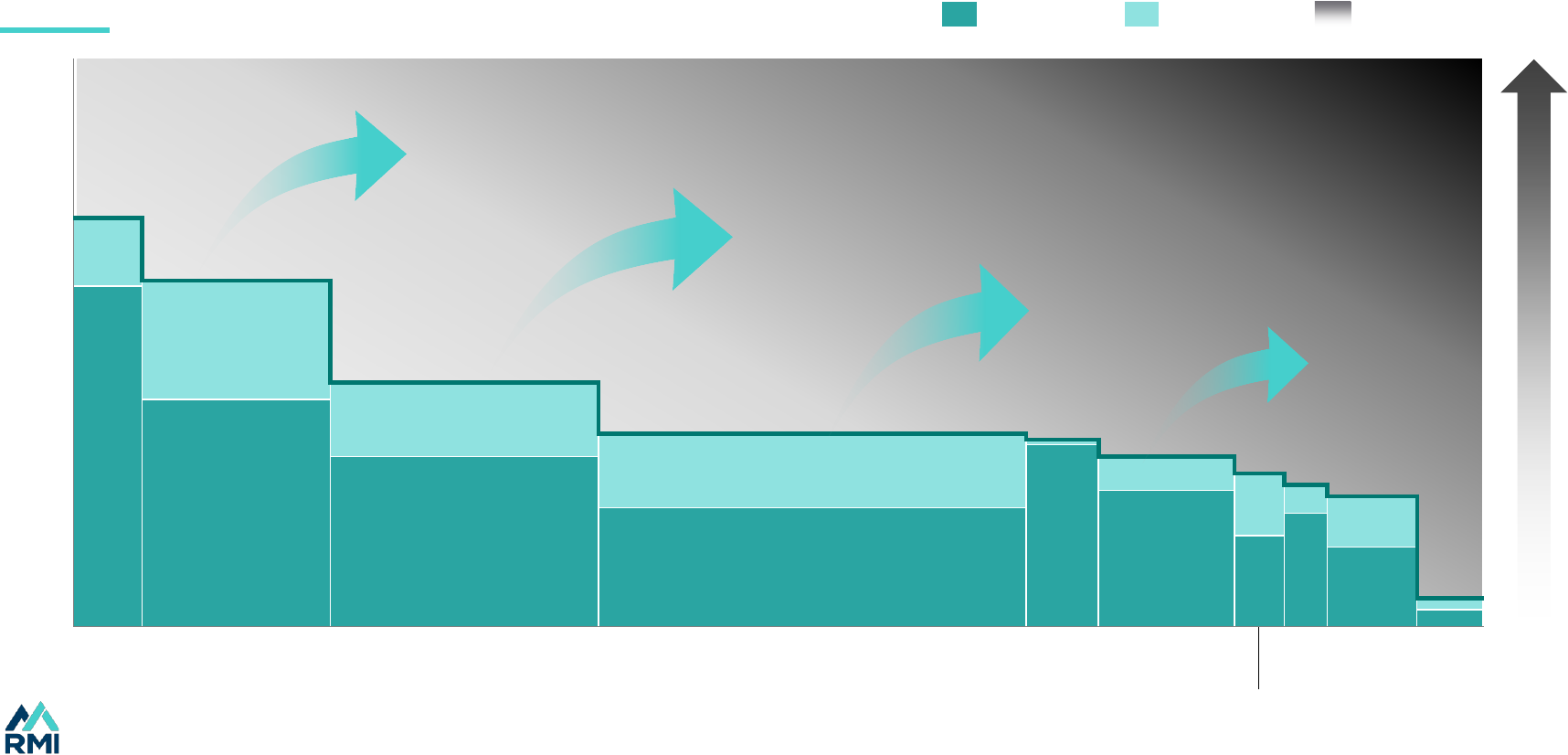

We should focus on the opportunities before our very eyes, not on potential end-game barriers

Technologies cascade across geographies

Source: Energy Institute, RMI. For more see X-Change: Electricity.

Harder

Easier

Other clean Solar + Wind Fossil fuels

51

100%

80%

40%

20%

0%

60%

Other

industry

Light industry

Petchem

Road transportSteelOtherBuildings Transport

other

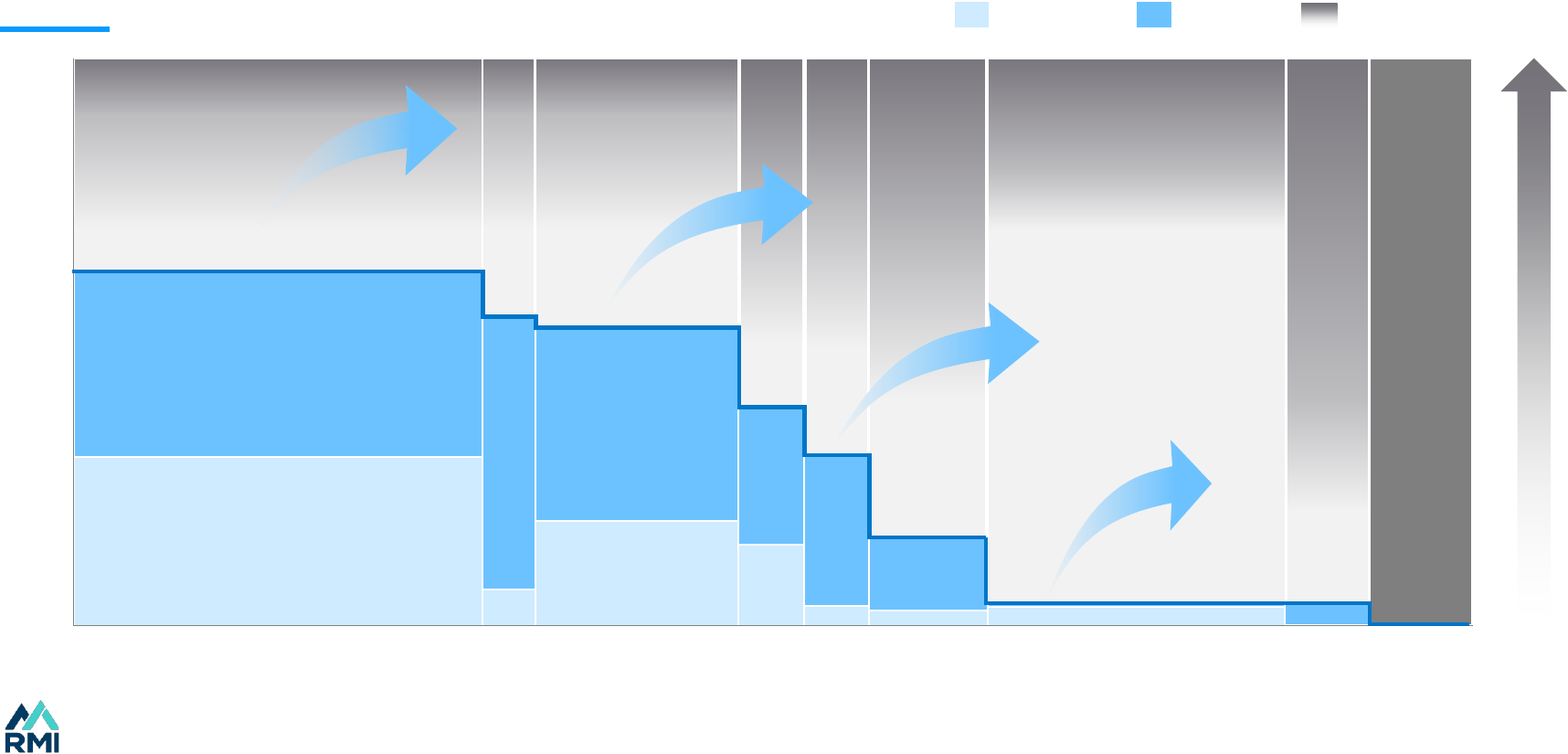

Non-energy

Final energy supply by sector

Every sector has low-hanging fruit at the frontier

Technologies cascade across sectors

Source: BNEF for final energy supply 2022, RMI.

Other clean Electricity Fossil fuels

Harder

Easier

52

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

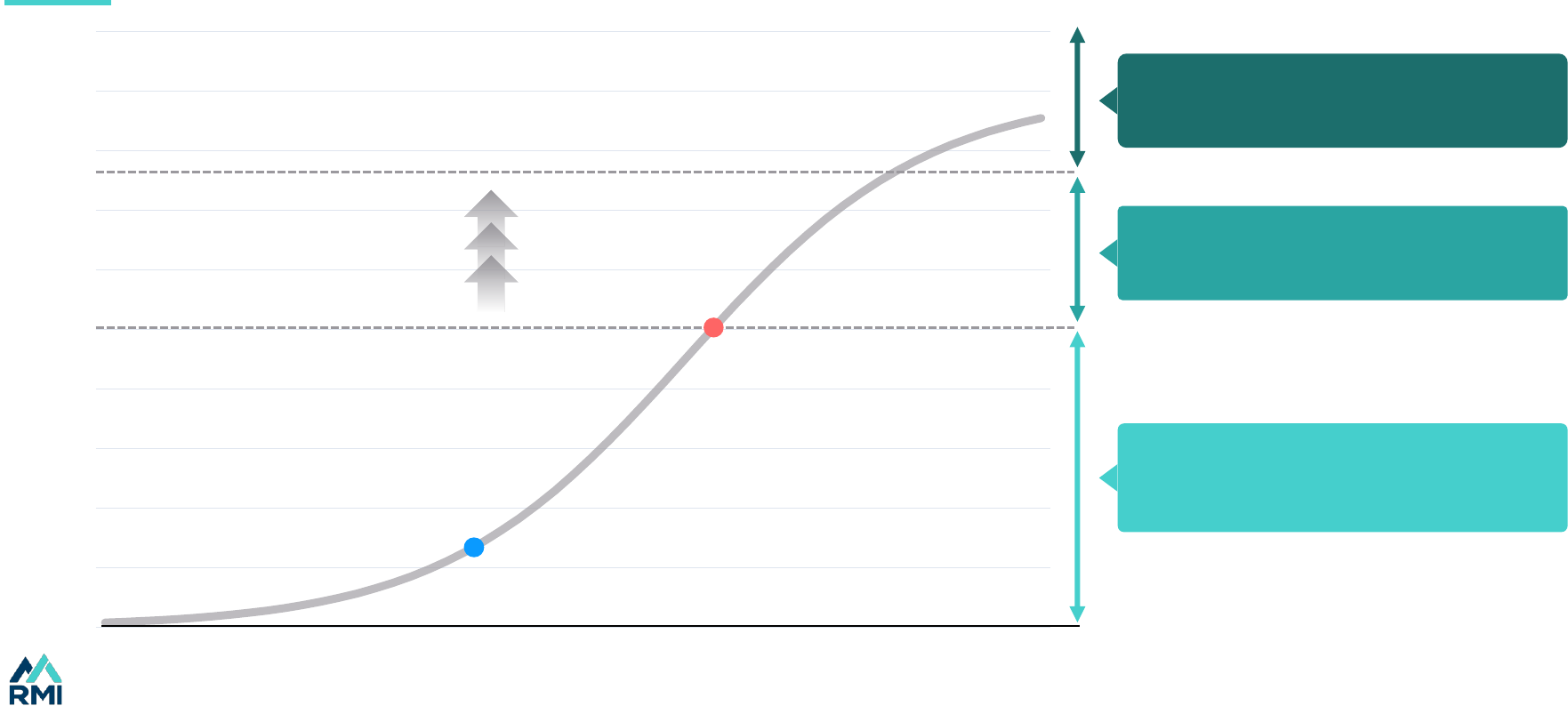

The world is here

Innovation raises the

ceiling of the possible

Leading countries and companies keep opening up new opportunities for the rest of the world

The ceiling of the possible keeps rising

Source: RMI

Solar and wind as share of electricity generation

ENDGAME PROBLEM

A challenge for tomorrow’s leaders

WE HAVE SOLUTIONS

Technical and economic solutions

exist

CUTTING EDGE OF CHANGE

A challenge for today’s leaders

The leaders are here

53

53

Index

Implications for the energy system

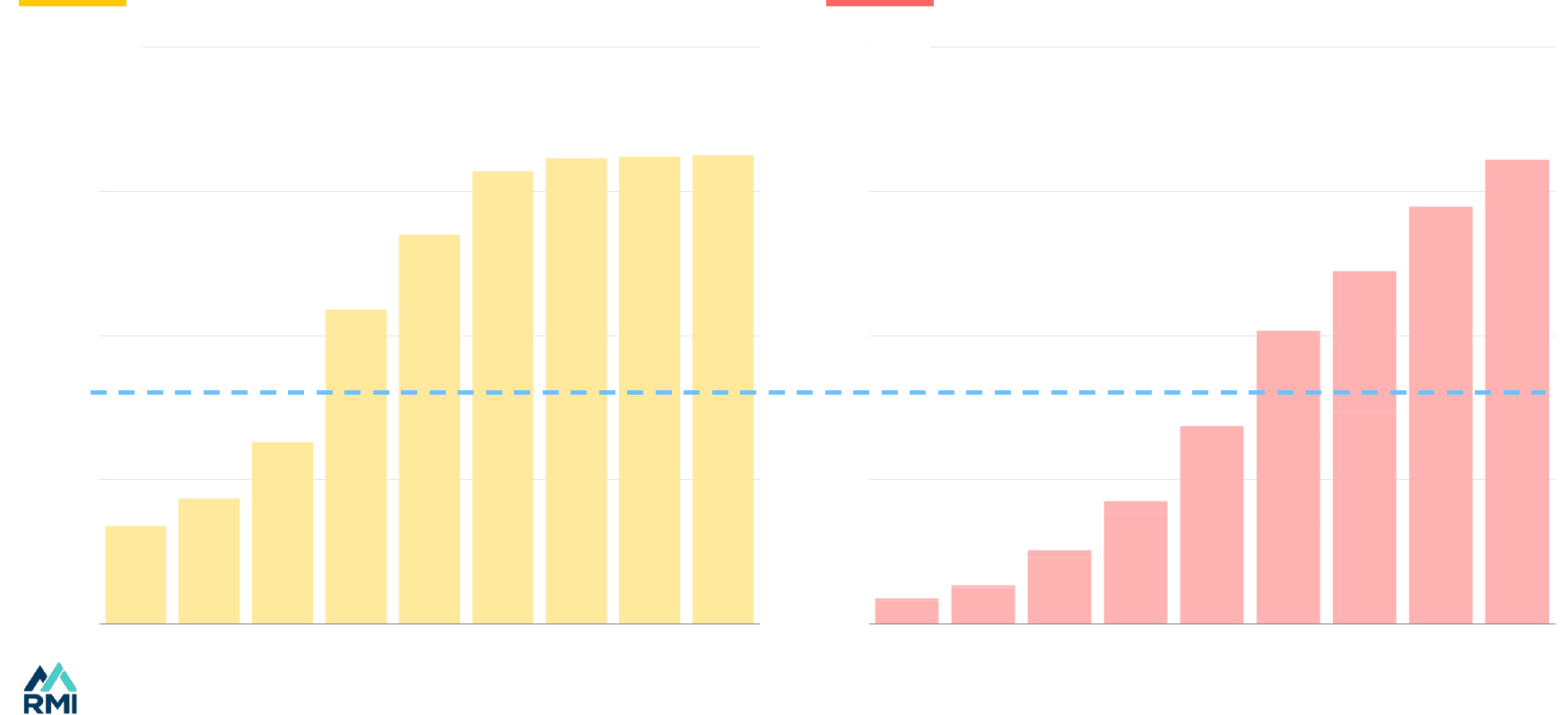

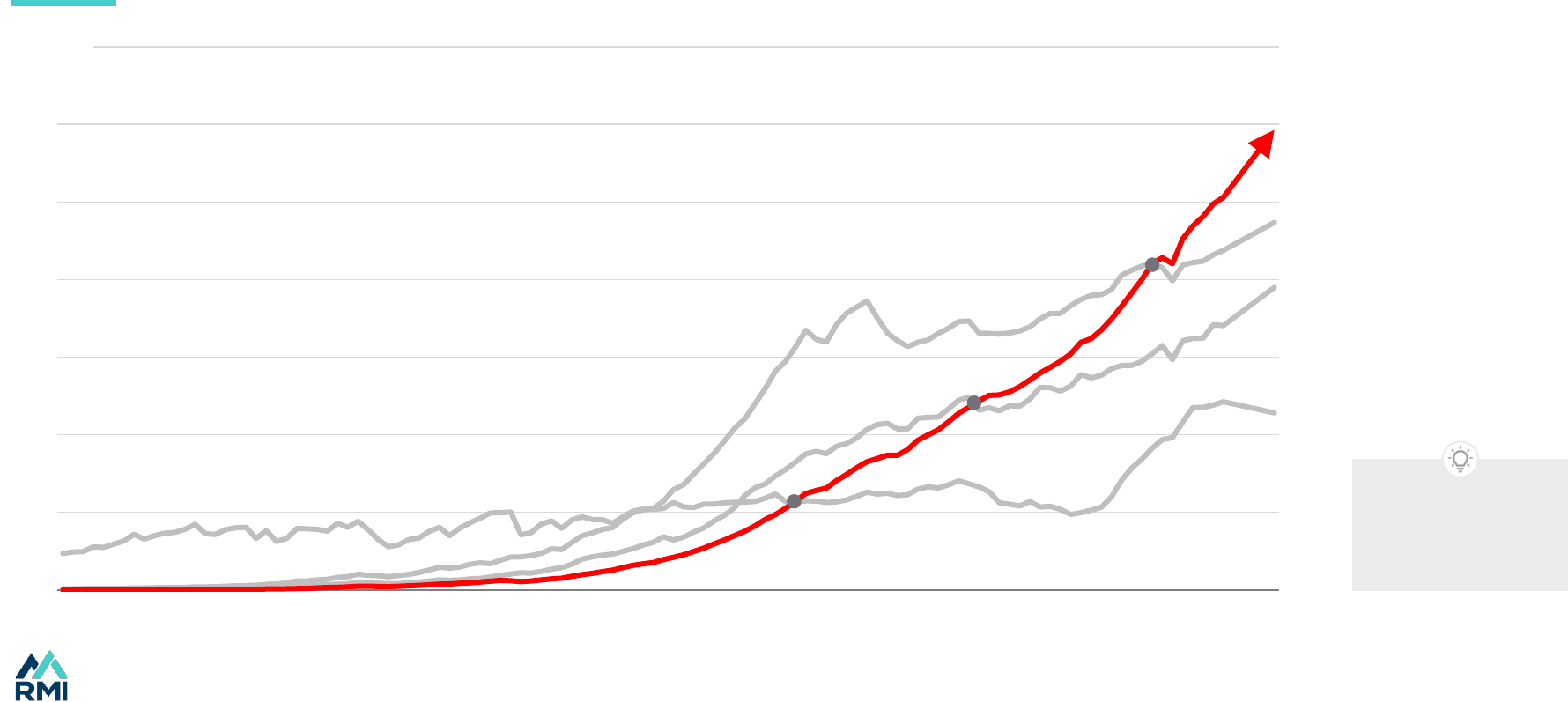

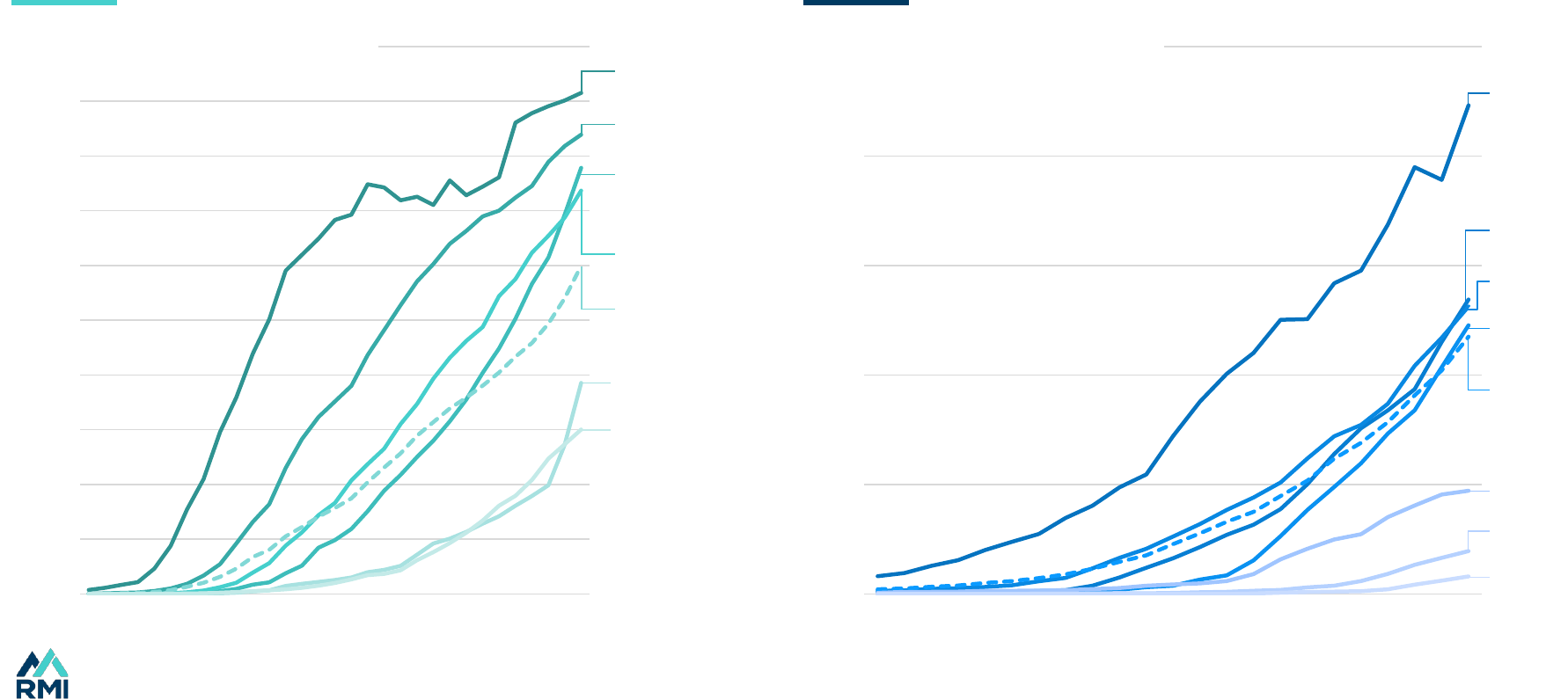

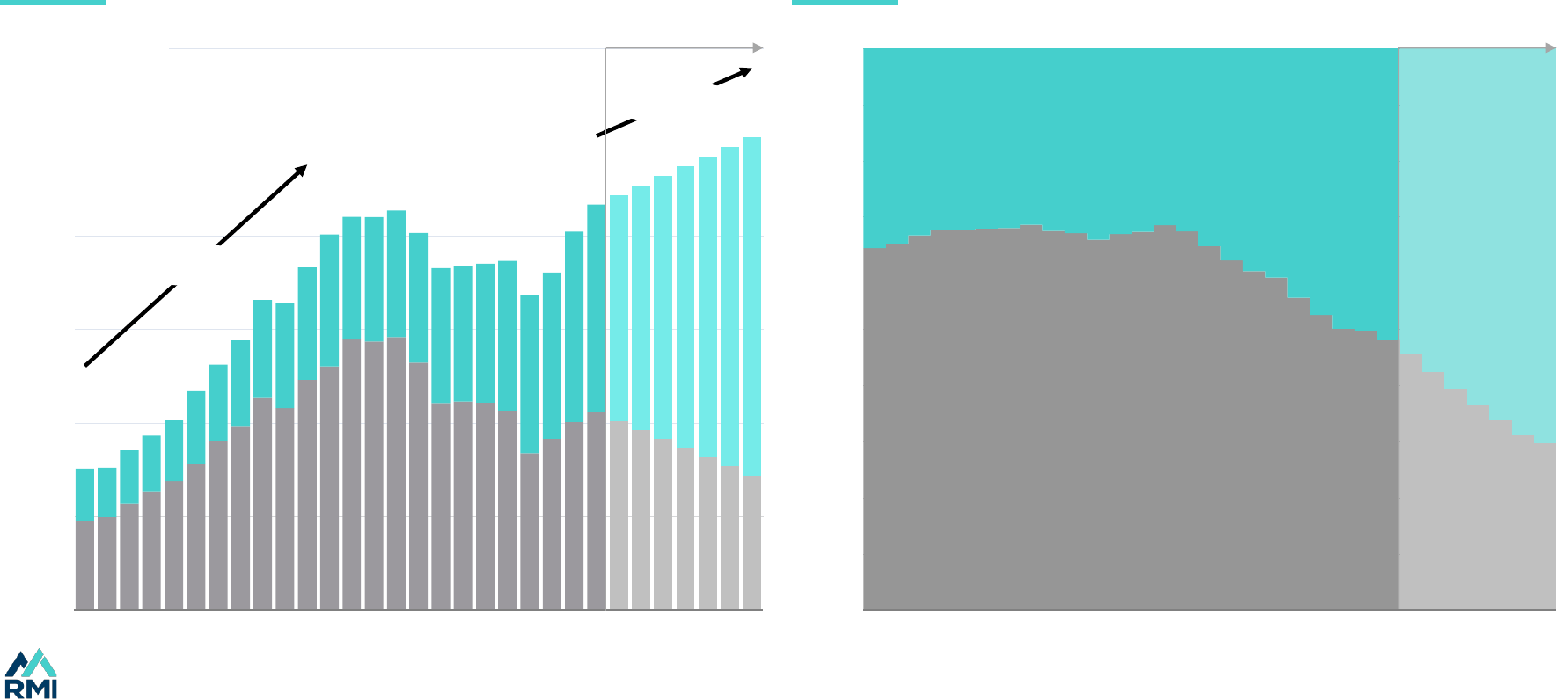

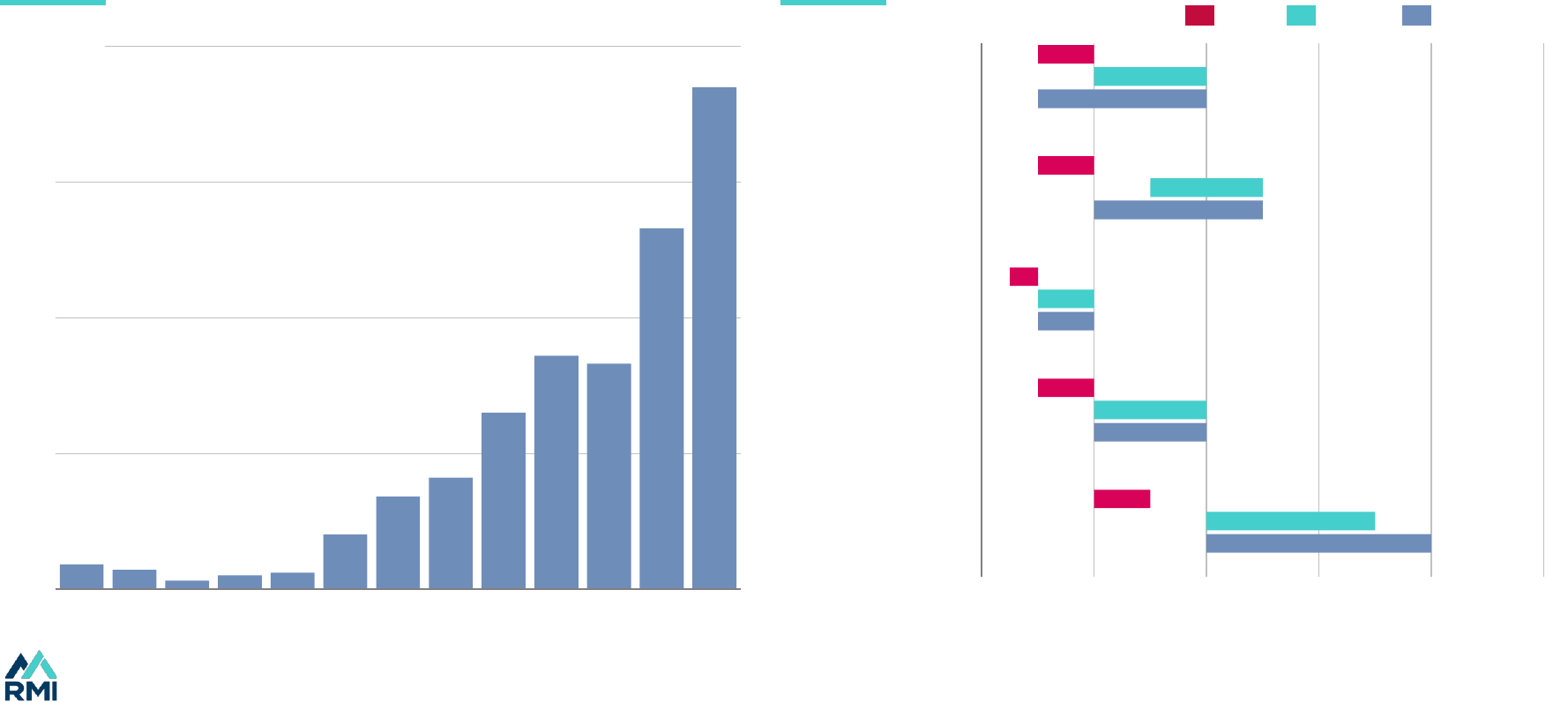

• If change continues on S-curves, then by 2030 we expect solar sales of over 1,000

GW a year and battery sales of over 6,000 GWh a year.

• S-curves imply that by 2030 solar and wind generation will triple to over 12,000

TWh and EVs will be two-thirds of car sales.

• The annual electrification rate is likely to more than double to 0.5% in 2030 as

transport joins the party, and success in China drags up electrification rates

elsewhere.

• Annual efficiency gains are likely to double from the 1.5% average of the past two

decades to at least 3% as the result of the rising share of renewables,

electrification, and a greater focus on end-use efficiency.

• Renewables will push out fossil electricity, electrons will push out molecules, and

efficiency will reduce waste. In a typical X shaped pattern.

• Over 75% of fossil fuel demand today is threatened by rapidly growing cleantech

alternatives.

• Fossil fuel demand will be squeezed between efficiency and cleantech. The demand

plateau will last until the end of the decade, and then clear decline will set in.

5

54

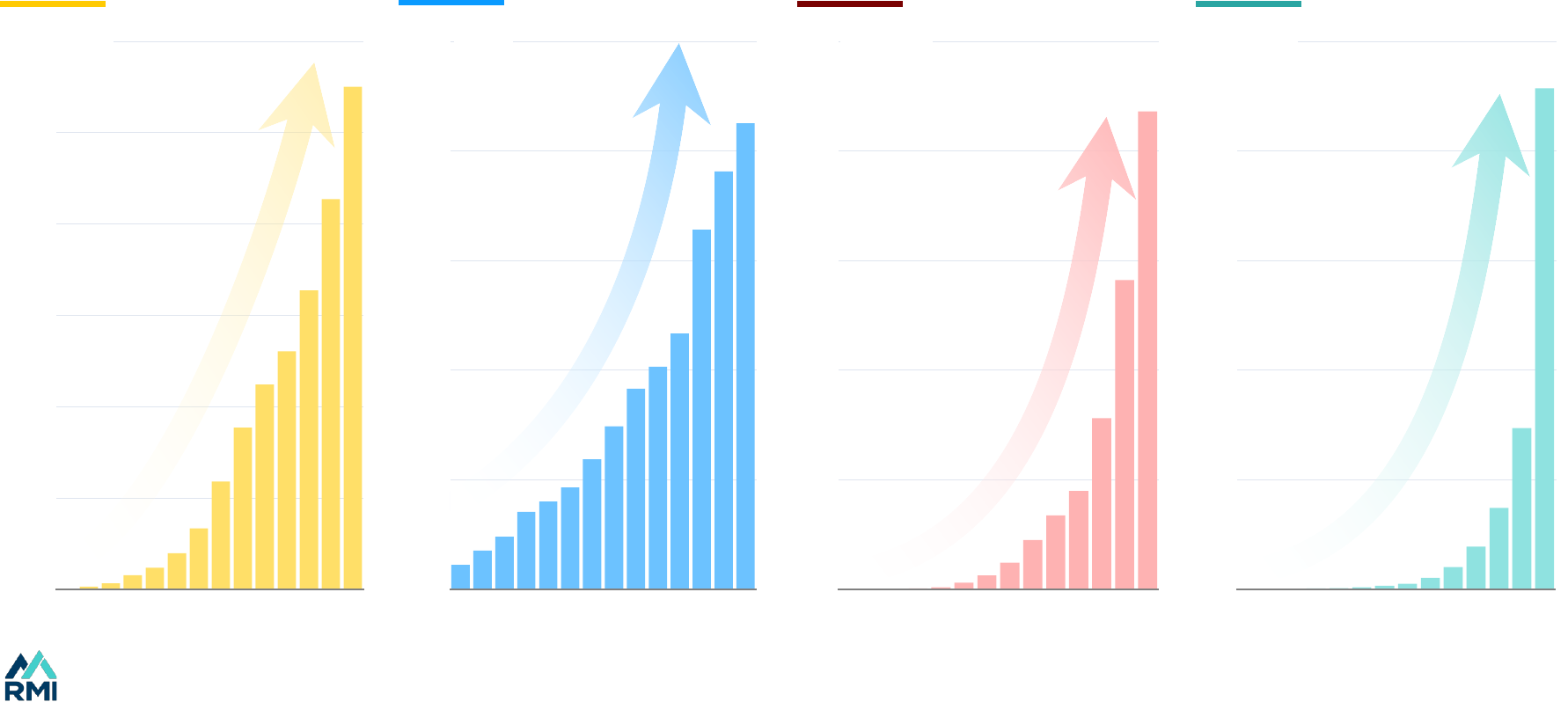

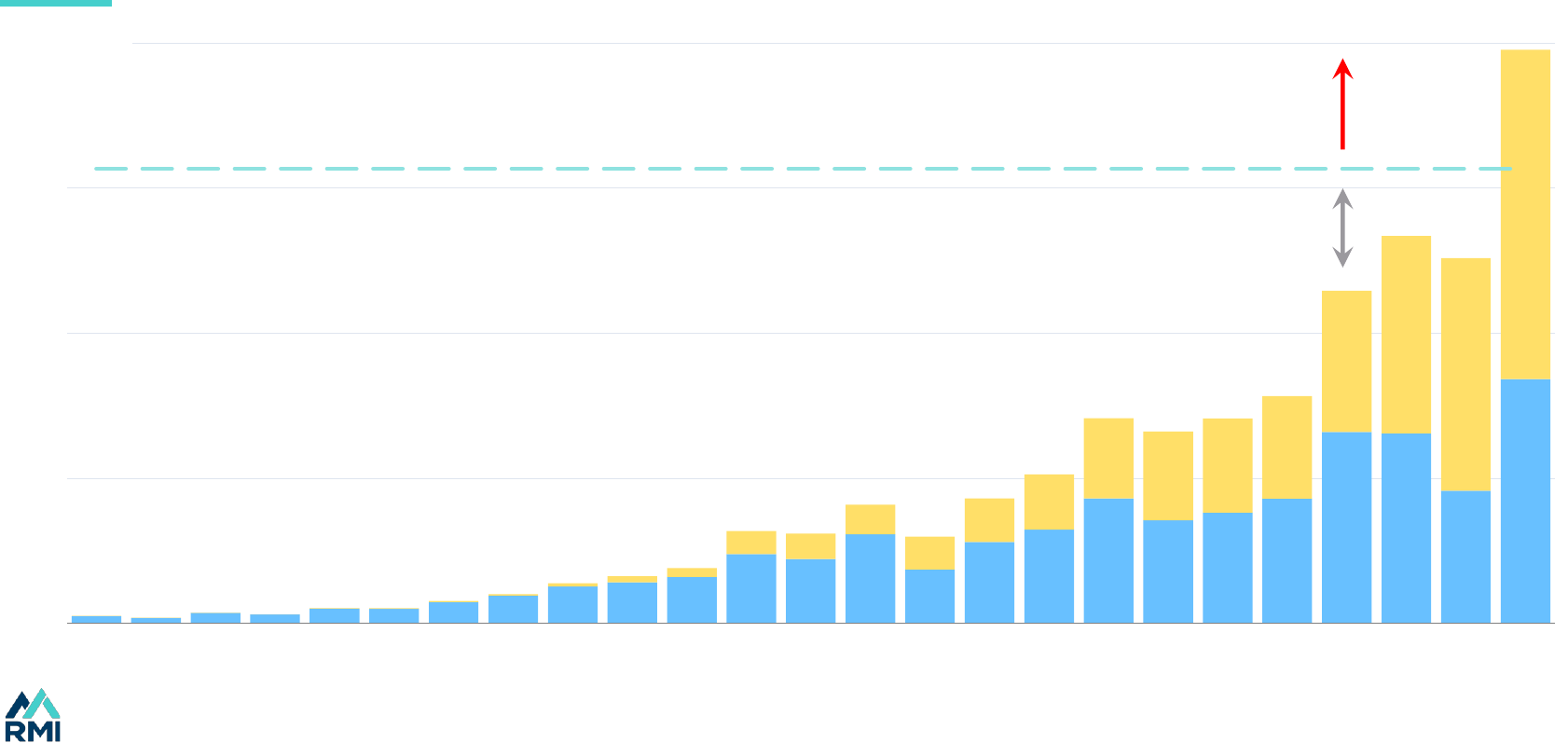

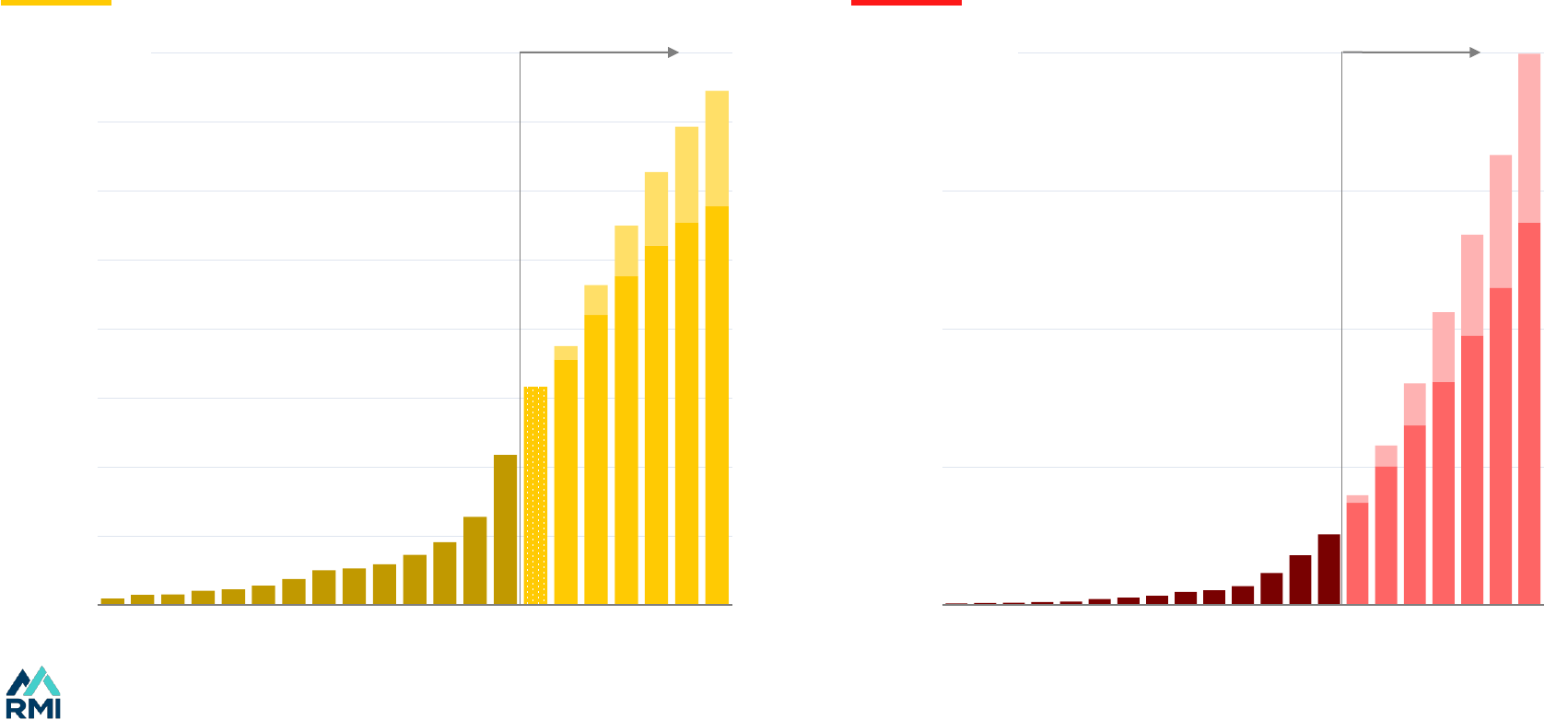

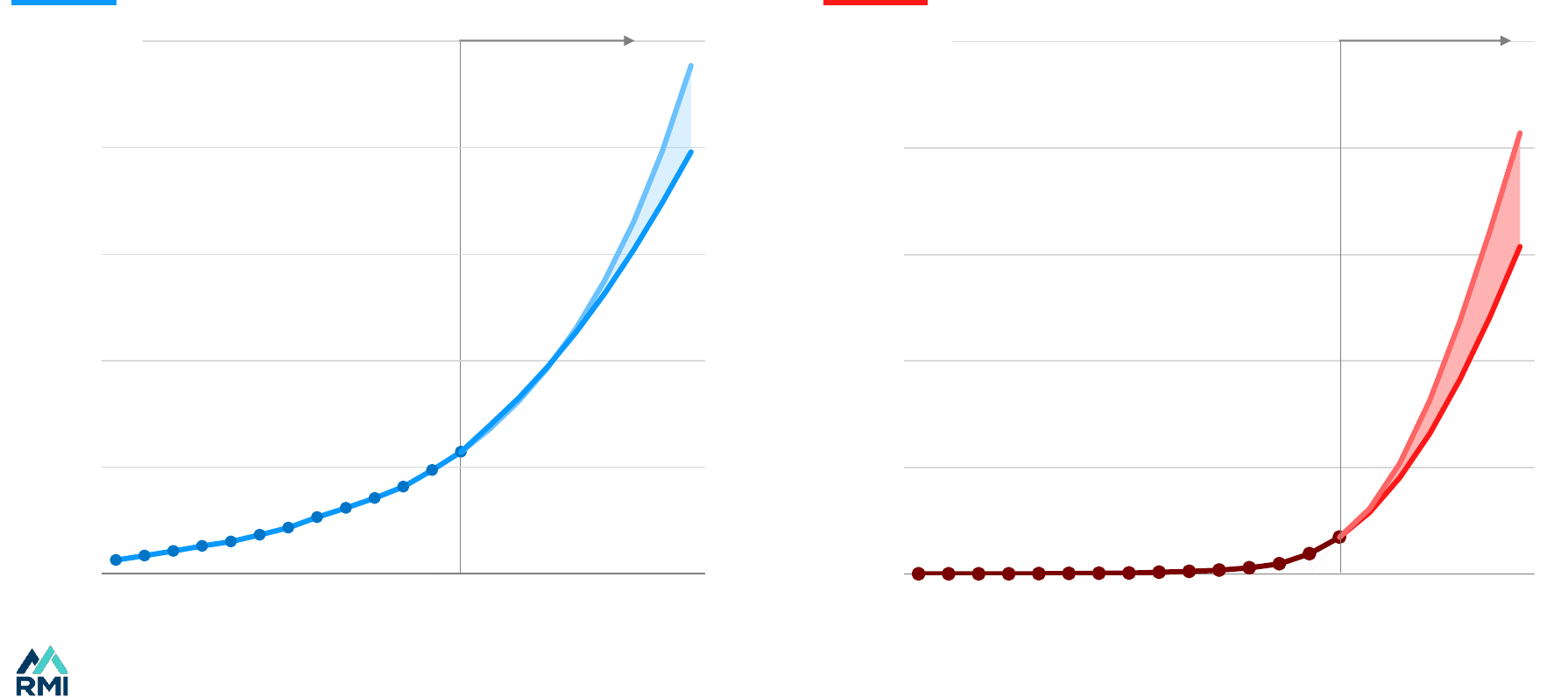

Super-fast growth in solar and battery sales

Global solar sales Global battery sales

Solar sales are on track for over 1,000 GW per year by

2030

Battery sales are likely to be over 6,000 GWh a year by

2030

Source: BNEF historical and 2024E for solar (high), RMI S-curves. For more see X-Change: Batteries.

0

200

400

600

800

1,000

1,200

1,400

1,600

2010 2015 2020 2025 2030

Past

Fast

Faster

Outlook

GW

0

2,000

4,000

6,000

8,000

2010 2015 2020 2025 2030

Past

Fast

Faster

Outlook

GWh

55

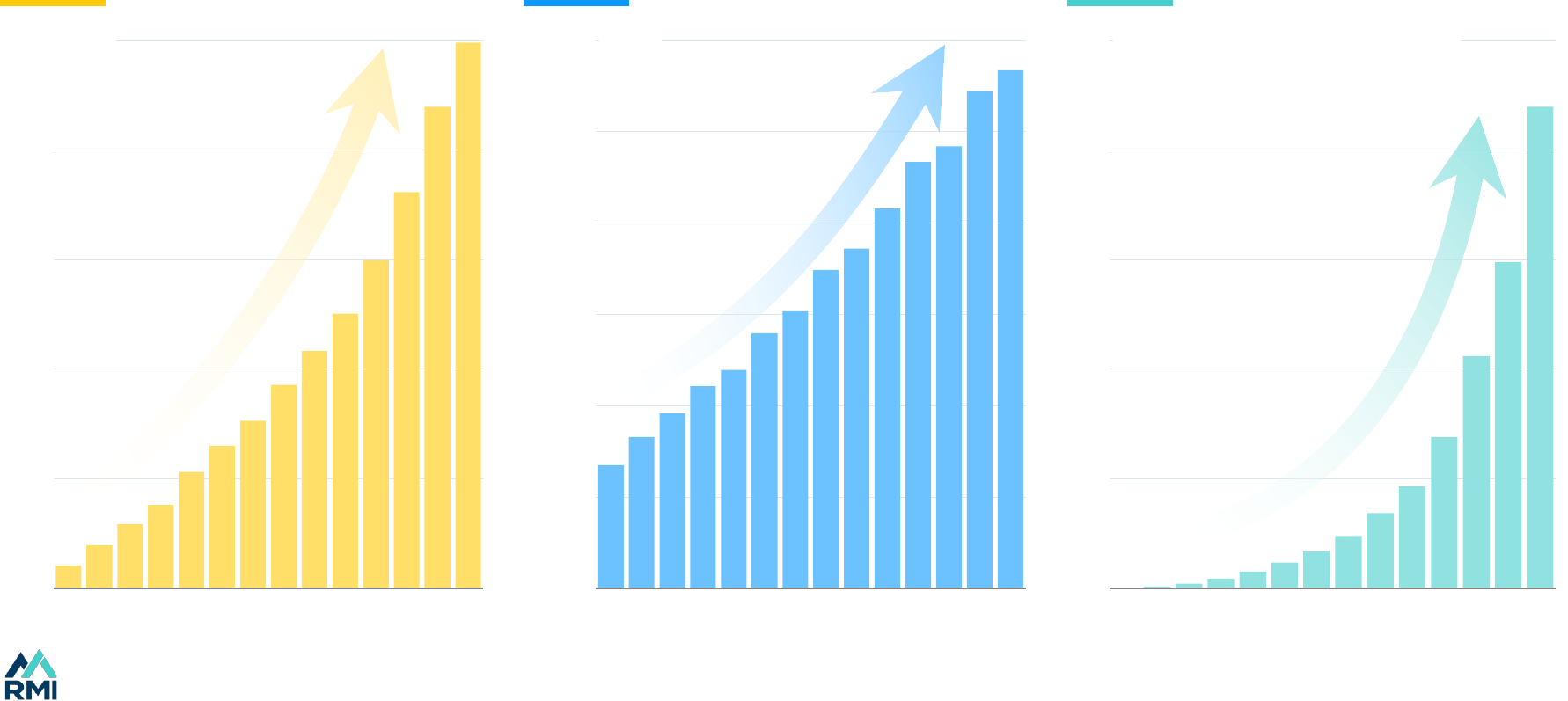

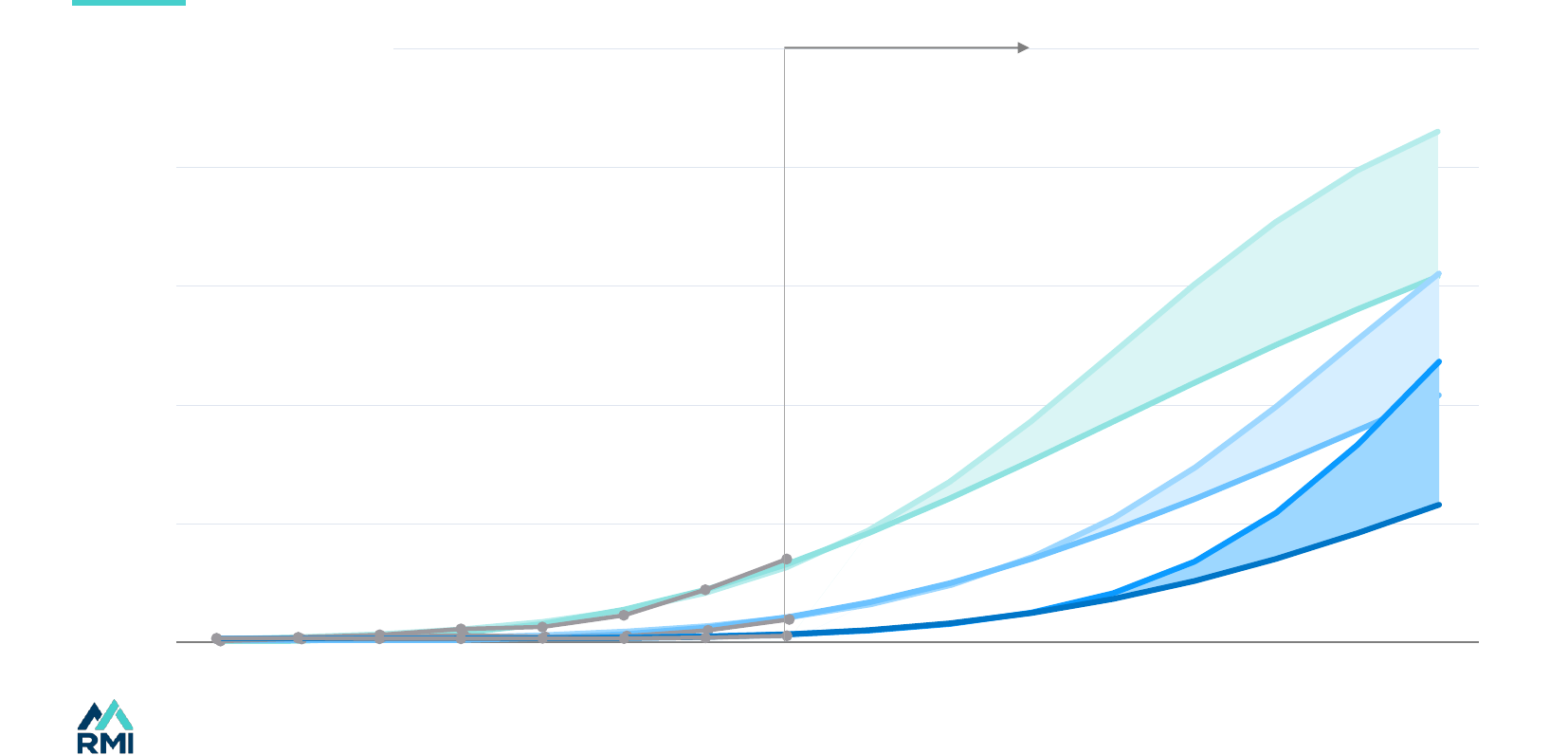

Source: Energy Institute, BNEF, RMI S-curves. For more see X-Change: Electricity.

0

3,000

6,000

9,000

12,000

15,000

2010 2015 2020 2025 2030

Faster

Fast

0

1,000

2,000

3,000

4,000

5,000

2010 2015 2020 2025 2030

Solar and wind generation Battery stationary storage

As the renewable revolution will continue to solve barriers to change

Outlook

Renewables will keep rising up their S-curves

Outlook

TWh GWh

Faster

Fast

56

0%

20%

40%

60%

80%

100%

2015 2020 2025 2030

of global sales

Where cars go, vans and trucks follow

The electric vehicle domino effect will continue

Source: BNEF, RMI S-curves. For more see X-Change: Batteries.

Cars

The electric vehicle domino

Light commercial

vehicles

Trucks

Outlook

57

Transport is joining the party just as electrification picks up in other sectors

Electrification will pick up speed

Source: Rystad Energy 1.6°C.

0%

20%

40%

60%

80%

1990 2000 2010 2020 2030 2040 2050

Industry

Transport

Buildings

Total

Outlook

of useful energy from electricity

58

Faster cleantech deployment will speed up efficiency improvements

Efficiency will be pulled up the S-curve

Source: Rystad Energy 1.6 °C. Electricity efficiency is final as a share of primary. Sector efficiency is useful as a share of secondary.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1990 2000 2010 2020 2030 2040 2050

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1990 2000 2010 2020 2030 2040 2050

Outlook

Industry

Buildings

Transport

Total

Electricity generation efficiency End-sector efficiency

Driven by higher

efficiency of electricity

versus fossil fuels

Outlook

Driven by renewables which

are about 2.5x more efficient

than fossil-fueled electricity

59

S-curves suggest we will triple renewables, and more than double electrification and efficiency rates

Tripling renewables by 2030

Source: IEA APS scenario as likely (Announced Pledges Scenario); NZE as feasible (net zero emissions).

Renewable capacity

Annual rate of electrification Annual primary efficiency gains

3

6

9

0

2022 2030

12

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

2022 2022-30

0%

1%

2%

3%

4%

5%

2000-22 2022-30

COP goal

“doubling down”

on annual

efficiency

improvement rate

versus 2022

Likely

Feasible

COP goal

“triple up”

renewables

from 2022

TW

60

Outlook

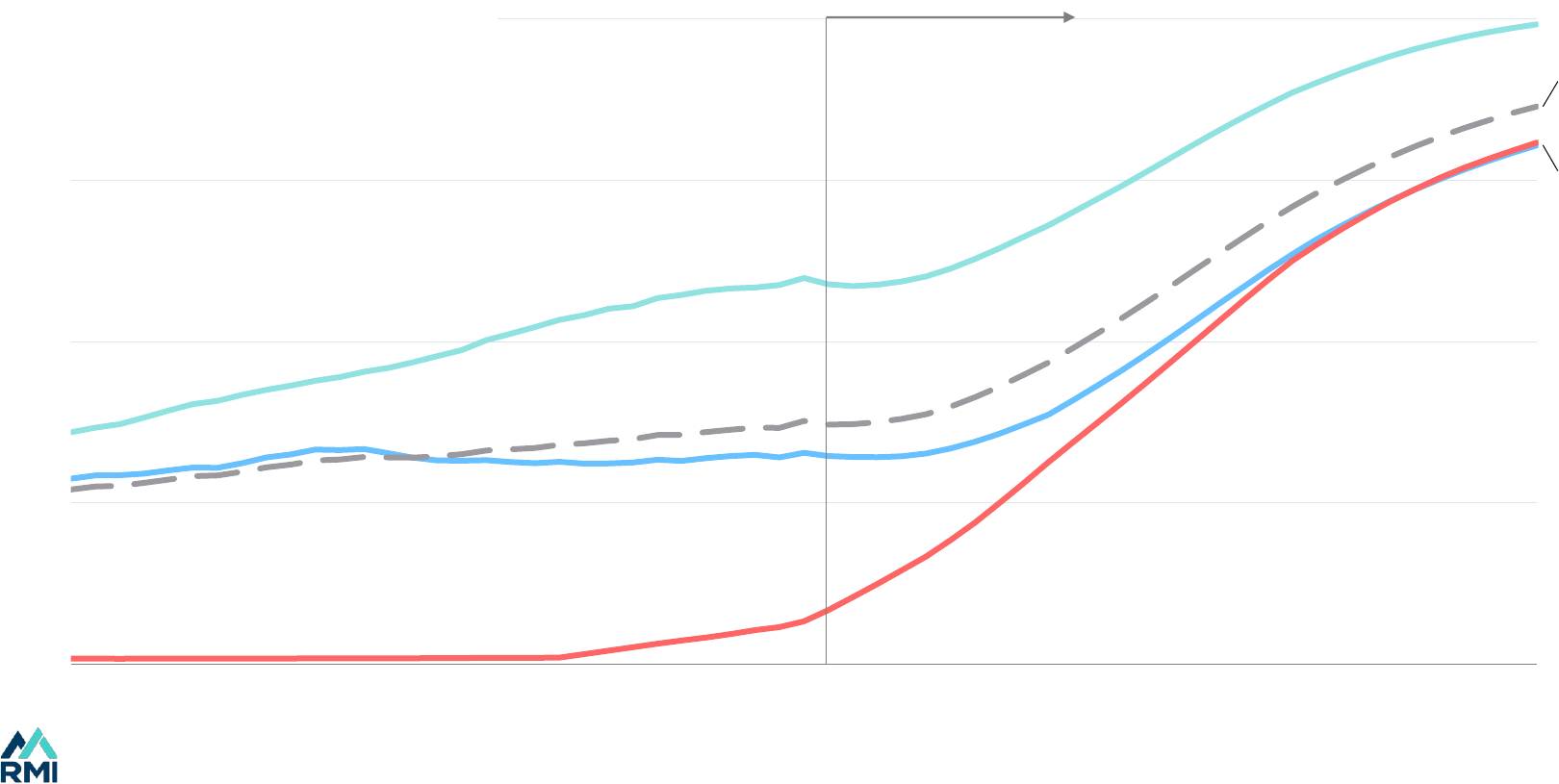

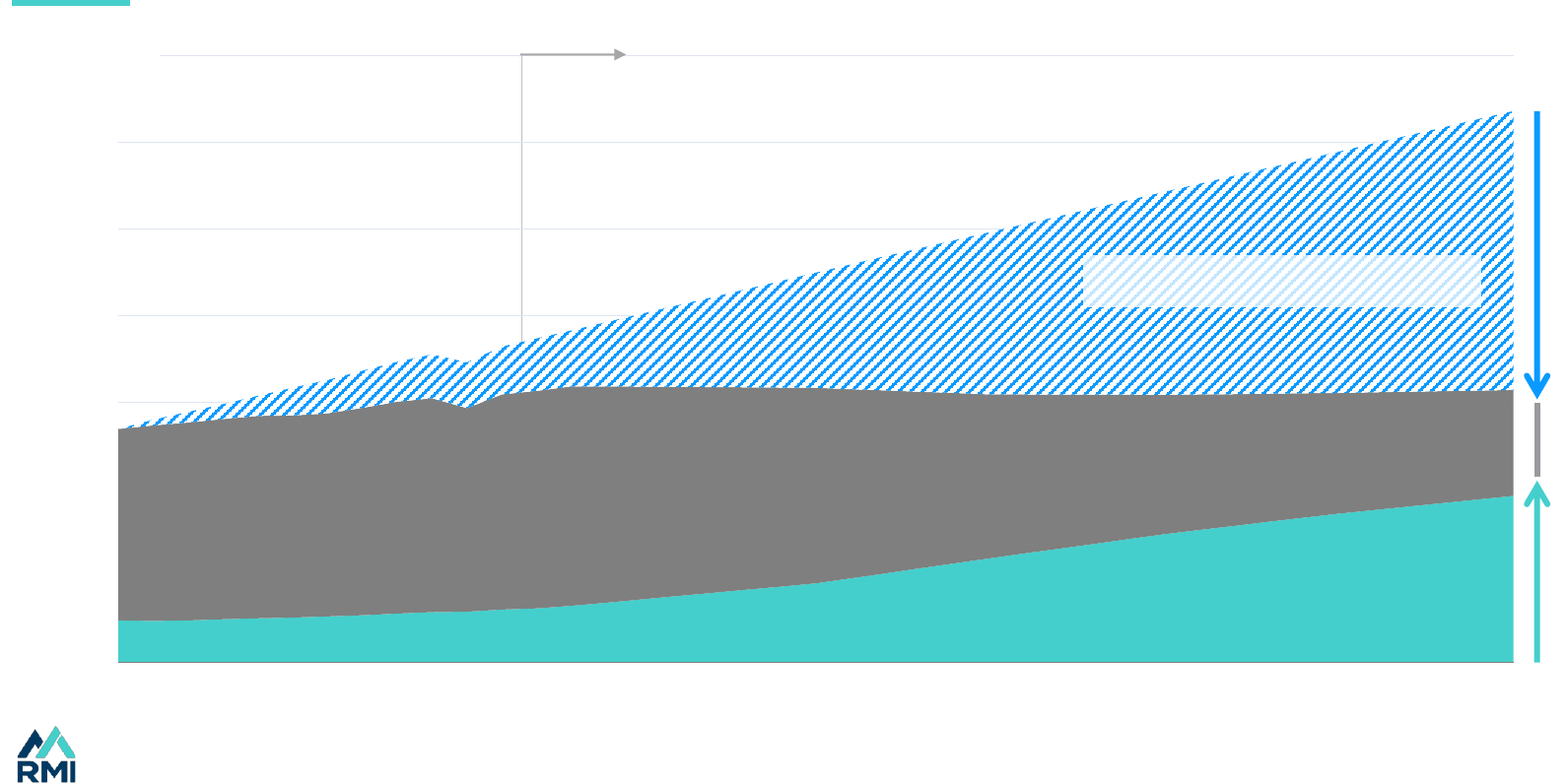

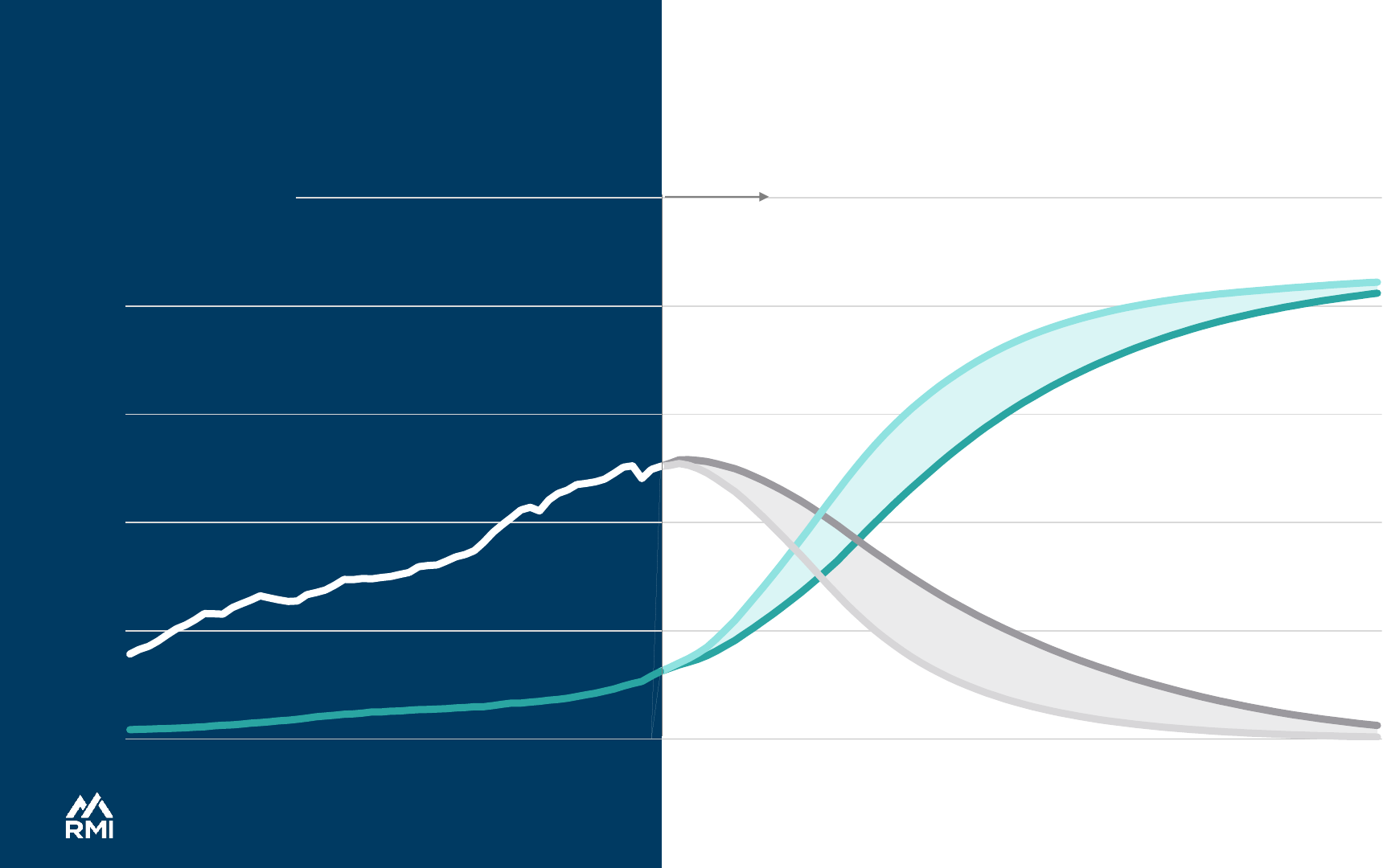

Fast or faster; either we are off the fossil plateau by the late 2020s or by the early 2030s

A new energy system is coming

Source: Rystad 1.6° & 1.8°C degree scenario.

Faster, 1.6°C

20602020 21001980

Solar & wind

Other

Fast, 1.8°C

20602020 21001980

0

100

200

300

400

500

EJ of useful energy

Fossil fuels

Outlook

61

Outlook

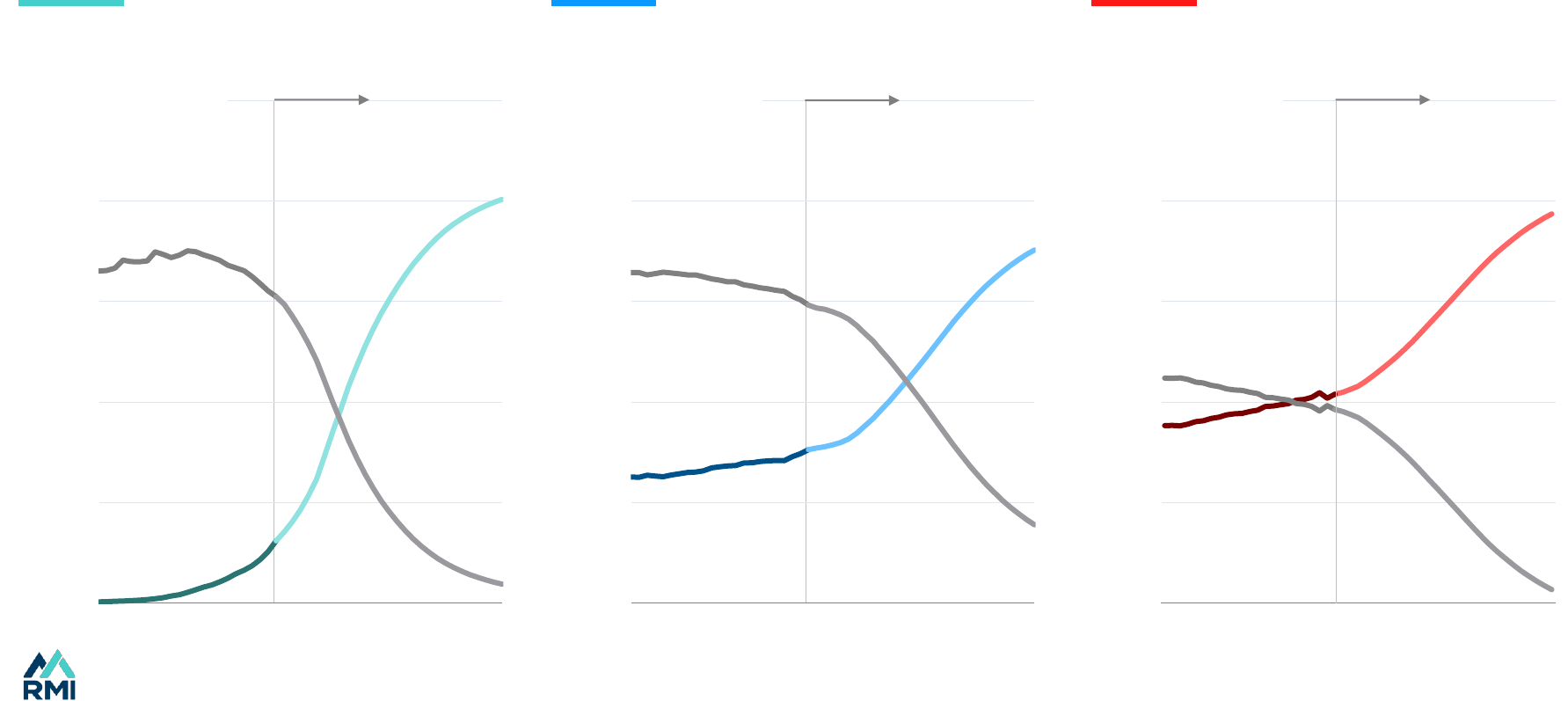

Renewables push out fossil electricity, electrons push out molecules, and efficiency reduces waste

In with the new, out with the old

Source: Rystad Energy 1.6°C scenario.

0%

20%

40%

60%

80%

100%

2000 2010 2020 2030 2040 2050

0%

20%

40%

60%

80%

100%

2000 2010 2020 2030 2040 2050

30%

40%

50%

60%

70%

80%

2000 2010 2020 2030 2040 2050

Wasted

energy

Fossil

molecules

Electrons

Useful

energy

Fossil-fueled

electricity

Solar & wind

Outlook

Renewables beat fossil-fueled electricity Obedient electrons beat fiery molecules Efficiency beats waste

Renewables Electrification Efficiency

Outlook

of useful energy

of primary

energy

of electricity

generation

62

0

1

2

3

1885 1905 1925 1945

0

5

10

15

20

25

1900 1910 1920 1930 1940 1950 1960

0

5

10

15

20

25

30

1946 1956 1966 1976 1986

10

100

1,000

10,000

100,000

1,000,000

1830 1880 1930 1980

We have seen this X shaped pattern before

Source: Perez, Fouquet, Nakicenovic, Mitchell; Note: all UK charts except horses to cars (US).

0%

20%

40%

60%

80%

100%

1860 1880 1900 1920 1940

0

2,000

4,000

6,000

8,000

1800 1820 1840 1860 1880 1900

Industry: Cast iron to steel Ships: Sailing ships to steamships Land transport: Horses to cars

Lighting: Gas to electricity Power: Steam to electricity Heat: Coal to gas

Coal

Gas

An X shaped technology transition is standard so we should not be surprised

Cars

Horses

Steam

Electricity

Electricity

Gas

Steamships

Sailing

ships

Steel

Cast iron

mtoe

share of production

000 units in fleet

fleet tonnage 000

mtoe mtoe

63

Over 75% of fossil demand today is under direct threat by exponentially growing cleantech

The largest areas of fossil fuel demand are most at risk

Source: IEA, IIASA, RMI.

Road Other Heat Other

Low temp.

heat

OtherBaseload

Last-mile

peak load

Fossil

extraction

and refining

Cleantech

rapidly

pushing

out fossils

Indirect

reduction due

to phase out of

fossil demand

Heat pumps

and electric

cooking

Industrial heat

pumps and other

electrification

Electric

vehicles

Solar and wind

Fossil fuel

demand by

sector, %

Demand at risk

Electricity Transport Buildings Industry

Energy

industry

Other renewables and

batteries

64

0

200

400

600

800

1,000

1,200

1,400

2010 2020 2030 2040 2050

Outlook

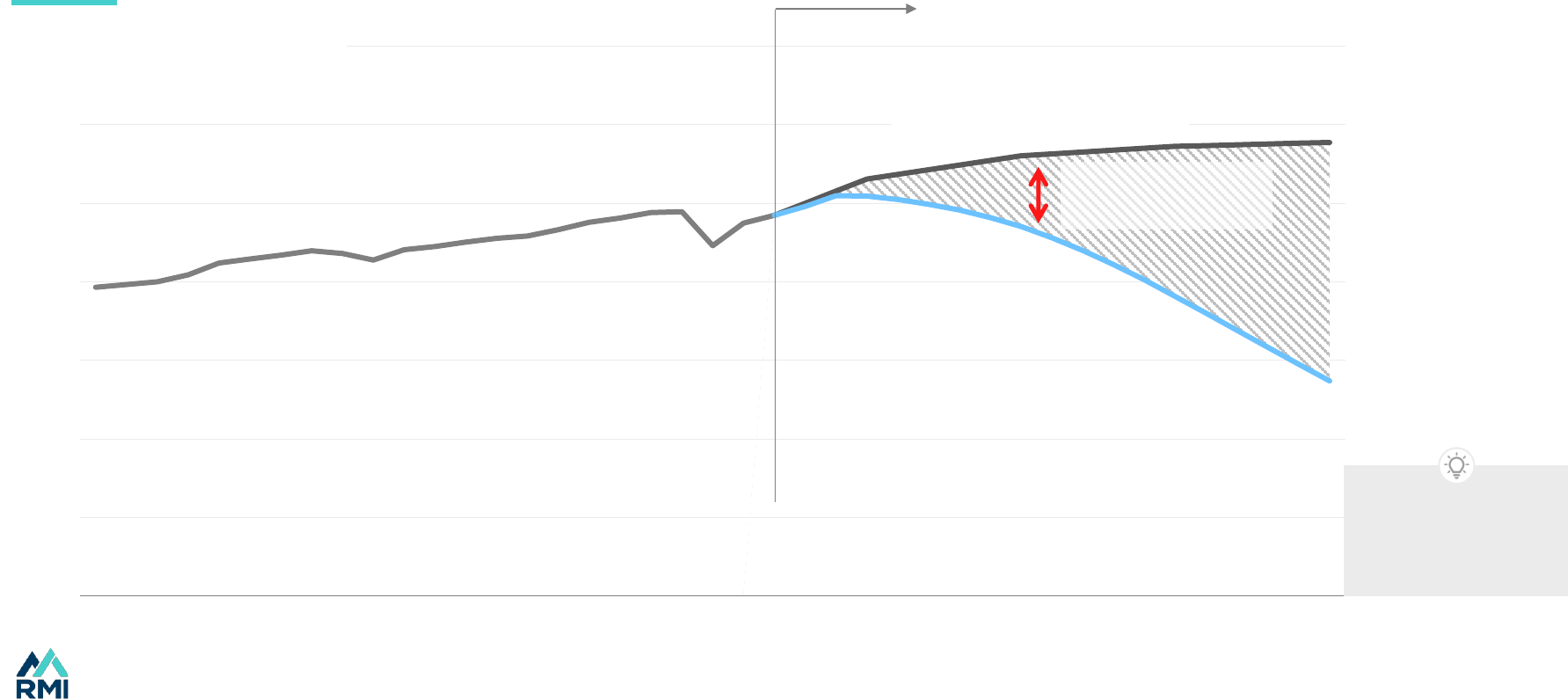

The growth of cleantech and rising efficiency will squeeze out fossil fuel demand

Fossil fuel demand gets squeezed

Source: IEA WEB, IEA APS scenario, RMI.

Efficiency

stops growth

in primary

energy

demand

Renewables

grow

Fossil fuels

are squeezed

in the middle

Avoided energy (Efficiency)

Fossil fuels

Clean energy

Primary energy supply

EJ

65

1990 2010 2030 2050 2070 2090

1990 2010 2030 2050 2070 2090

0

50

100

150

200

250

1990 2010 2030 2050 2070 2090

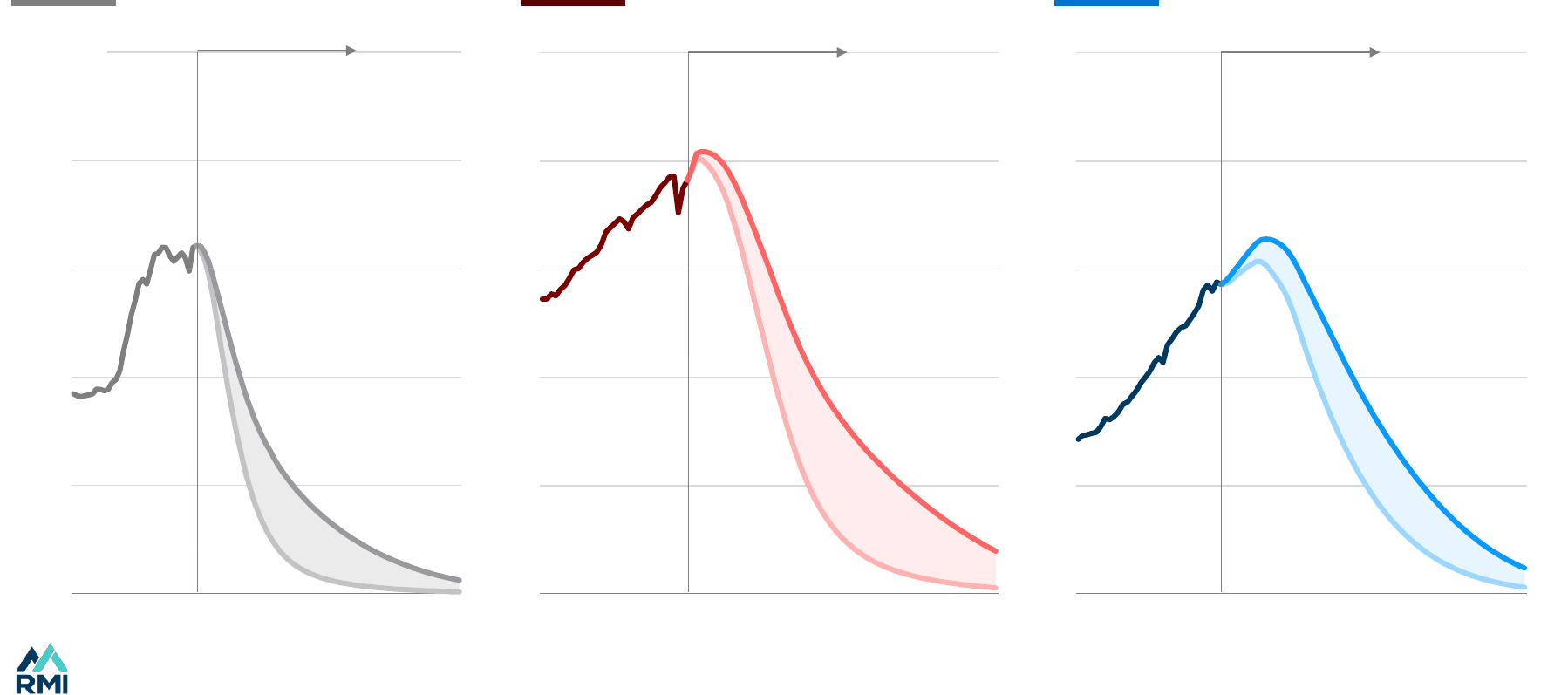

So fossil fuel demand is on the brink of rapid decline

Source: Rystad Energy (Fast 1.8°C, Faster 1.6 °C ).

Fast

Faster

Fast

Faster

Fast

Faster

Fossil fuel demand faces a cliff edge. The key variable is the length of the plateau — short or very short

Global coal demand

Global oil demand

Global gas demand

EJ

OutlookOutlookOutlook

66

66

• Paris is achievable because we are at the pivot point in the 300-year history of

fossil fuel use.

• The race for the top is on fire. A battle for leadership is taking place in every area

of energy supply and demand. Competition will drive change.

• The Global South can continue to leapfrog to cleantech. Witness the success of

Kenya, Barbados, Morocco, Vietnam or Bangladesh.

• We are at peak waste, so we can reduce the pressure on nature.

• The great capital reallocation will continue. Capital will shift into areas of growth

and out of those in decline.

• Stranded fossil fuel assets will result from the gap between the expectations

of incumbents for business-as-usual and the reality of exponential change.

• Since the fossil fuel system is huge ($50 trillion of fixed assets), this asset stranding

has profound implications for the financial system.

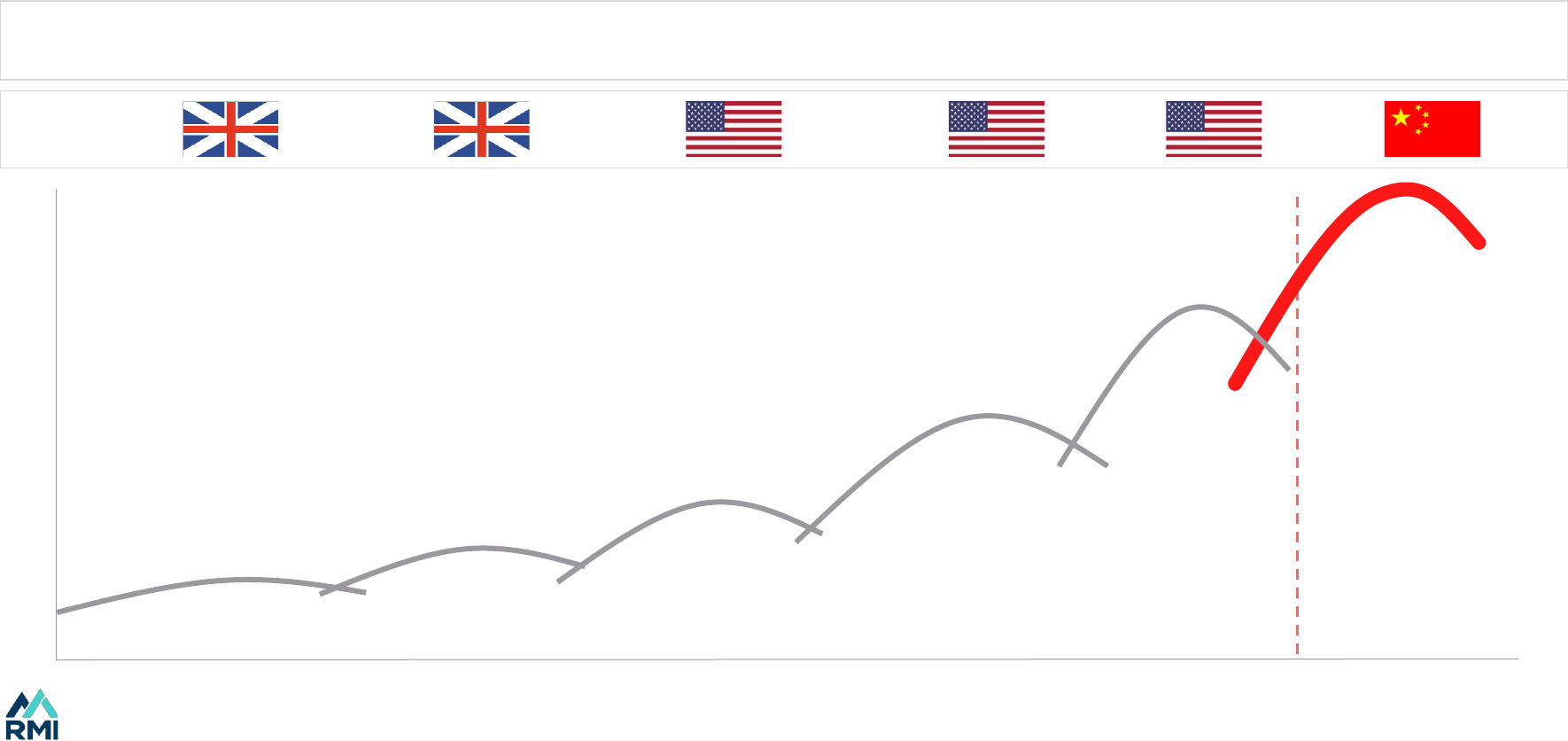

• As China is leading this transition, we need to benchmark to China.

• The debate will be very different by 2030 and the transition will be priced into

markets.

Index

Wider implications of the transition

6

67

This is the pivot decade from growth to decline

Paris is feasible

Source: Global Carbon Project, OWID (1850-2023), Rystad Energy to 2023-2070; RMI illustrative onwards. Paris

here means the goal of the 2015 Paris Agreement to keep global warming well below 2°C .

0

5

10

15

20

25

30

35

40

45

1850 1900 1950 2000 2050 2100 2150

2050 2100 2150

1.5°C

1.8°C

Outlook

Global CO

2

emissions from energy

GtCO

2

68

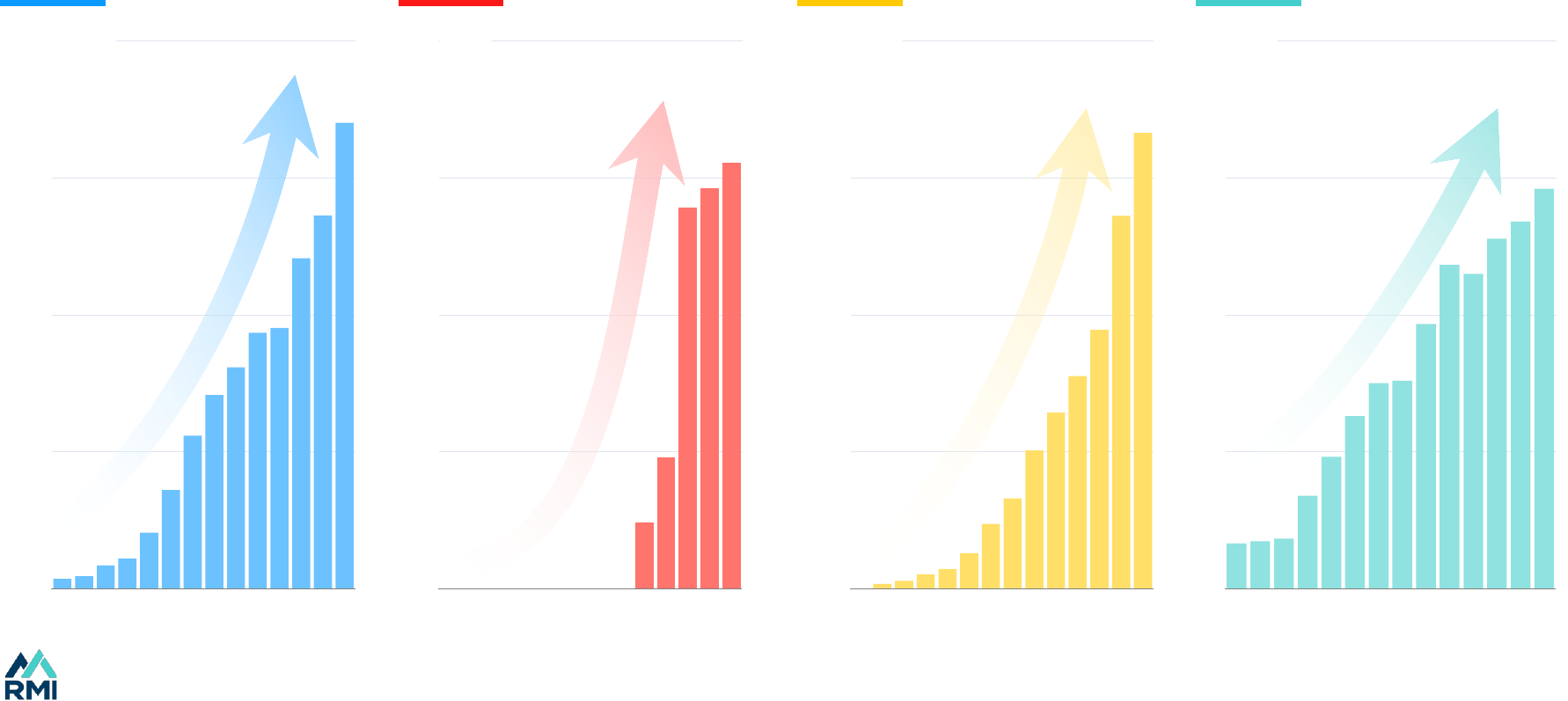

2000 2010

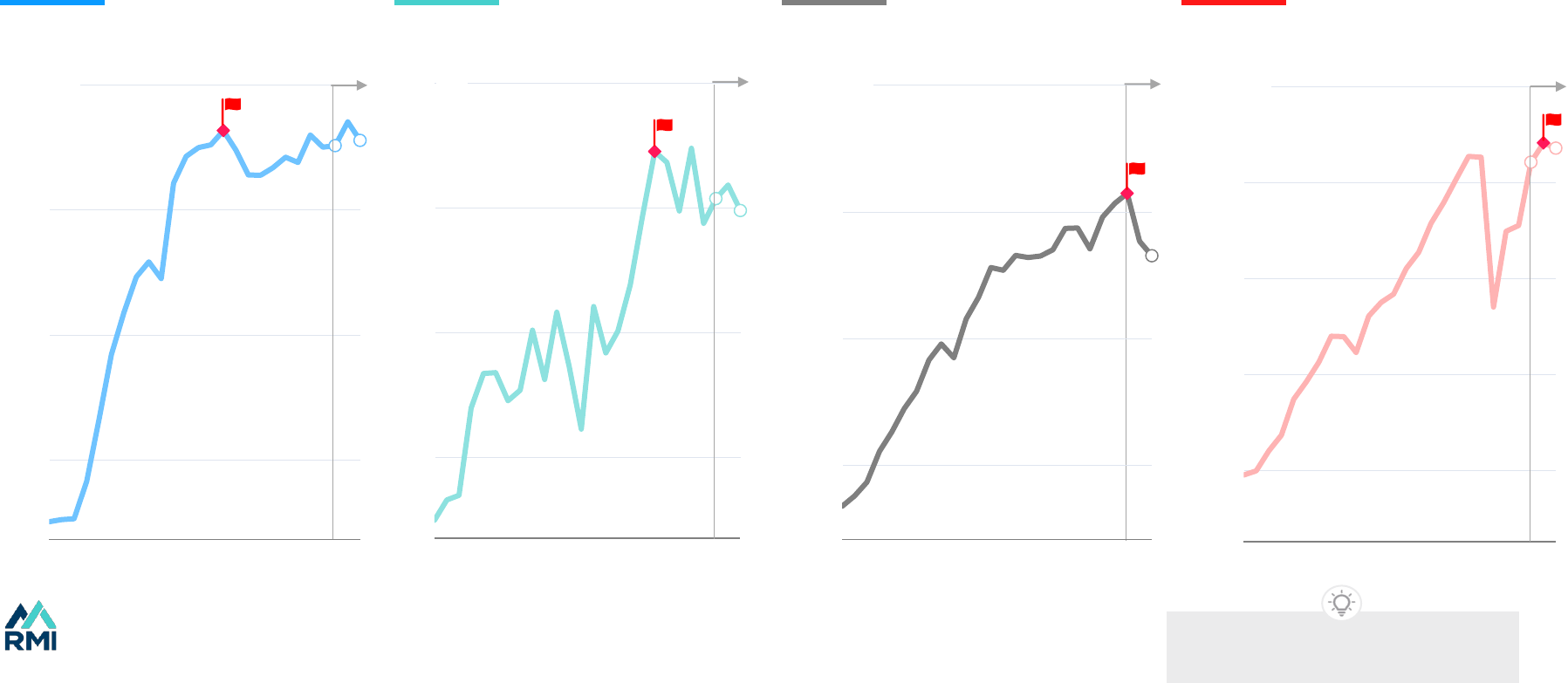

Nobody wants to miss out on the technologies of the future

The race for the top is on fire

Source: Energy Institute, IEA, BNEF, RMI analyses. For more see X-Change: The Race to the Top.

0%

20%

40%

60%

80%

100%

2015

2020 2025 2030

0%

10%

20%

30%

40%

50%

60%

Note: Solar, wind, and EVs in an S-curve outlook based on RMI modeling; electrification is from BNEF’s ETS.

0%

10%

20%

30%

40%

2000 2005 2010 2015 2020 2025 2030

2020 2030

S-curve outlook

S-curve outlook

BNEF outlook

generation from solar and wind

Renewables Electric vehicles Electrification

car sales EV of final energy from electricity

China

United States

Europe

69

Falling costs open up new opportunities to bring energy to those who lack it

The Global South can continue to leapfrog

Source: Ember, IEA.

0%

5%

10%

15%

20%

25%

30%

2000 2010 2020

Bangladesh

Malaysia

Philippines

United States

Vietnam

0%

5%

10%

15%

20%

25%

30%

35%

40%

2010 2020

Namibia

Yemen

Chile

Jordan

Vietnam

Barbados

India

US

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

2010 2020

Uruguay

Kenya

Morocco

Brazil

Chile

US

of generation of generation of final energy supply from electricity

Solar Wind Electrification

70

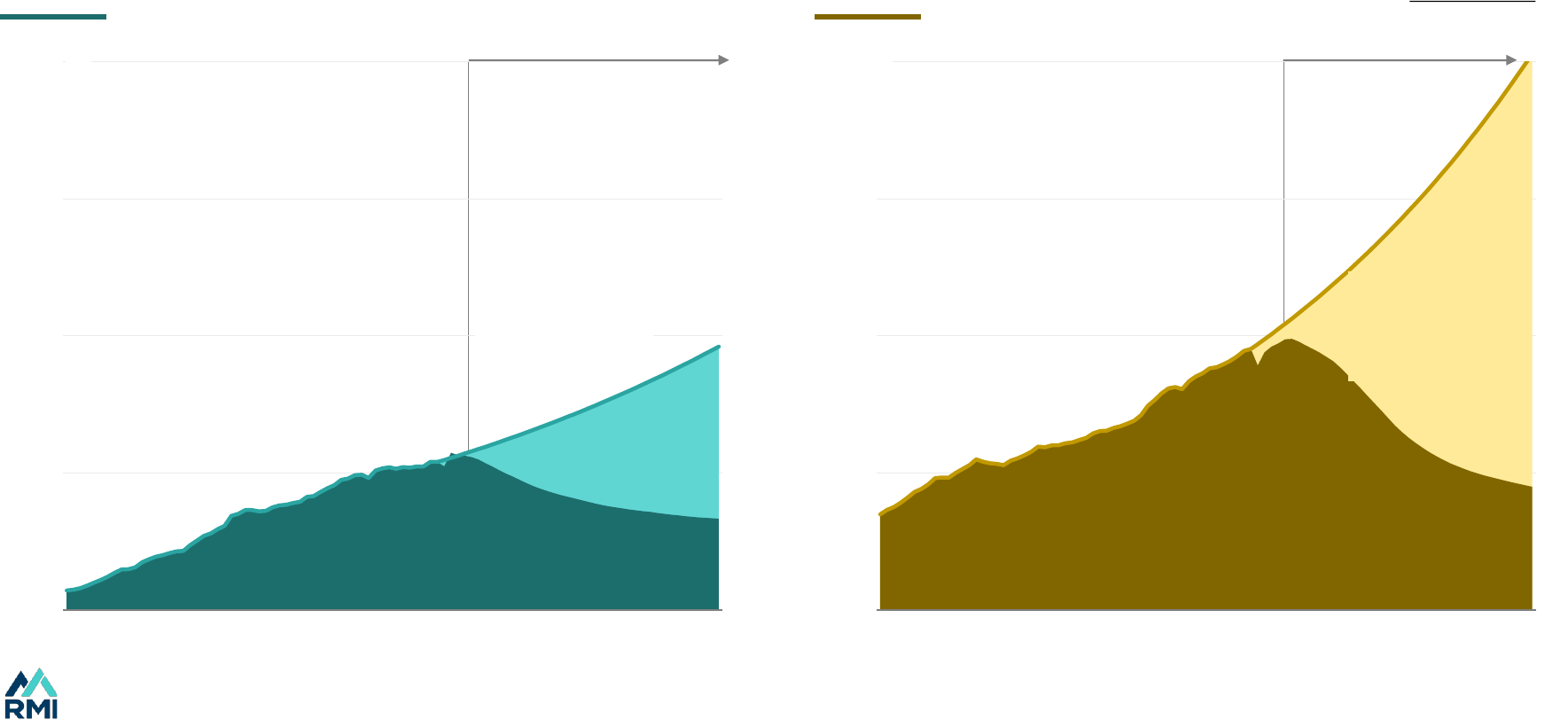

We are at peak waste

Source: Rystad Energy 1.6 °C Scenario.

0

100

200

300

400

1965 1975 1985 1995 2005 2015 2025 2035 2045 2055

Solar/wind

Energy waste from electricity

Trend line

(No transition)

0

100

200

300

400

1965 1975 1985 1995 2005 2015 2025 2035 2045 2055

Electrification

& more efficient

equipment

Trend line

(No transition)

Energy waste from equipment

Outlook

So we can massively reduce the strains of the energy system on nature

Solar & wind reduces losses from generation

Electrification reduces end-use losses

Outlook

EJ EJ

ILLUSTRATIVE

71

The required growth in investment is achievable, and reallocation from fossil to cleantech is well underway

We are halfway through a Great Capital Reallocation

Source: IEA, RMI. For more see The Great Reallocation: Capital expenditure on energy production.

0

500

1,000

1,500

2,000

2,500

3,000

2000 2005 2010 2015 2020 2025 2030

CAGR 9%

CAGR 2%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2000 2005 2010 2015 2020 2025 2030

Outlook

Total investment in primary energy supply Share of total investment

Outlook

$ billion

Cleantech

Fossil

72

Assets get stranded at the top of the market, and disruption is driven by price changes

The fossil fuel system faces trillions in stranded assets

Source: Rystad Energy, OPEC, RMI.

0

20

40

60

80

100

120

140

2000 2010 2020 2030 2040

Rystad 1.6°C

OPEC Outlook

Stranded

assets

Incumbent expectations

The reality of a rapid

technology transition

Price shock from

overcapacity

Oil demand

million barrels per day

The fossil fuel system

has around $50 trillion

of fixed assets and is the

largest in the world

Outlook

73

China is leading this technology revolution, and others need to catch up or fall behind

We need to change our framework of reference to China

Source: Carlota Perez (first five), RMI (renewable age).

Transition

Industrial

Revolution

Age of Steam

& Rail

Age of Steel

& Electricity

Age of Oil &

Mass production

Information

Age

The Renewable

Age

2020

Innovations

Iron

Waterpower

Mechanization

Steam engines

Steam power

Rail

Electricity

Steel

Heavy engineering

Mass-produced

automobiles

Cheap oil

Petrochem

Information

technologies

Telecomms

Software

Renewable energy

Electrification

Resource efficiency

1

st

wave

2

nd

wave

3

rd

wave

4

th

wave

5

th

wave

6

th

wave

1800

1900

Led by

74

When the facts change, people change their minds. Repricing follows.

The debate will be very different in 2030

Source: RMI.

2015 2024 2030Area

Expensive Cheap Super cheapCost of renewables

Niche Moderate IntenseSocietal pressure for change

Toy for the rich A second car for the rich A cheaper car for allEVs

Grid can’t take 20% Grid can’t take 70% Leaders enjoy cheap energyRenewables

<1% of world has targets 90% of world has targets 90% of world has plansNet zero

Growth Plateau DeclineGlobal fossil fuel demand

CCS Lots of technological solutions Lots of commercial solutionsHard-to-solve areas

Climate makes good speeches Renewables nice to have Renewables a key tool of powerGeopolitics

ESG Carbon offsetting Minsky MomentFinancial markets

Greenwash Green premium Green prizeCorporations

China pollutes too much China makes too many climate solutions China and United States competeUnited States vs. China

75

75

• This is the pivot decade when cleantech manufacturing capacity is built,

renewables get too cheap to resist, and fossil fuel demand reaches the end of its

plateau.

• Focus on the signal not the noise. We need to prepare for change, not hide behind

denial.

• We need to continue building out the renewable system, speed up electrification in

the OECD, and increase focus on efficiency.

• We should make good bets on solutions that work: small modular technologies

and efficiency measures. Equally, we need to avoid high-cost, inefficient, and

unproven bets.

• Companies need to move from tactics to strategy.

• Investors should retool for the megatheme of the energy transition.

• Energy modelers need to change their approach or become stranded experts.

• And we need to get on with it. We are in a race between climate and economic

tipping points. The direction is inevitable, but speed is up to us.

Index

What we need to do now

7

76

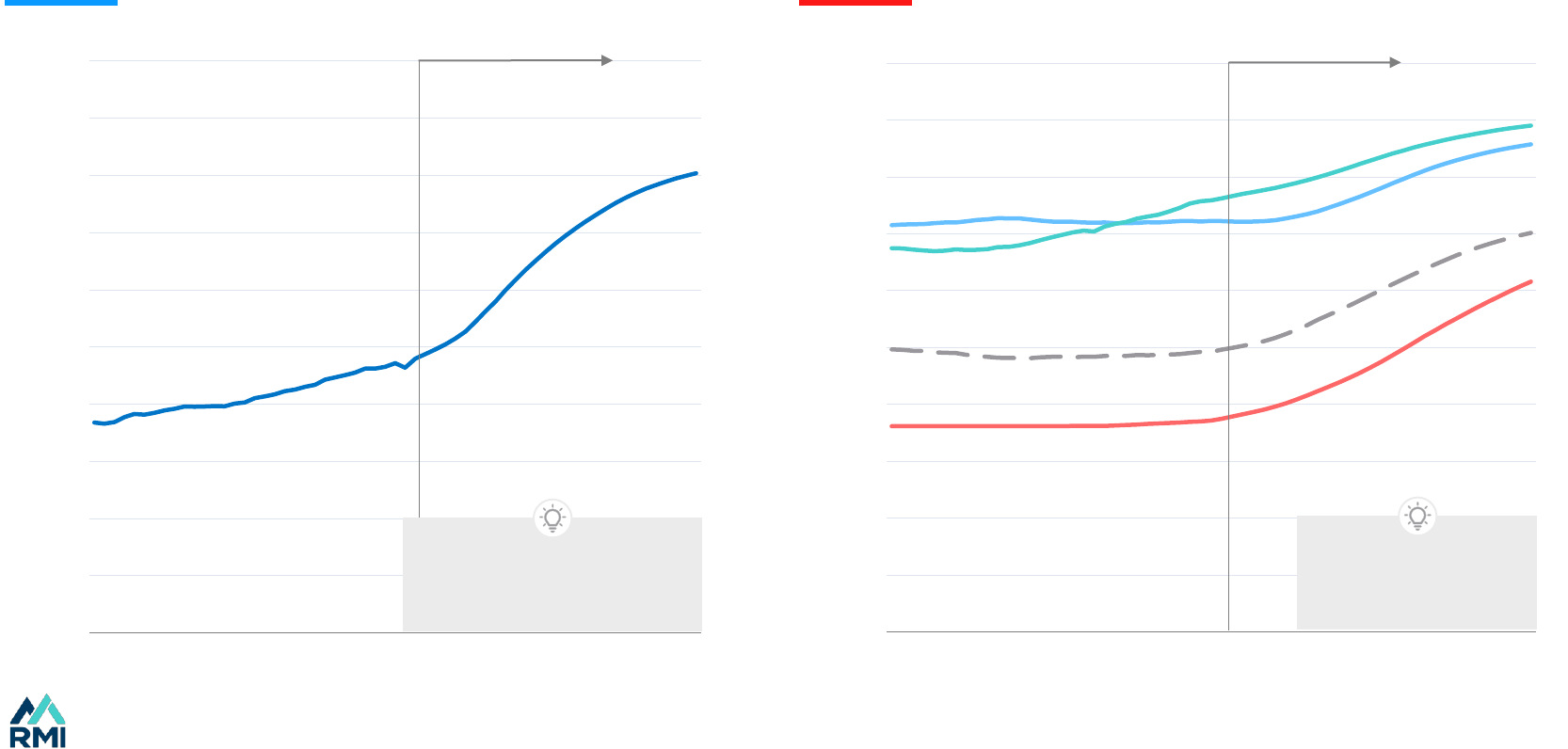

420

430

440

450

460

470

480

490

500

510

520

2010 2015 2020 2025 2030

0%

20%

40%

60%

80%

100%

2015 2020 2025 2030

Sources: BNEF, RMI, Rystad Energy.

0

20

40

60

80

2018 2022 2026 2030

0

12

3

6

9

15

2020 2022 2024 2026 2028 2030

TWh manufacturing capacity

Manufacturing capacity is

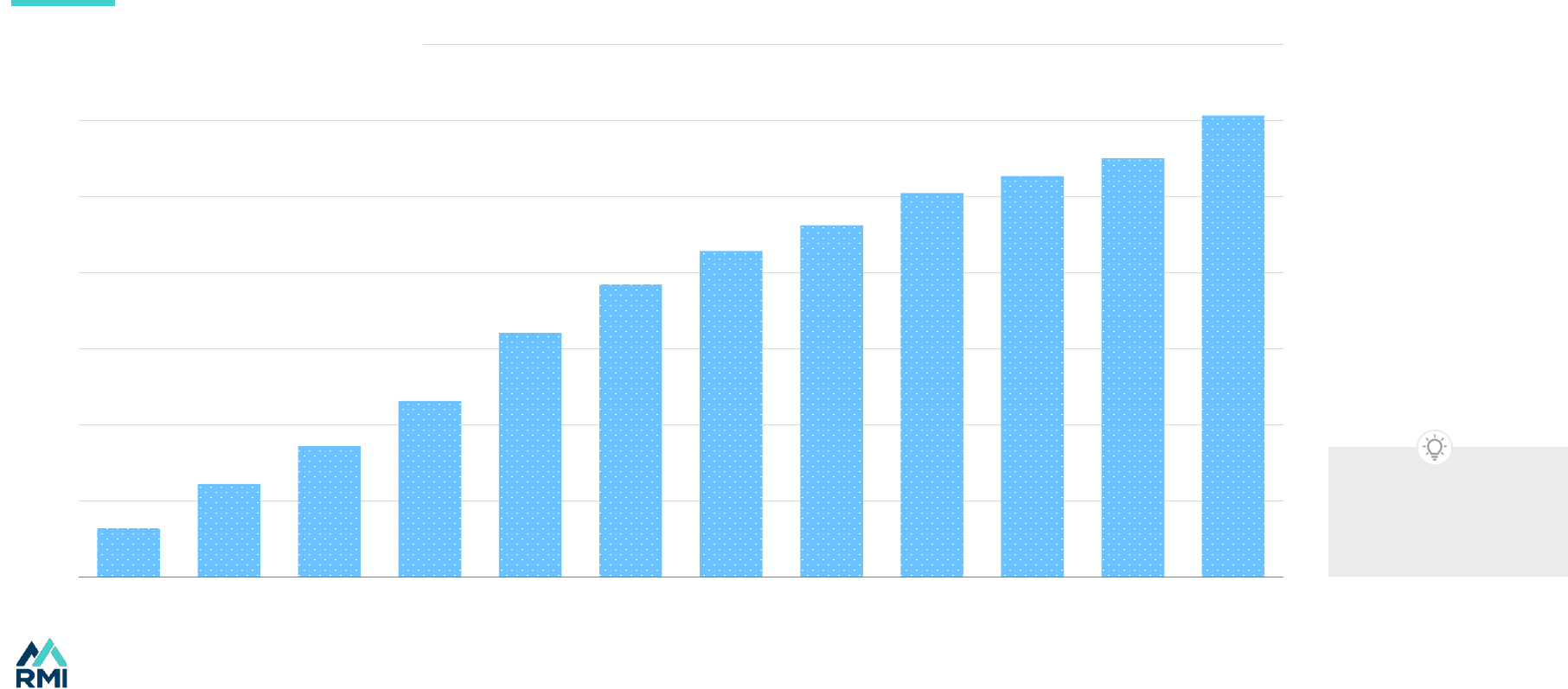

built: Batteries

Cleantech goes up the steep

part of the S-curve: EV

Renewables get too cheap to

resist: Solar

Fossil fuel demand enters

terminal decline

EJ fossil fuel demand$/MWh LCOEEV share of car sales

Faster

Fast

Fast

Faster

Fast

Faster

You snooze, you lose

The 2020s are the pivot decade

100%

77

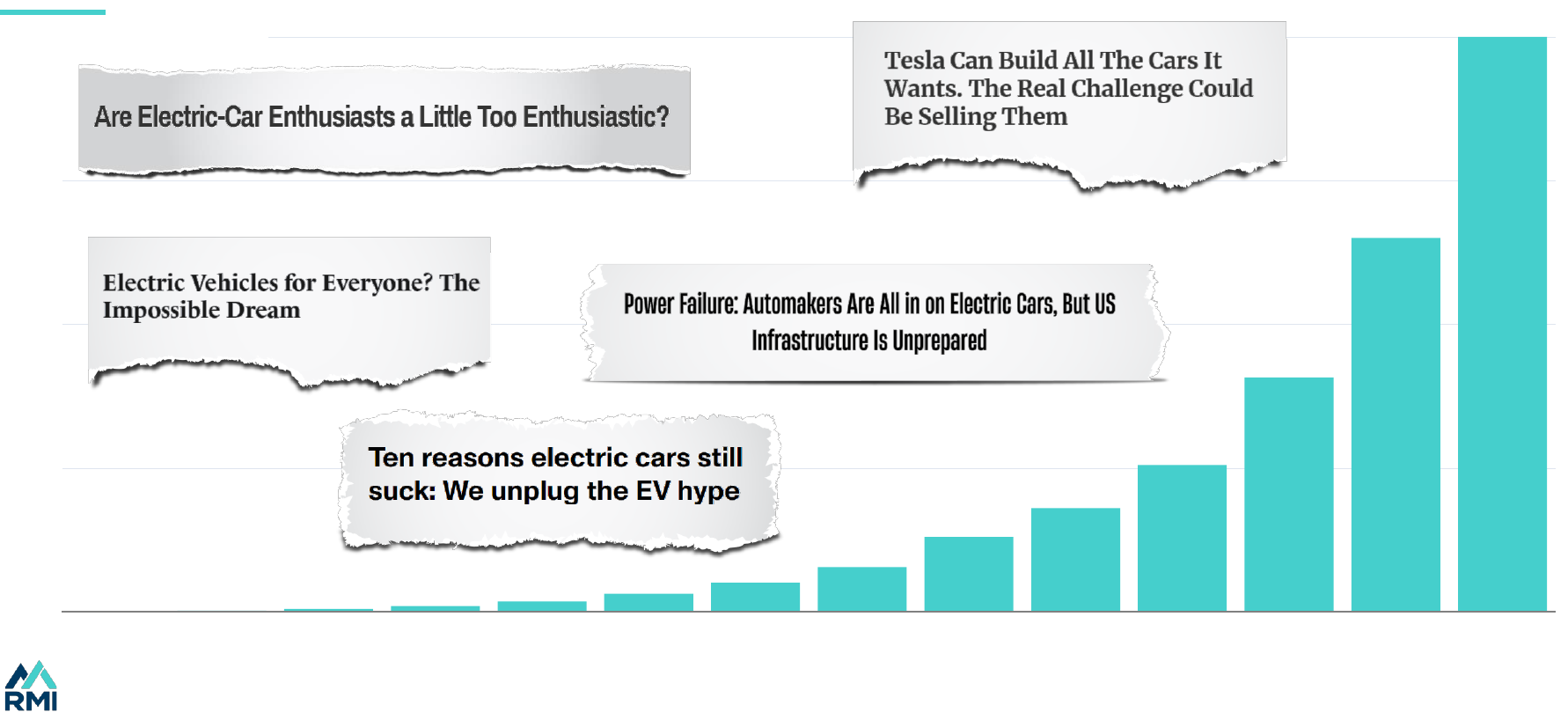

There are always barriers to change. Those who solve them get rich.

Focus on the signal not the noise

Media headlines are centered around their year of publication.

Sources: IEA ,CNET, Time, Forbes, InsideHook, Manhattan Institute.

0

10

20

30

40

2010 2015 2020

million EVs (fleet)

EV adoption versus headlines

78

If you want to stay in the game, you need to deploy renewables and electrify end-use demand, and fast

Build, baby, build…

Source: IEA.

0

50

100

150

200

2010 2012 2014 2016 2018 2020 2022

0 2 4 6 8 10

High voltage line

Distribution line

Car charging hub

Onshore wind

Utility solar PV

China Europe United States

Connection queue growth in United States Typical deployment time

GW

Years

Utility-solar PV

High-voltage line

79

Redesign electricity markets to pass the low cost of renewables onto industry and households

Speed up electrification in the OECD

Source: IEA WEB, IEA, RMI. Note: assuming a 40% efficiency of natural gas for a fairer comparison between the two energy carriers.

10%

15%

20%

25%

30%

2010 2010 2020

France

Spain

US

Italy

UK

Germany

China

0

1

2

3

US Western Europe China

In the US & Europe,

natural gas is

cheaper than

electricity

In China,

electricity is

cheaper than gas

Electricity share of final energy Electricity multiple of natural gas prices in 2023

times higher electricity vs. efficiency-adjusted gas price

Price parity

80

Focus on modular technologies with steep learning curves; avoid expensive and hard-to-deploy technologies

Make good bets on the technologies of the future

Source: Adapted from Malhotra and Schmidt, “Accelerating Low-Carbon Innovation.”

Need for customization

Degree of

design

complexity

Platform-based complex

product systems

e.g., Small modular reactors,

carbon capture & storage

Complex product systems

e.g., Nuclear power plants, BECCS

Mass-produced complex products

e.g., Electric vehicles

Platform-based complex products

e.g., Wind turbines, concentrating

solar power, standardized asset

retrofits

Complex-customized products

e.g., Biomass power plants,

geothermal power

Mass-customized products

e.g., Rooftop solar PV

Standardized complex

product systems

e.g., Combined-cycle gas turbine

power plants

Mass-produced products

e.g., Solar PV modules, batteries

Small-batch products

e.g., Bespoke asset retrofits

Mass-customizedStandardized Customized

Complex

Design-

intensive

Simple

81

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

2011 2013 2015 2017 2019 2021

0

100

200

300

400

500

600

700

Primary energy Final energy Useful energy Value added

Harvest the vast fields of efficiency

Source: IEA, IIASA, RMI assumptions, Amory Lovins.

The efficiency

opportunity

is huge

EJ million tons CO

2

per year

Emissions avoided by efficiency, in contextEnergy demand from primary energy to value added 2019

The efficiency potential is huge, and proven

Efficiency

CCS

The

efficiency

opportunity

is already

delivering

82

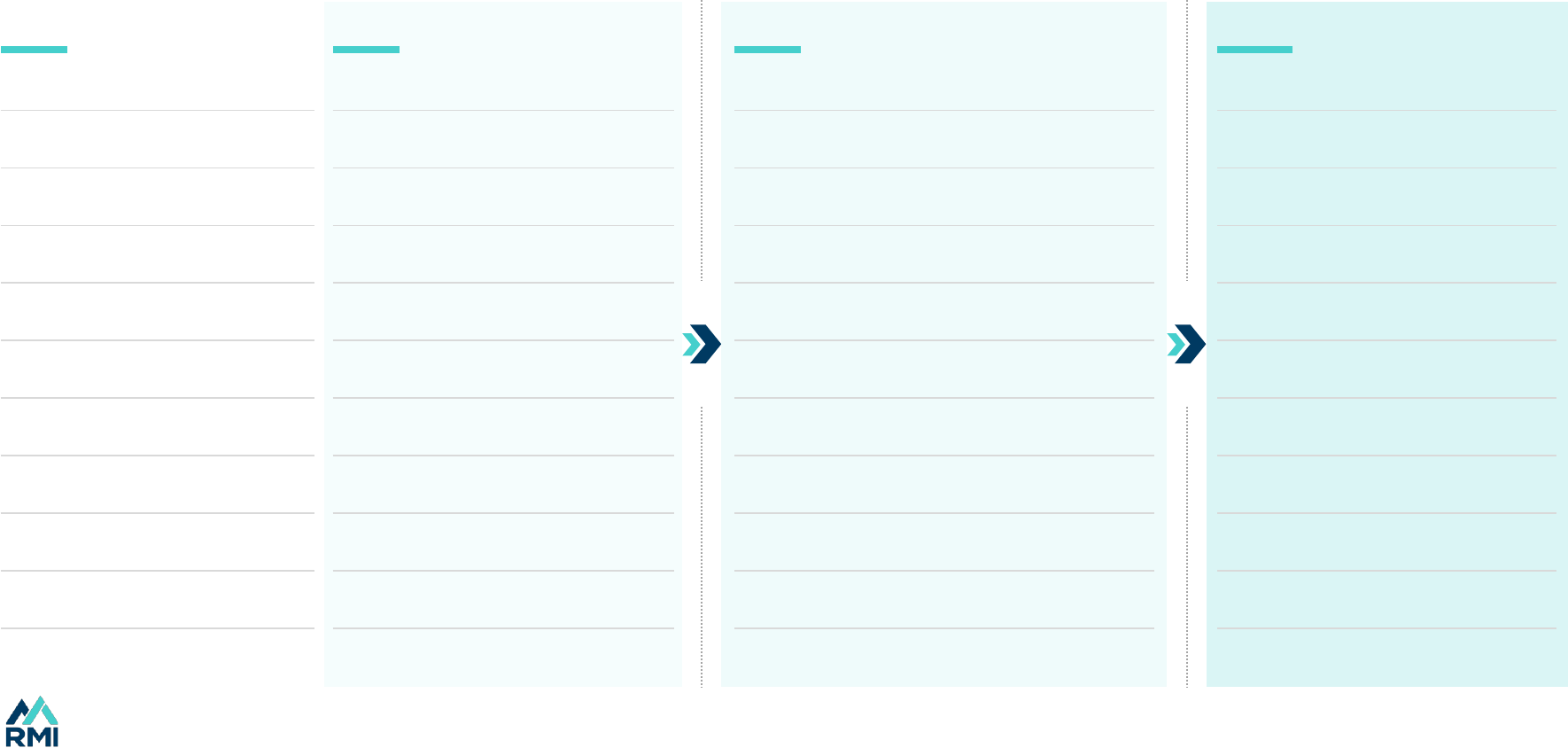

The energy transition is not a box-ticking exercise

Companies: time to move from tactics to strategy

Source: RMI.

Future What to doType

Decline of core products Reinvention; rundownFossil fuel producers

Need to find a new energy source Retool for the new energy sourceHeavy fossil fuel users

Company types and actions

Rapid growth, rapid innovation Innovate and expandRenewable companies

A brave new world of opportunities Solve barriers and get richEntrepreneurs

A new environment Rethink areas of focusOthers

83

Finance: Retool investment strategies

Source: RMI.

The energy transition is a megatheme, like the industrialization of China or the growth of the internet

Allocate capital to

sectors with growth

Exit sectors in

decline. Or trade the

volatility on the way

down

Go long-short winners

and losers from

change. Disruption is

coming, so separate

reality from lip service

Pick winners. The

Gartner hype curve is

the standard tool

Beware of fossil

Minsky moments the

coming decade

84

Adjust energy models to capture reality

Source: RMI.

Annual

renewable

sales

2023 2030

Tomorrow’s

debate

Today’s

debate

Yesterday’s

debate

Incumbent modelers need to up their game or become stranded experts

Annual renewable deployment concept chart Who is where?

A new energy paradigm

Renewables are the future

Change is difficult, but we

should try and do this

..and the many tied banks and

consultants

Green idealists are naïve; the

world needs our fossils

The group

Illustrative

8585

On the one hand, climate tipping points are coming

faster than expected…

We are in a race between climate and economic tipping points

Source: Lenton et al based on IPCC reports

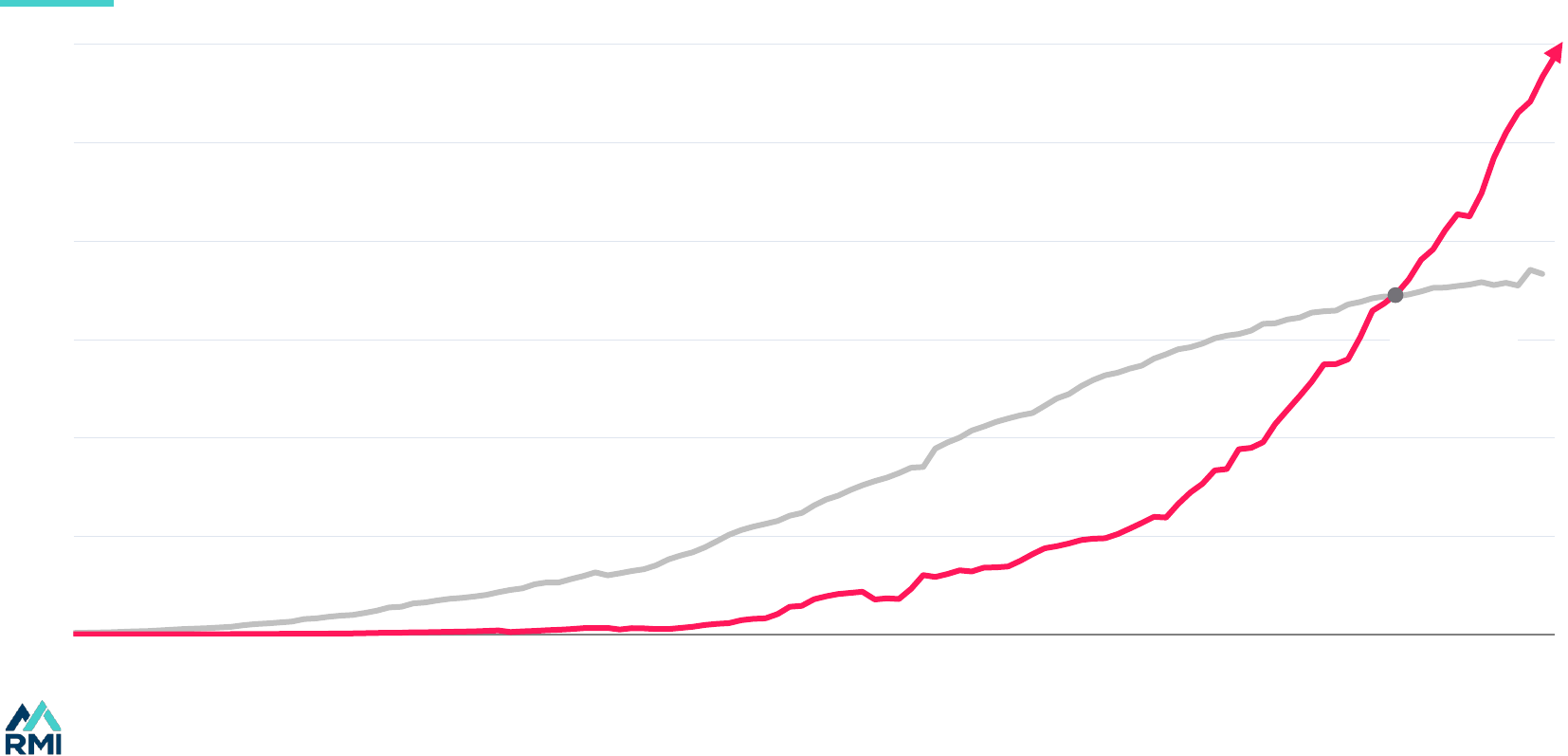

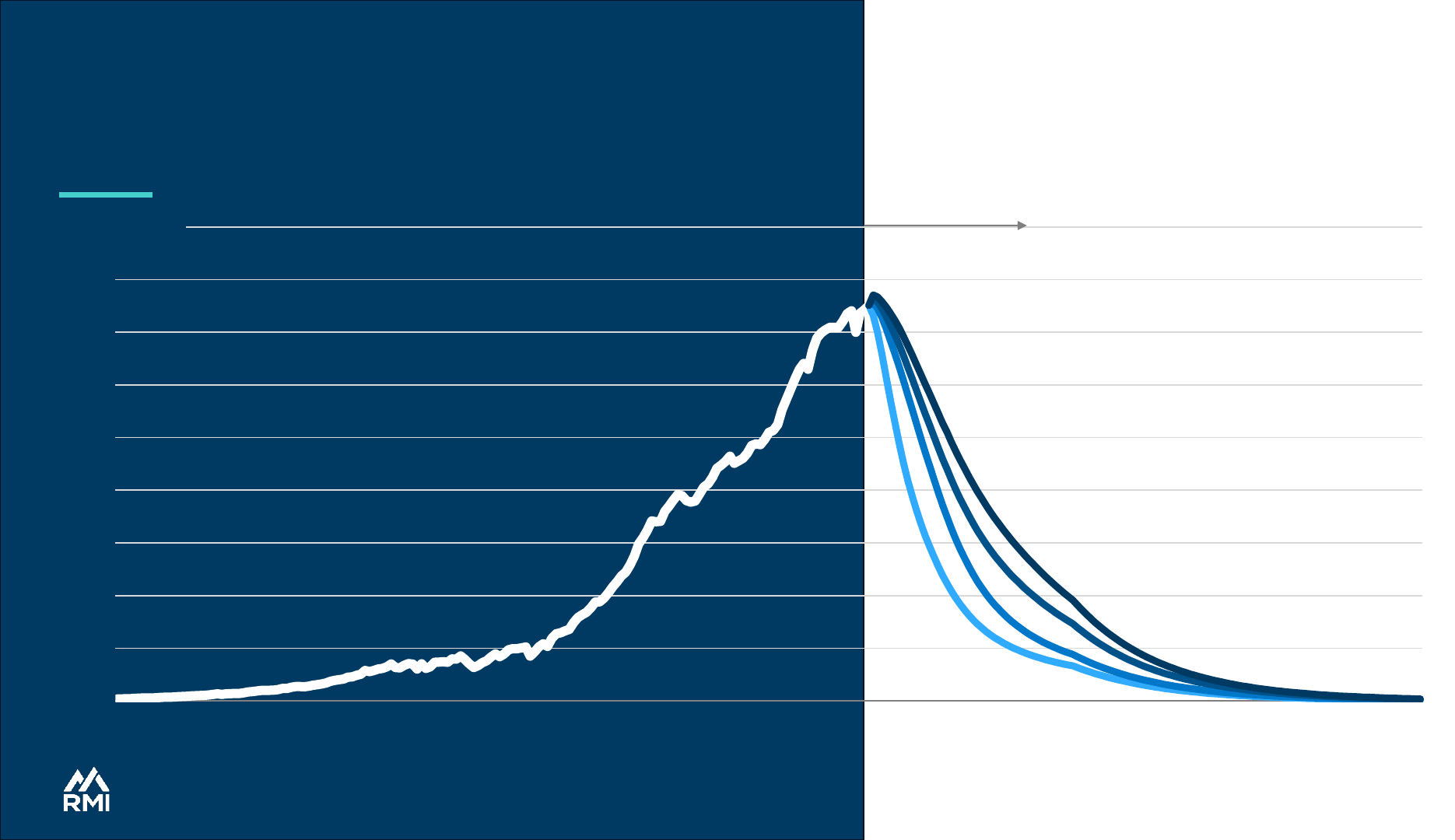

Actual solar additions vs. consensus outlooks

…on the other hand, climate solutions are scaling

faster than most analysts thought possible.

2001

2007

2013

2019

Climate tipping points

1.1°C

(2020)

Undetectable Low

0 1 2 3 4 5

°C

Past

Future?

High Very High

2015 2020 2025 2030

0

200

400

600

800

WEO 2016

WEO 2018

WEO 2020

WEO 2022

WEO2023

Actual

GW of annual additions

S-curve trend

Forecasts

Source: IEA STEPS, BNEF actuals

86

There is both inevitability and agency. As time is short there is every reason to act.

Direction is inevitable, but speed is up to us

Source: Rystad Energy scenarios (1.6°C Faster, 1.8°C Fast).

0

100

200

300

400

500

Faster

Fast

Fast

Faster

Clean

Fossil fuels

Outlook

EJ useful energy

2030 2040 2050 2060 2070 2080 2090 2100202020102000199019801970

RMI is an independent nonprofit, founded in 1982 as Rocky Mountain Institute, that transforms global energy systems through market-driven solutions

to align with a 1.5°C future and secure a clean, prosperous, zero-carbon future for all. We work in the world’s most critical geographies and engage

businesses, policymakers, communities, and NGOs to identify and scale energy system interventions that will cut climate pollution at least 50 percent

by 2030. RMI has offices in Basalt and Boulder, Colorado; New York City; Oakland, California; Washington, D.C.; Abuja, Nigeria; and Beijing.

Kingsmill Bond, [email protected]

Sam Butler-Sloss, sb[email protected]

Daan Walter, [email protected]

Sign up to our distribution list

RMI – The World Re-Energized

RMI – The Peaking Series

Authors

About RMI

Related

Acknowledgments

With thanks to: Amory Lovins, Hannah Ritchie, Joseph Zacune, Will Atkinson, Chiara Gulli, Laurens Speelman, Ita Kettleborough, and Harry Benham.